Throughout the pandemic, Air Canada (TSX:AC) has been one of the most interesting stocks to follow. It crashed significantly at the start of the pandemic, and while many thought that it was cheap, and others thought it might go bankrupt, the stock hasn’t really done all that much over the last two years.

Although I don’t fault the company for any of this, it’s just, unfortunately, been significantly impacted by the pandemic. Nevertheless, I personally haven’t been a fan of the value the stock offers at this price, whether it was last year or even today.

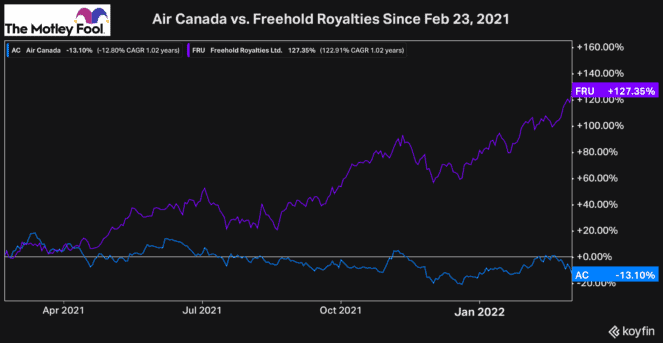

I’ve warned investors it has numerous headwinds to face on multiple occasions over the past couple of years. And just over a year ago, I laid out a number of those reasons while simultaneously recommending investors consider a high-quality energy stock like Freehold Royalties (TSX:FRU) instead.

Why is Air Canada stock fairly valued at around $25 a share?

Along with the fact that the pandemic was still a meaningful factor this time last year, even though we had begun to vaccinate our most elderly, another reason I wasn’t keen on the airliner had to do with the valuation of Air Canada stock.

At around $25 a share, the company is not as cheap as the share price makes it looks when you consider the shareholder dilution and all the debt the company has taken on. In addition, it was clear this time last year that it would be a long path until the company was seeing significant levels of capacity, where it could start to earn positive cash flow. And that didn’t happen until the fourth quarter of 2021.

Another reason was that the industry had no momentum, while energy stocks like Freehold were still undervalued and in the midst of a recovery.

In the following 12 months, Air Canada stock has continued to trade flat and just recently lost some value as uncertainty picks up. Meanwhile, Freehold has gained over 125% for investors.

The takeaway is that there is a lot of factors that go into selecting stocks. Not only was Air Canada stock not that cheap last year, but without any catalysts or momentum, it would likely continue to trade flat at best.

Meanwhile, even if that had happened to Freehold, at the time, its dividend was offering a yield of roughly 4%. So, it would have at least continued to return you some passive income.

But because it’s not just Freehold stock that was recovering — its entire industry had momentum and was also recovering significantly — Freehold has seen its cash flow skyrocket, allowing it to increase the dividend on five separate occasions over the last year and by a whopping 300%.

So, even for investors who haven’t lost capital investing in Air Canada stock, just the opportunity cost of owning it over the last 12 months has been significant.

Bottom line

Today, Air Canada is in much of the same situation it was in last year. While we have made progress on the pandemic, it will continue to impact Air Canada’s international operations especially, making it some time before the company recovers to full capacity.

Furthermore, with the uncertainty in markets today and the ongoing war in Ukraine, investors want stocks with defensive operations they can count on right now. So, until the market environment offers more certainty for investors, and Air Canada shows its well on its way to recovering, there are far better stocks to buy, including Freehold, that are trading ultra-cheap today.

So, despite the fact that its chart makes the stock look cheap, for now, until it’s actually recovering, beginning to report meaningful earnings and starting to pay down some of its debt, in my view, Air Canada stock is worth between $20 to $25 a share, exactly where it’s trading today.

Meanwhile, Freehold not only offers growth potential in this economic environment, but as of Friday’s closing price, the stock was offering a yield of 6.4%.