Tourmaline Oil (TSX:TOU) is a Canadian mid-tier natural gas producer — the largest natural gas producer in Canada. Today, Tourmaline is one of the many energy stocks that are benefitting from rising natural gas prices and soaring cash flows. In turn, its shareholders are receiving much of this cash flow in the form of dividends and share buybacks.

Please read on as I walk you through why Tourmaline is an energy stock I’d buy right now.

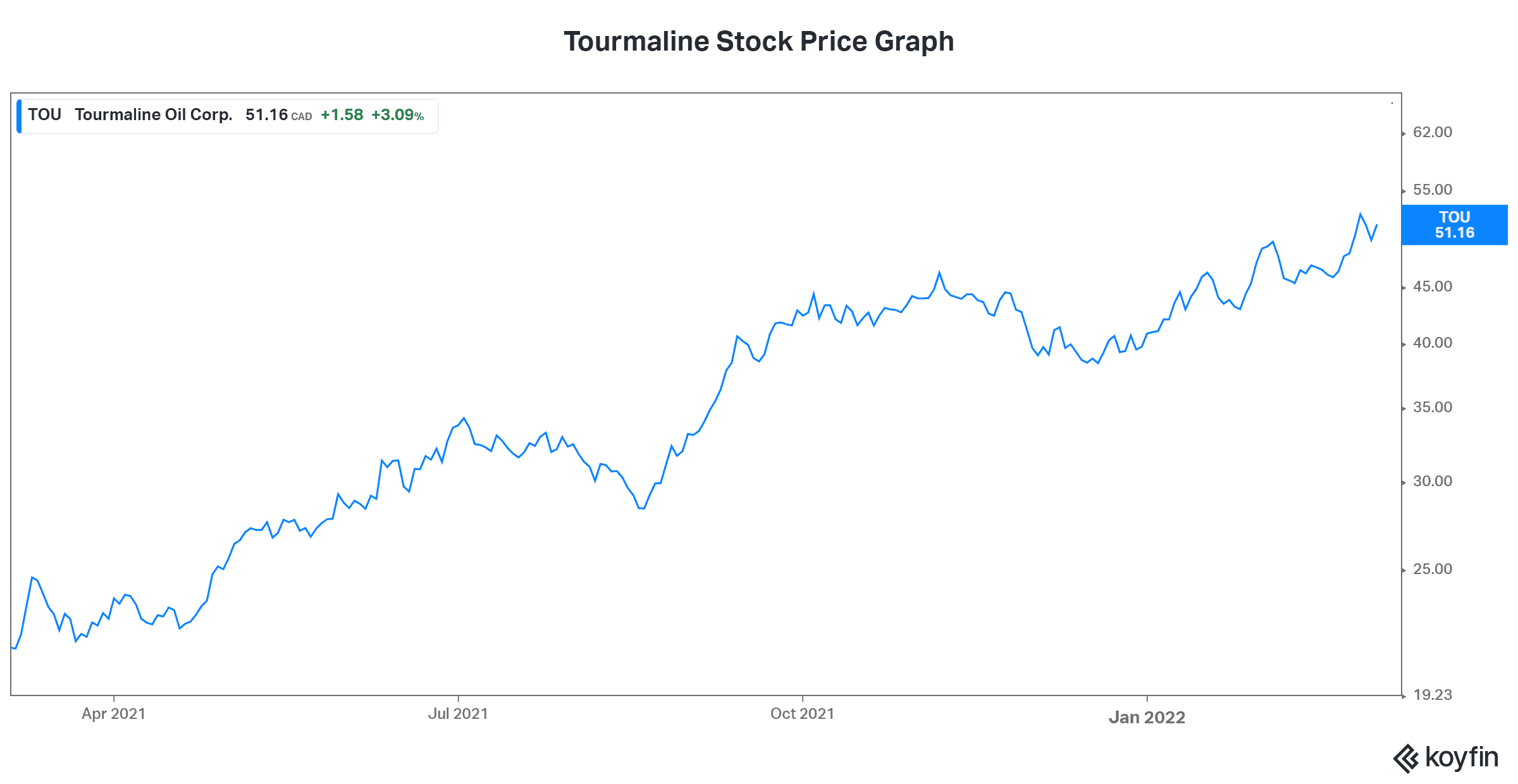

Tourmaline stock price soars, as this is one of the top energy stocks

Q4 2021 results over at Tourmaline were very impressive. They reflect the realities of being a strong company in an industry that’s booming. But on the day that 2021 results were released last week, Tourmaline saw its stock price head lower. I’m here to say that this is not the full picture by any means.

To get the full picture, we need to take a step back. Once we do this, we find that Tourmaline has seen its stock price soar. In fact, it has risen 90% in the last year. But there’s more. Tourmaline has also given shareholders returns in the form of dividends. For example, the company increased its dividend base three times in 2021 for a 29% increase. It also increased its dividend last week — another 11% increase to $0.80. Finally, Tourmaline has issued numerous special dividends.

So, at the end of the day, Tourmaline has given a lot of its cash flow back to shareholders. Financial discipline and shareholder value have been key priorities at Tourmaline, and it shows.

Why Tourmaline stock is just beginning its ascent

Natural gas fundamentals haven’t been this good in a very long time. In fact, it’s been 20 years. And back then, natural gas was flying high but had many headwinds looming. For example, production was booming. Also, it was a closed market — anything produced in North America stayed in North America.

Today, natural gas prices are closing in on US$5.00. They’ve increased 80% in the last year, and all indications point to them heading higher. There are two main reasons for this view that I have. Firstly, it’s been widely acknowledged that natural gas is a “bridge” fuel that can take us into a world of renewable energy. It’s much less dirty than coal, and the opportunity for natural gas to replace coal is huge.

Secondly, natural gas produced in North America is no longer trapped in North America. LNG capacity has been built out in the U.S. and exports to high demand areas are accelerating. For example, Asia is a massive source of demand for North American natural gas. While Canada is behind in its LNG build-out, some Canadian companies like Tourmaline are finding their way around this. As for the medium-term future, Canada is finally stepping up its LNG export capacity, and we should expect to see LNG move significantly higher over time.

What all of this means is that Canadian natural gas is about to see explosive increases in demand. We know that it’s among the cleanest in the world. We also know that it’s among the cheapest in the world. This means that we can safely say that the global demand picture will remain bright for some time to come.

Motley Fool: The bottom line

Tourmaline has seen its stock price rally hard as natural gas prices soar. But this is just the beginning. Tourmaline generates strong cash flows, has a pristine balance sheet, and has solid operations. This will ensure that Tourmaline will see its stock price continue to soar for as long as natural gas prices remain strong, which I believe will be a long time. The energy up-cycle is still in the earlier stages. So, consider adding energy stocks like Tourmaline today.