It’s easy to buy TSX stocks in a rising bull market. Sentiment is positive, and momentum helps push investments up, regardless of if they deserve it or not. The problem is, you often pay a price premium to own investments in “happy” markets.

Bear markets are just the opposite. When stocks are quickly declining, buying is the last thing many investors want to do. In fact, selling stocks and preserving capital often become the priority.

Investing in TSX stocks is never easy

This conundrum is exactly why investing in TSX stocks is more difficult than many admit. The stock market messes with our human psychology. The peak of a bull market is often the time when investors should sell and take profits. Periods of rapid stock decline and deep selling are when investors should be buyers. Yet our gut reaction often leads us to do the opposite.

Warren Buffett, one of the greatest investors of all time, once thoughtfully said: “Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can’t buy what is popular and do well.” The time to buy quality TSX stocks is when everyone is selling stocks at extreme discounts.

The best investments are often made in bear markets

The market constantly reacts and overreacts. It attempts to predict the future with the worst-case scenario in a bear market. Likewise, the market becomes overly optimistic in a bull market. Consequently, it is crucial to act counter to your emotions.

Time and time again, the market collapses and then recovers. The great part is that stock markets almost always recover more than they fall. As dire as the world appears now, chances are very good it will normalize, and so will the stock market. While it may not feel like it, buying TSX stocks on a serious selloff is the most de-risked way to invest.

Master your emotions to master the stock market

If you are new to investing and want to master the market (rather than be mastered) it is crucial that you master your emotions and think counter to the market. Fortunately, you can do this by just buying stocks in high-quality businesses, owning them for the long term, and then basically doing nothing. Buy-and-hold investing is boring, but it is often the most successful.

If you aren’t afraid of the recent market selloff, now may be the perfect time to dip your feet into investing. It is always important to have a diversified portfolio with at least eight to 10 stocks. However, if you are just looking for a good starter stock for your portfolio, Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM) is ideal.

Brookfield Asset Management: A top TSX stock to buy and hold forever

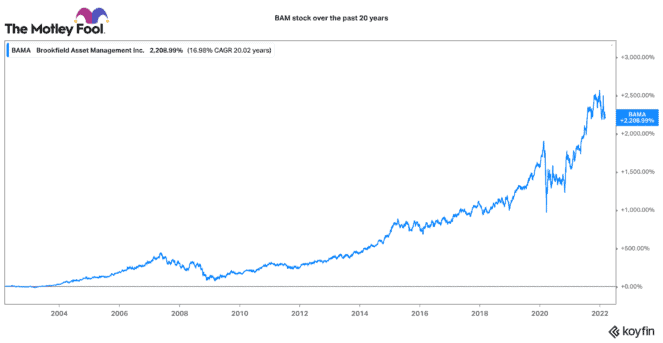

With $690 billion of assets under management, Brookfield is one of the largest alternative asset managers in the world. It owns and manages everything from real estate to infrastructure to private equity to insurance. This TSX stock is down nearly 12% this year, and it looks attractive today.

Brookfield has a diversified operational platform and a contrarian investment approach. This means it can invest counter to the market. Despite its size today, its business is only accelerating. Brookfield has grown distributable earnings per share by a compounded annual growth rate of 29% over the past five years.

This TSX stock has failed to keep up with its strong operational performance. As a result, it is presenting attractive value today. If you want a high-quality business with solid +20% growth and only modest risk, Brookfield is a great stock pick to buy on the pullback.