The story of Shopify (TSX:SHOP)(NYSE:SHOP) is one of extraordinary circumstances. It’s also a great idea executed in an exceptional manner. It’s the true emergence of e-commerce and a signal of a new world. Not surprisingly, Shopify stock has embodied all of these qualities. But the problem is, every story has an ending. And every story has twists and turns. Well, readers, we’ve come to a doozy of a twist.

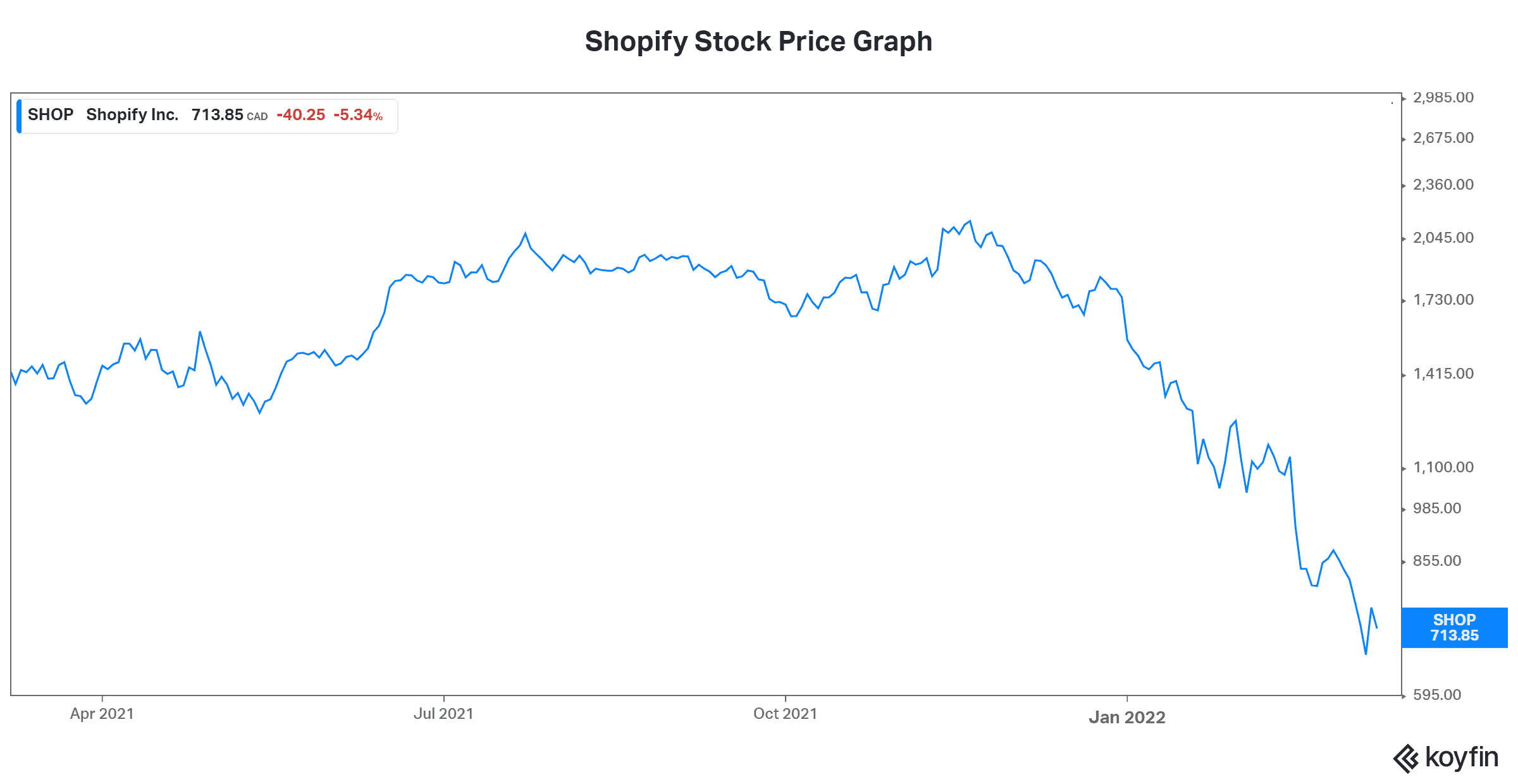

Shopify has seen its stock price fall 65% from its highs of November 2021. While this fall is drastic, it also makes sense. And with this fall, we have to ask ourselves, is it time to buy this top tech stock?

Shopify stock: Trying to catch a falling knife

A famous adage in investing warns us to never try to “catch a falling knife.” The reasoning here is simple. When a stock is in a free fall, it’s really hard to tell when and where the stock will finally settle. Momentum is working against it. Therefore, it’s best to sit on the sidelines until such point where the dust settles. We definitely don’t want to get caught up in downside momentum.

So, for Shopify stock, it kind of makes sense that it has been crashing. Valuations were an issue. It was trading under the assumptions of only blue skies ahead. Simply put, the market was pricing Shopify for the impossible. No company can shoulder a “priced-for-perfection” valuation forever. Sooner or later, reality hits. So, while Shopify is a top-notch company, the question is, how much should we pay for the stock? This is where it gets interesting.

Do valuations finally make sense for Shopify?

For the first time in a long time, I think I can finally say that Shopify stock’s valuations don’t make me nervous. Furthermore, they actually look reasonable and maybe even be attractively valued. Let me highlight some of the valuation numbers. Today, Shopify stock is trading at a price-to-sales multiple of 16 times. In the latest quarter, revenue increased 41% — lower than prior quarters, but still, exceptionally high. I like these numbers.

Also, Shopify stock is trading at a P/E multiple of 25.7 times. That seems fine. The problem here is that earnings and profitability are being hit. With this, earnings estimates for the quarters and years ahead are being ratcheted down. This is big. Revenue growth is great, but if this doesn’t translate to earnings growth, there’s a problem. Maybe the problem is part of growing and getting bigger. Certainly, we can understand investing back in the business in order to achieve long-term growth.

Many growth opportunities exist for Shopify, but high capital spending warrants caution

But here we are today, with the prospect of big spending on growth threatening Shopify’s profitability. It’s a great long-term move, especially when we see what the opportunities are. But, of course, it dampens the shorter-term optimism, as it will hit profitability.

One of the most exciting opportunities for Shopify is its international expansion. Selling globally is incredibly challenging, but Shopify is setting it up. Foreign exchange conversion, translation, and many other hurdles need to be addressed for Shopify’s clients to successfully navigate their way globally. For example, Shopify launched JD Marketplace in January. It enables merchants to sell products in China with little hassle. China’s e-commerce market is estimated to be worth $3.3 trillion by 2025. That’s five times larger than the United States. Clearly, the opportunity is huge.

But all of this growth and new initiatives take money. This is why Shopify’s profitability is being hit and will continue to be hit for the next few years.

Motley Fool: The bottom line

So, the bottom line here is that Shopify remains a leader in e-commerce. But it takes spending to maintain this leadership position and the next few years will see just that. The valuation today looks acceptable, but the upcoming earnings hit might still surprise some. I would therefore wait for a better time to buy Shopify stock.