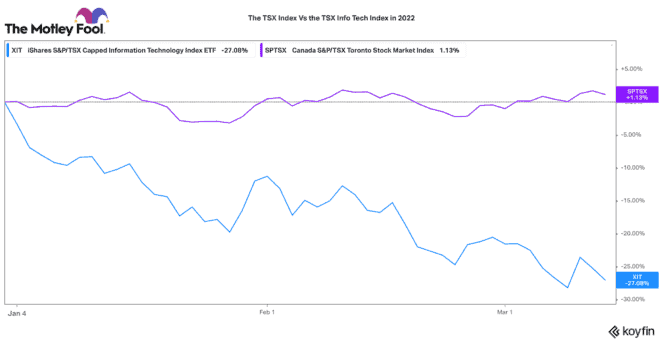

Growth and technology stocks have been hammered in 2022. The S&P/TSX Composite Index is modestly up 1.13% this year (mainly due to strength in oil, banks, and utilities). Yet the S&P/TSX Capped Information Technology Index is down 27%!

Pandemic tailwinds are unwinding for TSX growth stocks

Certainly, since the March 2020 pandemic crash, TSX growth stocks had enjoyed an incredible run. Many top growth stocks enjoyed ample tailwinds from work-from-home and increased e-commerce sales. With interest rates rising, supply chain challenges, and the world re-opening from pandemic lockdowns, some of these trends could unwind to an extent.

Growth will undoubtably slow going forward. A normalization of pre-pandemic type returns can be expected. However, at some point, the current bearish market behaviour will rebound and quit punishing these stocks. The good news is, many companies are still soundly growing over 20% a year and profitability continues to rise.

A great time to pick up high-growth stocks when they are cheap

The recent decline might be an incredible opportunity to buy quality growth stocks at a sheer discount to where they traded only a few months ago. If you can take a long-term perspective, the dips and crashes have traditionally been the best time to pick up growth stocks. If you are not afraid of the volatility, here are two top TSX growth stocks to consider while they are still cheap.

Nuvei

One high-growth stock that is starting to look very interesting is Nuvei (TSX:NVEI)(NASDAQ:NVEI). It provides a specialized payment platform for merchants around the world. It just delivered monster results in 2021. Payment volumes increased 121% to $95.6 billion. Revenues grew 93% to $724.5 million and adjusted EBITDA increased 95% to $317 million (a 43% EBITDA margin)!

After a short report attack caused the stock to sell off nearly 50%, this tech stock is presenting decent value. Despite its solid growth, it only trades with an enterprise value-to-EBITDA ratio of 17.7 times. Its price-to-sales ratio of eight is high but nearly half what it was a year ago.

The company is targeting about 30% revenue and EBITDA growth in 2022. That growth rate is expected to carry through the medium term as well. So far, it has done well at hitting (or exceeding) its annual expectations.

After the short report, the company has focused on transparency and better disclosure. While this growth stock has some valuation risks, now seems like an interesting time to begin a position.

goeasy

If you are looking for a high-growth stock that is non-tech, goeasy (TSX:GSY) has become very cheap. Over the past 10 years, goeasy stock has risen on average by 33%. It has delivered a 2,086% total return in that time. That makes it one of the best-performing stocks in Canada.

Yet this growth stock has pulled back 28% year to date. Today, it only trades for 10 times earnings. Likewise, it pays an attractive 2.8% dividend. It has grown that dividend by about 23% every year for the past decade.

goeasy is one of Canada’s largest providers of non-prime lending and leasing services. It has a great omni-channel platform that still has room to scale across Canada. Likewise, the company is developing new lending services and verticals.

Further, it is eyeing broader international markets for future expansion. Insiders have recently been buying the stock, so that is always a good sign for this growth stock’s future business prospects.