Air Canada (TSX:AC) and Cineplex (TSX:CGX) have been two of the hardest-hit stocks by the pandemic. And unsurprisingly, because their share prices are still down so significantly, they’ve been two of the top stocks that investors have been looking to buy.

However, despite the potential these two stocks have, especially now as many restrictions are being reduced, there might be one top Canadian stock to buy that offers better recovery potential for investors today.

Now is the time to buy top recovery stocks

More than two years into the pandemic now, and countries around the world are continuing to signal its time to move on from the pandemic. It’s not just the dropping of restrictions, though. Governments and health officials are making prudent plans to allow us to get back to normal life and live with the virus.

So while it’s not certain these restrictions will be gone forever, officials continue to plan for all scenarios to do anything possible to avoid future lockdowns. And with new technology such as oral antiviral treatments, it’s increasingly looking as though we can get back to normal once and for all.

It’s this certainty what investors have finally been looking for, which is why now is the time to find the top recovery stocks to buy. And now, with the operations of both Cineplex and Air Canada able to stage a recovery, their share prices should eventually follow suit.

So with the value that these stocks trade at, there is some upside in the shares. However, the upside for both Air Canada stock and Cineplex could be limited due to several factors, including how much value has been lost through the pandemic.

So instead of these two top Canadian recovery stocks, you may want to consider American Hotel Income Properties REIT (TSX:HOT.UN), which could be an even better investment in the current environment.

Can this stock outperform Air Canada and Cineplex?

American Hotel Income Properties is a real estate investment trust that owns premium hotels in the United States. So much like Air Canada and Cineplex stocks, HOT has been significantly impacted by the pandemic, making it one of the top recovery stocks to buy.

Throughout 2021, the REIT saw occupancy levels between 80% and 90% of what it did in 2019, the year before the pandemic. So while there is upside in American Hotel Income Properties’ units, it’s also clear that it’s recovering quicker than Air Canada and Cineplex. That’s one of the main reasons it could be the best of the three stocks to buy now.

Plus, with pent-up demand from travellers, but also the potential for business travel to pick up again, HOT stands to continue to see a strong recovery. And because there have been fewer restrictions south of the border recently, the stock has a clearer path to recovery with fewer headwinds and uncertainty.

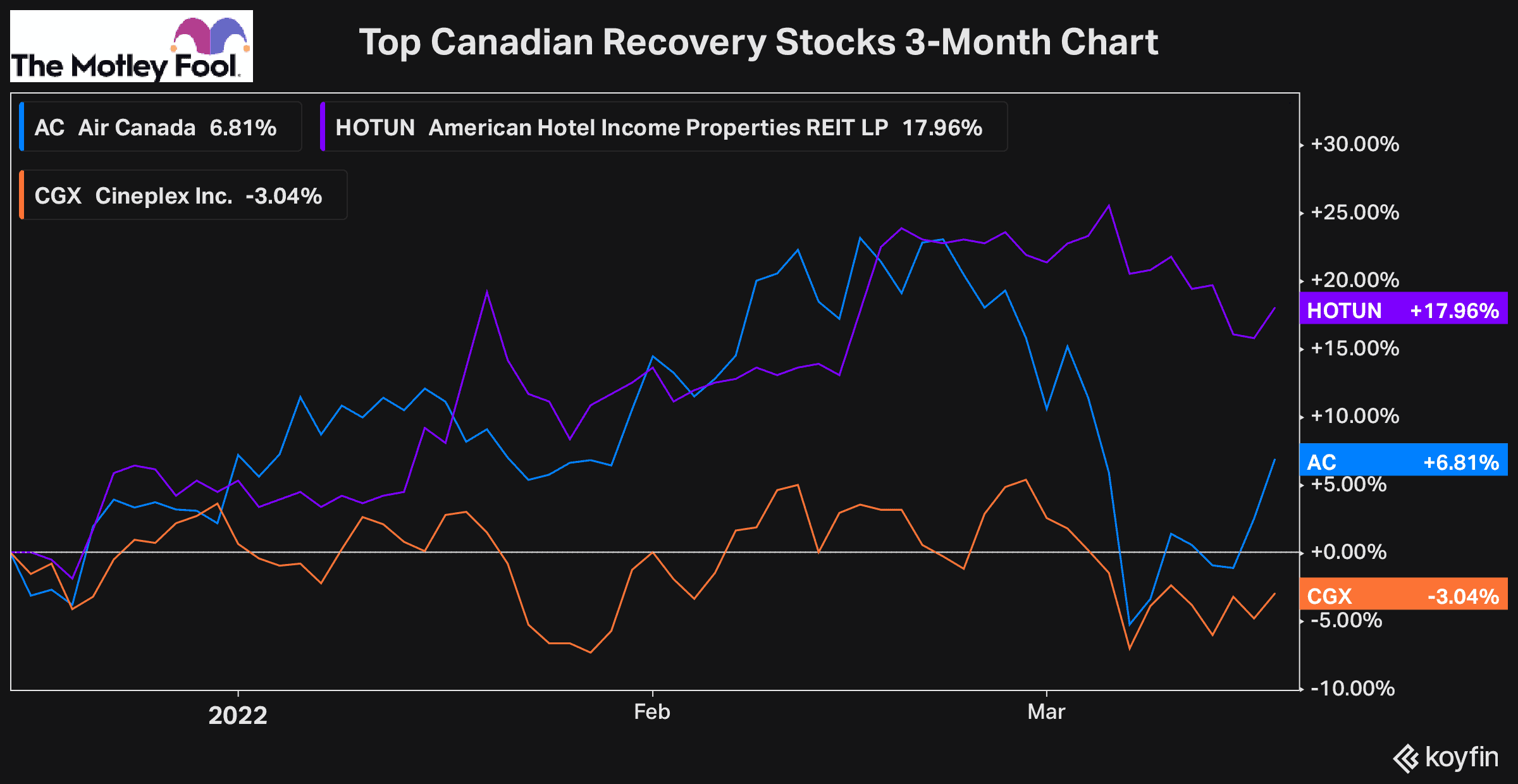

Over the last three months, American Hotel Income Properties has outperformed both Air Canada and Cineplex stocks, showing it has the most momentum of the three today.

And on top of everything else, the REIT pays a distribution that has a current yield of 4.4%. So if you’re trying to decide which recovery stocks are the best to buy, American Hotel Properties looks like it’s one of the top investments to consider today.