On March 8, 2022 the NASDAQ 100 Index officially entered a bear market, closing more than -20% lower compared to its all-time high on November 19, 2021.

The mega-cap heavy index was dragged down by losses in many high-valuation growth stocks that were performing well during the COVID-19 pandemic. Unfortunately, a combination of high inflation and impending interest rate hikes have sent some strong headwinds their way.

That being said, over the long term, the NASDAQ 100 Index will likely deliver great returns. According to Dow Jones Market Data, the average bear market lasts for 110 days. If you can stomach the volatility and unrealized losses, now could be a great time to lock in a low cost basis.

When it comes to buying the dip, you could pick individual NASDAQ stocks like Apple, Microsoft, Advanced Micro Devices, NVIDIA, Alphabet, and Tesla, but a safer and easier way is to buy an exchange-traded fund (ETF) that tracks the NASDAQ 100 Index. Let’s examine our options here.

The Canadian version

If you’re investing in CAD, buy BMO NASDAQ 100 Equity Hedged to CAD Index ETF (TSX:ZQQ). With $1.4 billion AUM, this ETF is the second largest of its kind in Canada. Currently, holding this ETF will cost you a 0.39% management expense ratio (MER), which is pricey for a passively managed fund but not more so than other Canadian competitors.

Unlike other CAD-denominated ETFs that track U.S. equity indexes, ZQQ is currency hedged. Theoretically, this means that ZQQ’s value will not be affected by fluctuations between the CAD-USD pair. In practice, the imperfect way the currency futures contracts are rolled forwards introduces tracking error, which results in a drag on performance.

The American version

If you’re investing in USD, buy Invesco QQQ Trust (NASDAQ:QQQ). With $135 billion AUM, QQQ is the largest of its kind in the world and popular among both institutional and retail investors alike with great liquidity. Currently, holding this ETF will cost you a 0.20% MER, which is half as expensive as ZQQ.

If you are comfortable with using Norbert’s Gambit to convert CAD to USD for cheap, you can save significantly by using a less-expensive U.S.-denominated ETF. Moreover, U.S.-denominated ETFs do not incur a 15% foreign withholding tax on dividends if held inside an RRSP.

Which one should I buy?

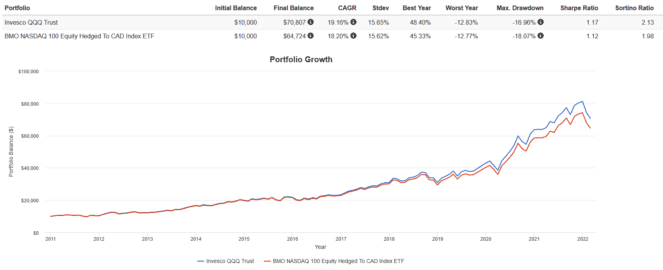

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

That being said, from 2011 to present ZQQ tracked QQQ closely, but did underperform over time by around 1%. This was due to its higher MER and the cost of the currency hedging. Otherwise, the funds are virtually identical in terms of volatility, drawdowns, and risk-adjusted returns.

My asset allocation advice here is optimize for tax efficiency. If you are investing in a TFSA, ZQQ is your best bet, as a foreign withholding tax applies to all U.S. holdings there anyway. For an RRSP, using Norbert’s Gambit to convert CAD-USD cheaply and buying QQQ can save you on MER and foreign withholding tax.