Serious issues are plaguing the markets. Record inflation, global tensions, and a pandemic that’s yet to be resolved have all placed incredible pressure on economies. Where are investors to turn? Should we sell, stock up on gold stocks, or focus on dividend-growth stocks? Well, the answer here is probably all of the above. Selling positions into strength will lock in gains. Buying gold stocks will provide some inflation protection. Finally, buying the best dividend stocks in Canada can give you the steady growth we’re all looking for.

Without further ado, here are three of the best dividend stocks in Canada. They’re dividend-growth stocks that are the answer for today’s investor. They all happen to be energy stocks, which makes sense given the booming cycle that they’re benefitting from right now.

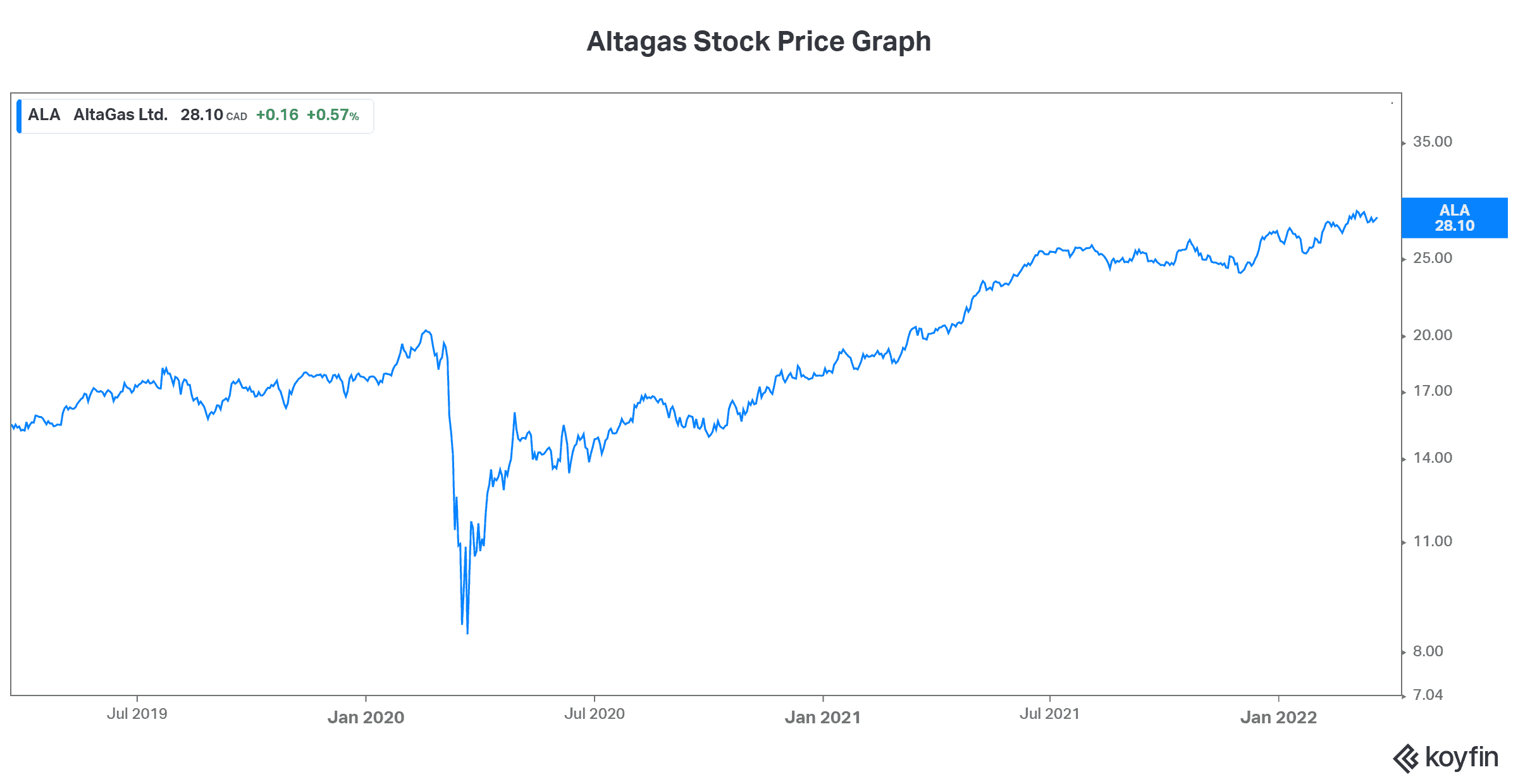

AltaGas stock: A utility/energy stock whose dividend is rising

AltaGas (TSX:ALA) has seen its dividend grow 10% in the last three years. But that’s nothing compared to what I believe is coming. In fact, AltaGas’s booming midstream business will likely support big dividend growth in the years to come.

Essentially, this Canadian energy infrastructure/utilities company has been on fire in the last couple of years. AltaGas’s utilities segment, which accounts for 51% of EBITDA, is the safe portion of the business. The energy infrastructure segment is the segment that’s booming as oil and gas prices soar. The bright spot of AltaGas’s energy operation is its global export platform. Through these facilities, AltaGas is exporting record amounts of propane and butane to Asian markets.

In 2021, AltaGas’s earnings increased 24%, while normalized funds from operations rose 20%. Global demand for AltaGas’s propane and natural gas by-products is insatiable. Therefore, I think we can expect more good years for AltaGas.

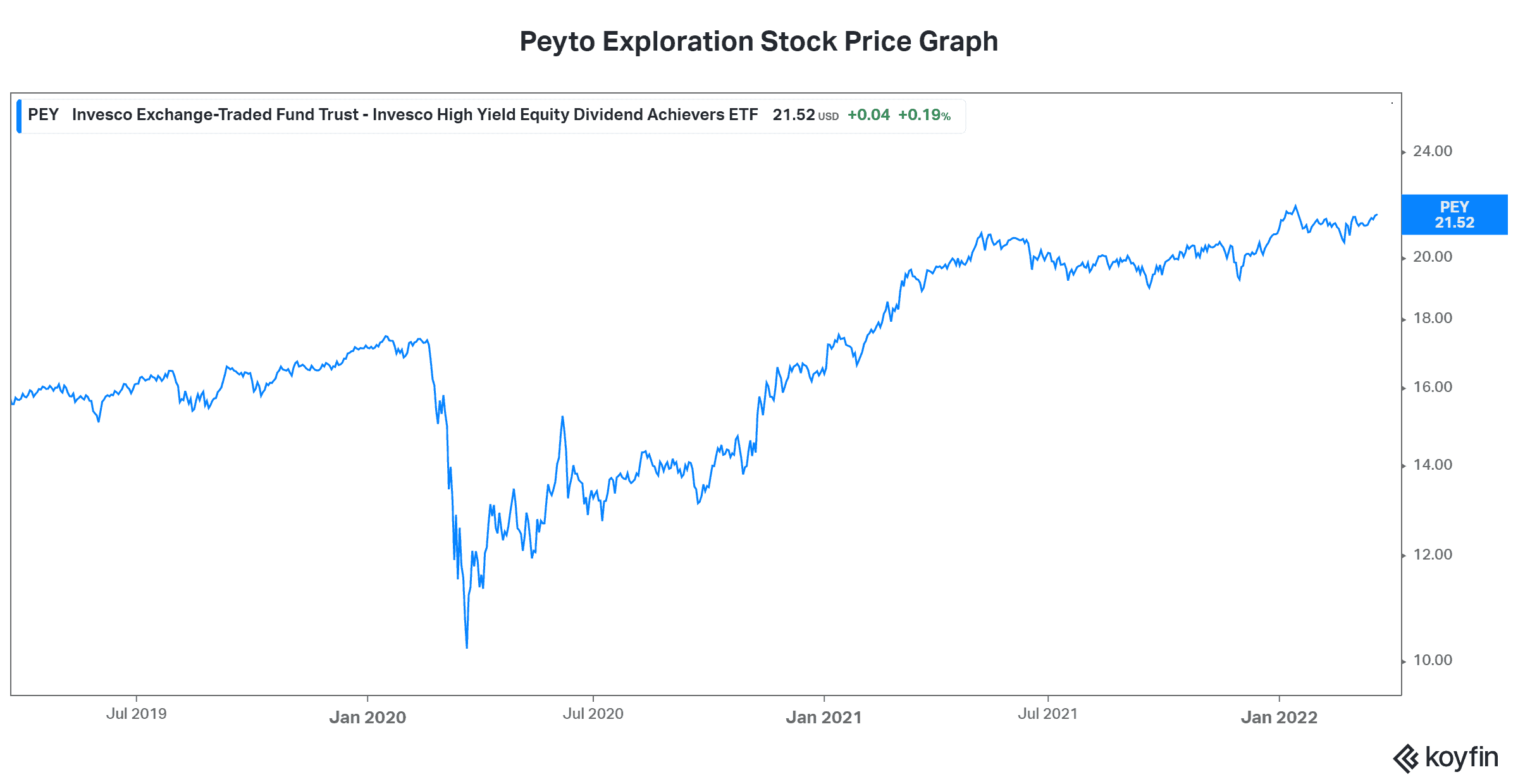

Peyto Exploration and Development: A dividend-growth story gaining momentum with natural gas prices

Peyto Exploration and Development (TSX:PEY) was always a high-quality natural gas company. Today, the stock is soaring, along with cash flows. These soaring cash flows have made Peyto a true dividend-growth stock. In fact, Peyto’s dividend has grown 150% in the last three years, with no end in sight for this company’s dividend growth.

A strong natural gas market is sealing Peyto’s fortunes as a top-tier natural gas player with a bright future. 2021 was a great year, with earnings, cash flows, and margins significantly higher than the prior year. Furthermore, Peyto achieved its best capital efficiencies in 19 years. According to management, things are only getting better in 2022.

So, for now, Peyto is using much of its cash flow to reduce debt. By the end of 2022, management expects that its debt to EBITDA ratio will fall below one times. This is representative of a very strong balance sheet and a very positive cash flow situation. In fact, it will be Peyto’s strongest balance sheet in its history. At that point, we can expect Peyto will begin raising its dividend again.

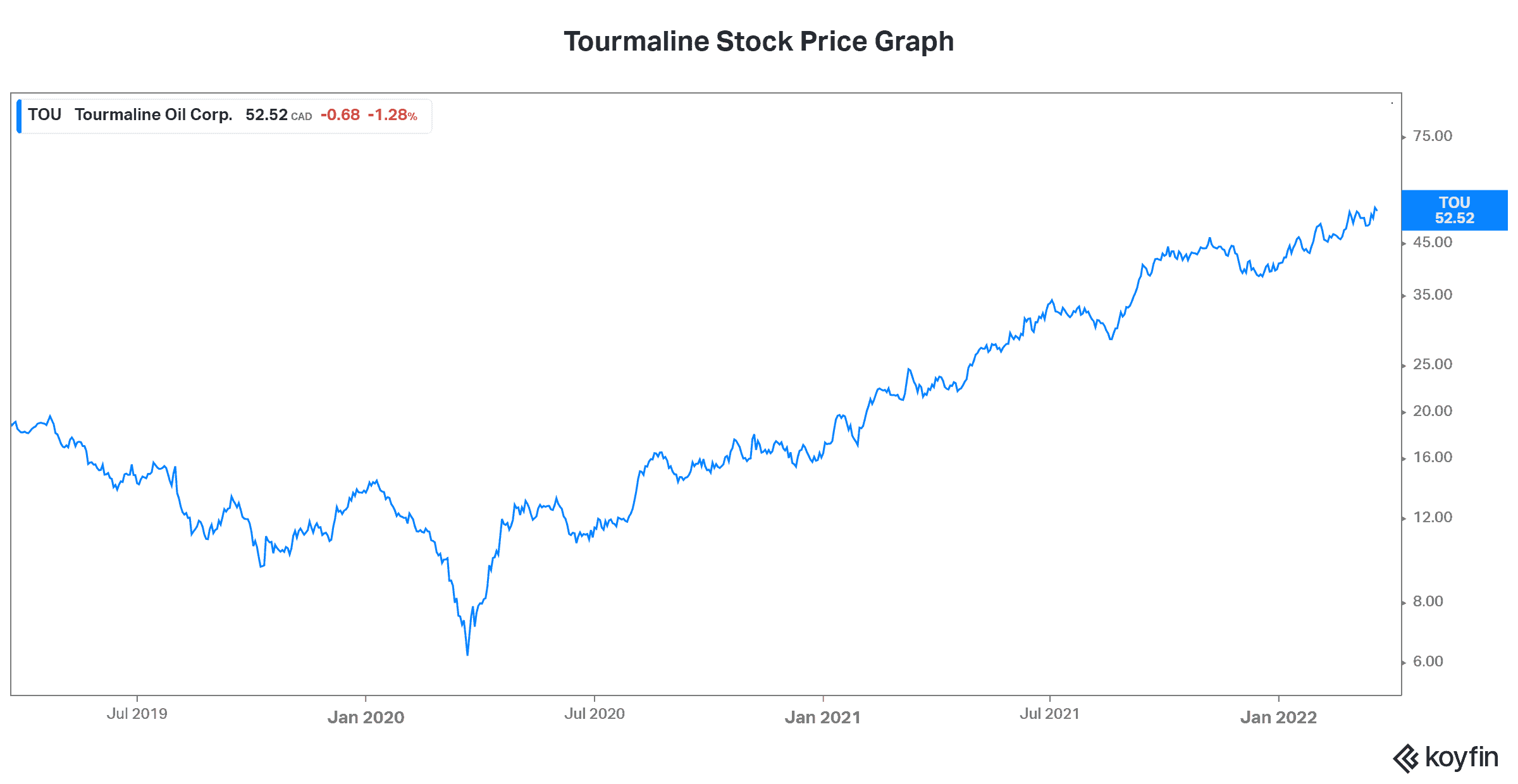

Tourmaline stock: Another Canadian natural gas success story with exceptional dividend growth

Tourmaline Oil (TSX:TOU) is a Canadian mid-tier natural gas producer — the largest natural gas producer in Canada. This is one of Canada’s energy stocks that’s soaring as cash flows soar. Furthermore, Tourmaline has seen exceptional dividend growth in the last three years. In fact, Tourmaline’s dividend has risen 67% in this period. Add to this that the company has also paid out numerous special dividends, and we have ourselves a clear winner.

But Tourmaline is not finished yet. Management has a clear intention to continue to return capital to shareholders. This is, in fact, exactly what they’re doing. I think that we can expect this to continue as long as natural gas prices remain strong.

The bottom line

Energy stocks and dividend-growth stocks really always have their place in investor portfolios. But I would argue that in today’s markets, they’re even more relevant. In a volatile market, stock prices can and do get whipped around pretty easily. But dividends from quality companies, like the ones discussed in this article, are a more stable source of shareholder returns. They are, after all, among the best dividend stocks in Canada.