Canadians love dividend stocks, and I totally understand why. Our stock market is filled with great banking, insurance, energy, utilities, and telecom stocks that offer high yields, a long history of consistent payouts, and ever-increasing dividend payments.

That being said, managing a portfolio of 15-30 dividend stocks can be tiring and tedious. Manually rebalancing them, reinvesting dividends, and keeping up with each company’s news and earnings can be daunting to prospective investors.

The good news is that various fund providers such as Vanguard and BlackRock have exchange-traded funds (ETFs) that do all the hard work for you. These ETFs hold a basket of dividend stocks according to various criteria. By purchasing a share of these ETFs, you own a slice of that basket.

The Vanguard option

Up first is a favourite for investors seeking high monthly income with the potential for capital growth: Vanguard FTSE Canadian High Dividend Yield Index ETF (TSX:VDY). VDY passively tracks the performance of 39 Canadian stocks characterized primarily by high dividend yields.

High dividend yields tend to be found in financial and energy sector stocks, so it’s no surprise that VDY is heavily weighted here. The top 10 holdings in VDY include Royal Bank, Toronto-Dominion Bank, Bank of Nova Scotia, Enbridge, Bank of Montreal, Canadian Natural Resources, Canadian Imperial Bank of Commerce, TC Energy, BCE, and Suncor Energy.

Currently, VDY costs a management expense ratio (MER) of 0.20% to hold, which is costlier than broad indexes but not expensive for a specialty fund. It works out to be around $20 per 10,000 invested. The 12-month dividend yield currently stands at a respectable 3.41%.

The BlackRock option

If you’re more of a dividend growth investor, iShares S&P/TSX Canadian Dividend Aristocrats Index ETF (TSX:CDZ) might be the better pick here. CDZ only holds quality stocks that have increased ordinary cash dividends for at least five consecutive years.

CDZ is more diversified, with a total of 86 underlying holdings spread out across the broad TSX sectors excluding information technology. The top 10 include Canadian Natural Resources, Smartcenters REIT, Enbridge, Keyera, Pembina Pipeline, Power Corporation, Canadian Imperial Bank of Commerce, Fiera Capital, BCE, and Great-West Lifeco.

CDZ has an MER of 0.66%, which is quite pricy at over three times the cost of VDY. For a $10,000 investment portfolio, this means an annual fee of $66. Keep in mind that the high MER will eat into your returns. The 12-month dividend yield currently stands at a healthy 3.35%.

The Foolish takeaway

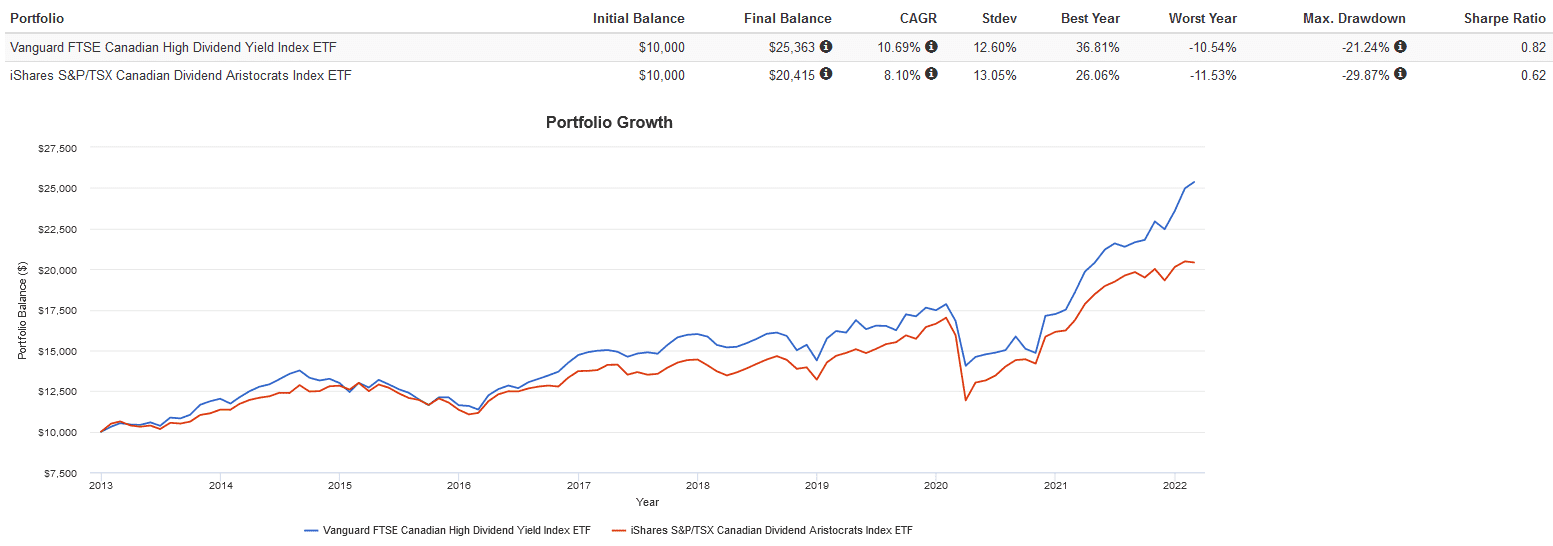

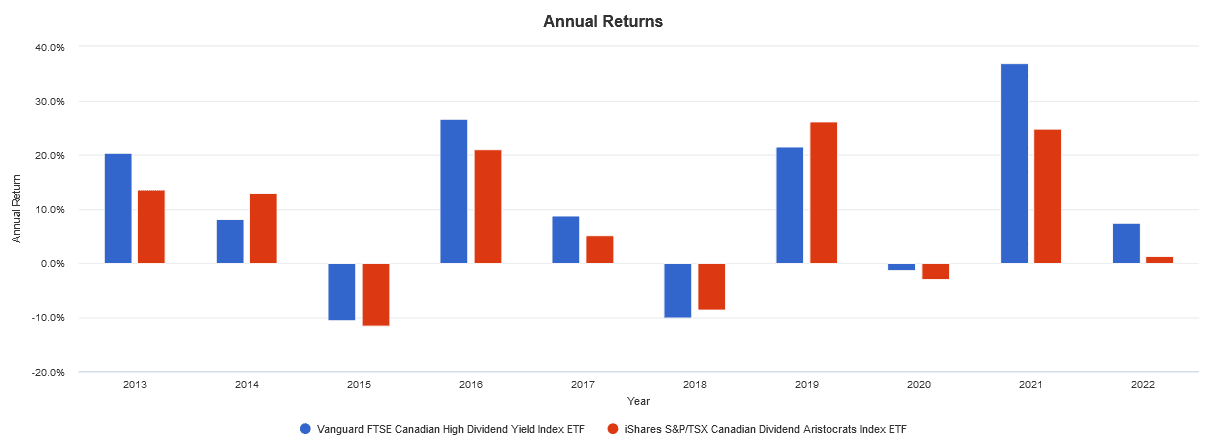

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

From 2013 to present with all dividends reinvested, VDY significantly outperformed CDZ on multiple metrics, including total return, volatility, best year, max drawdown, and risk-adjusted return.

My pick here is VDY. Although it has fewer holdings and is more concentrated in the financials and energy sectors, the stocks it holds are large-cap, blue-chip companies with good management and profitability. Over time, the lower MER of VDY also gives it a significant advantage.