Gas prices have always been volatile. But while many of us always paid attention to them, we haven’t necessarily changed our habits because of them. Today, gas prices at the pump are significantly higher than one year ago. They are, in fact, at record highs. Surely, this is something that we, as investors, must take into account in our decision making.

So, what exactly does this mean, and how should we invest accordingly?

Rising gas prices benefits, you guessed it, oil and gas companies

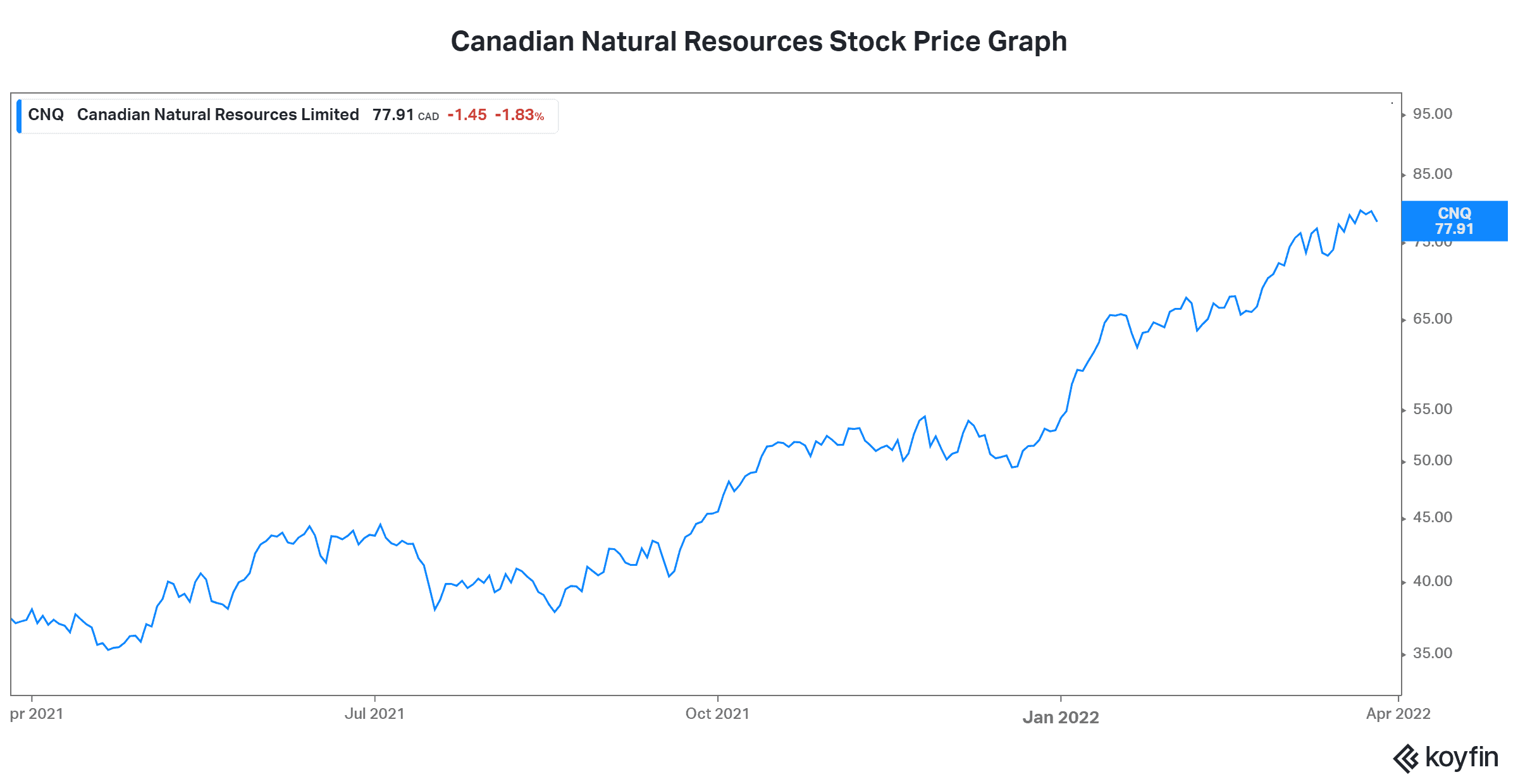

Excuse me for stating the obvious, but rising gas prices is great for oil and gas stocks. We should still be mindful of the risks in these stocks. That’s why I would stick to the higher-quality companies when investing in energy stocks. Like always, this is the way to go. As an example, we have Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ), a $93 billion, top-tier Canadian oil and gas company.

Canadian Natural is benefitting greatly from strong commodity prices. In fact, the company is awash in cash flow, which allows it to dramatically reduce its debt and to increase its dividend. The plain truth is that oil and gas will be needed for years to come, and recent events have highlighted this fact. So, along with this short-term strength, we can also feel comfort in the long term.

Lastly, CNQ stock is a great stock to choose to take advantage of rising gas prices, because it’s super resilient. This means that in most commodity price environments, Canadian Natural holds up comparatively well. The company’s long-life, low-decline asset base makes it so.

Consumers’ wallets are being hit by rising gas prices

With gas at the pump rising to record levels, it just makes sense that consumers may have to reduce spending elsewhere. I’m thinking that companies like Canada Goose Holdings (TSX:GOOS)(NYSE:GOOS) might suffer. With less disposable income, shoppers might opt for the less-expensive options.

Although Canada Goose’s stock price has already fallen 50% from its 2021 highs, it remains quite overvalued and at risk. It trades at 34 times earnings, and, in my view, earnings are at risk. So, this leaves us with an already richly valued, cyclical stock that’s probably heading into a cyclical low period. I think Canada Goose will be a casualty of rising gas prices in the next year or so.

Companies that have fuel as a major expense are also being hit

There’s no company where fuel prices make up a greater portion of costs than Air Canada (TSX:AC). In 2019, when oil prices averaged below $60, aircraft fuel represented 22% of total operating cost. Oil prices are dramatically higher today at approximately $105. This will prove to be very detrimental to the bottom line.

I do not believe that airliners will be able to raise prices in any significant way as we come out of the pandemic. Therefore, I think that rising gas/fuel prices will hit Air Canada hard. While many were hoping for a big rebound for Air Canada stock in 2022, soaring oil prices has placed that whole possibility into question. Tread carefully and be mindful of the changing risk/reward dynamic of Air Canada stock.

Motley Fool: The bottom line

In closing, I would like to remind investors that soaring oil and gas prices do warrant a re-examination of your stock holdings. We should adjust to the new world we are living in today so that we can continue to make money tomorrow.