During the pandemic, there was a massive amount of stimulus that kept the economy going. It was a necessary reaction to a bad situation. It kept the economy alive, and it kept many people afloat. But here we are two years into the pandemic. We’re feeling the consequences. This necessary response that kept the economy alive is causing inflation to rear its ugly head.

Record inflation is our reality today. It’s rising at unprecedented levels. Here are two stocks to buy for protection.

Inflation is rising but we can protect ourselves

There was a time when policy makers and economists classified the recent sharp rise in inflation as “transitory,” or not permanent. Well, nothing is permanent, but the idea that the rise in inflation would just be a blip that shouldn’t concern us, was misguided.

During the pandemic, Canada pumped hundreds of billions of dollars into the economy. This was its economic relief. It was a necessary thing to do. But the negative repercussions were always looming. The inflation rate in Canada in January 2022 was 5.1%. It increased to 5.7% in February and then 5.7% again in March. This is now the highest inflation rate we have seen in Canada since 1991. To make matters worse, this trend shows no signs of letting up. In fact, forecasts are calling for a 6% inflation rate for the year.

Gold stocks are among the best inflation hedges out there

While gold has lost a bit of its appeal in the mind of investors, it remains a very strong store of value. This means it’s a good inflation hedge. So we can buy gold stocks as a proxy for this. This can protect us from rising inflation. It’s certainly the right time for it, as we’re facing more increases in the inflation rate.

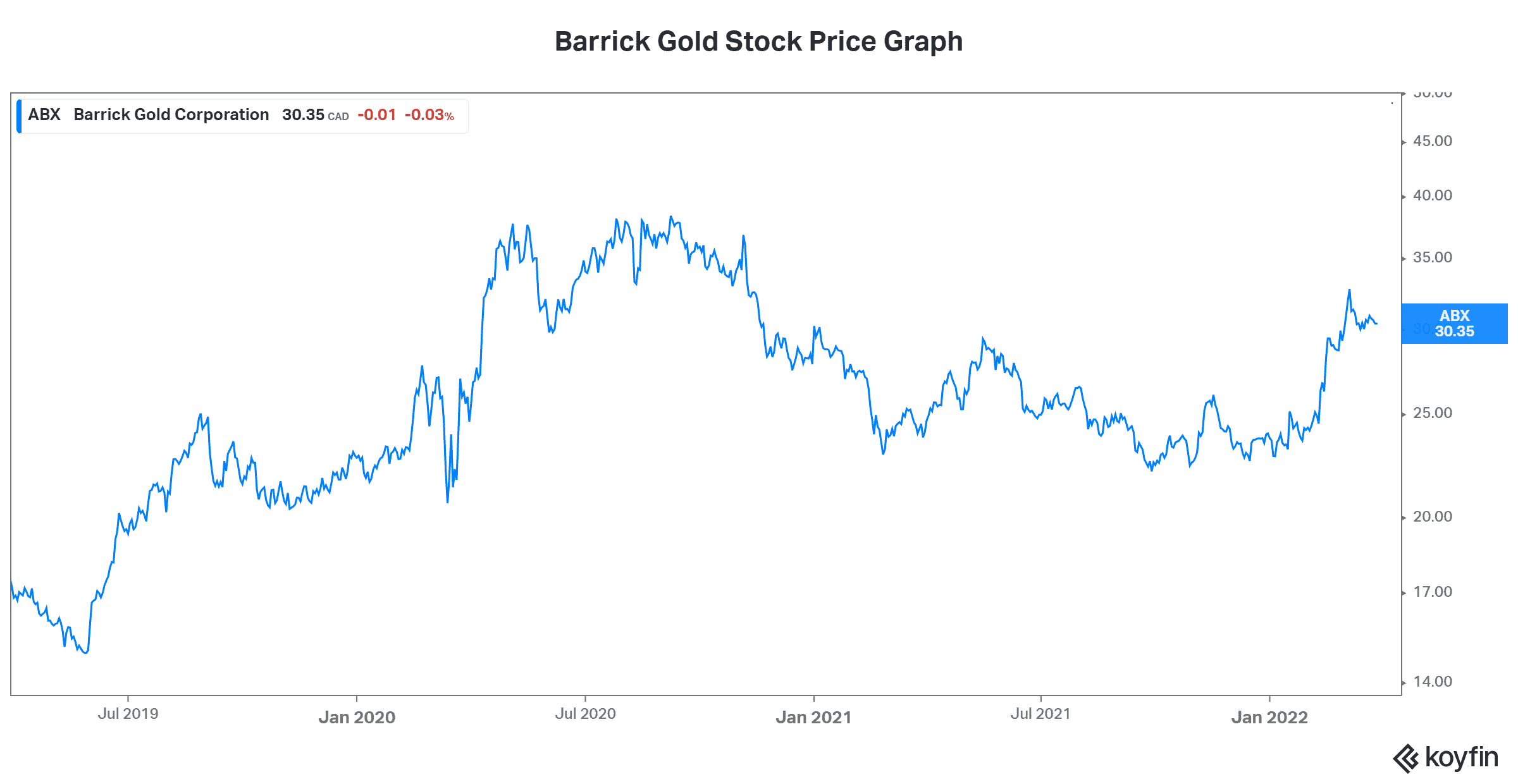

As far as gold stocks go, Barrick Gold Inc. (TSX:ABX)(NYSE:ABX) is the biggest and most well-known globally. It can therefore almost be thought of as a proxy for gold. If you believe gold prices are rising, then Barrick Gold stock is a good option for you. This is because is it has really good leverage to rising gold prices.

On top of the positive macro environment for gold stocks, Barrick also has numerous company-specific factors that make it attractive. It was once a heavily indebted gold company that struggled to move forward. Today, Barrick’s fortunes are rapidly improving. Some years ago, most gold companies went through a period of rigorous cost cutting. Persistently low gold prices necessitated this. This has translated into significant growth in cash flows for gold companies today and tomorrow. Barrick Gold stock is cheap. It has high margins. And its cash flows are rising along with the price of gold.

Some companies are sheltered from rising inflation

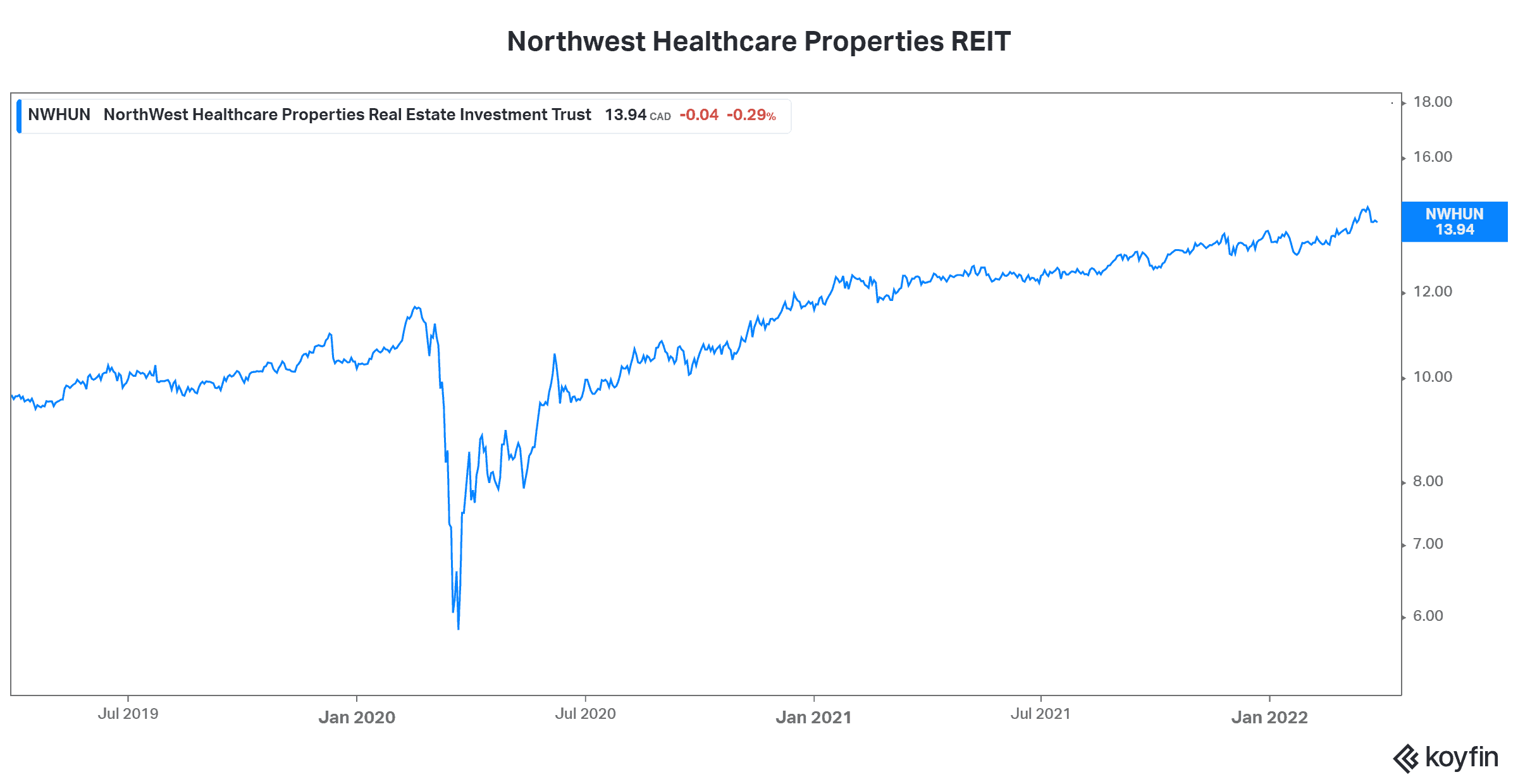

Other companies have an inflation hedge built into their business. Take Northwest Healthcare Properties REIT (TSX:NWH.un), for example. It’s a real estate investment trust (REIT) that owns and operates a lucrative portfolio of global health care real estate.

The fact that Northwest’s assets are all in the health care industry has many implications. Firstly, this is a defensive holding whose cash flows are relatively steady and stable. Secondly, it means that the majority of its revenues are indirectly or directly funded by the government. Lastly, its revenues are inflation-indexed, which is always a very attractive feature. Today, it’s even more attractive given the environment we’re in.

Motley Fool: the bottom line

So in closing, I would like to reiterate the importance of reacting to the rapidly rising inflation rate. It’s not a temporary phenomenon. Rather, it’s something that will probably be an issue for some time. In response, you can buy stocks like the ones mentioned in this article to protect your money.