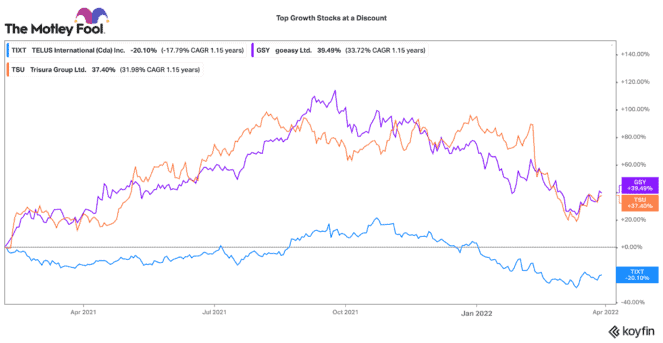

High-growth stocks on the TSX have been under significant pressure in 2022. Fortunately, if you are willing to do some digging, there are some really attractively priced small- and mid-cap growth stocks out there.

Today, the market seems to have forgotten them, but at some point, sentiment will change, and they could have massive upside. Here are three ultra-cheap, high-growth TSX stocks I’m eyeing today.

A top insurance stock

Generally, when we think of TSX growth stocks, we think of the technology sector. However, that is not always the case. Trisura Group (TSX:TSU) is a specialty insurance provider largely in Canada and the United States. Many don’t know this stock, but it has delivered a whopping 566% total return over the past four-and-half years.

Trisura has focused on niche insurance products that are lower risk, but higher return. Likewise, it has an insurance fronting business, where it underwrites policies, collects fees, and offsets the risk to a re-insurance provider. This has resulted in consistent market-leading high-teens return on equity (ROE).

Over the past three years, it has grown revenues and earnings per share by a compounded annual growth rate of 92% and 67%, respectively. That may slow, but it will still likely deliver elevated returns over its peers.

This TSX stock trades for 19 times earnings, which is still a significant discount to insurance fronting peers in the United States. This is the cheapest this stock has been since the pandemic hit.

A top TSX financial stock

Another unconventional cheap growth stock is goeasy (TSX:GSY). Like Trisura, goeasy has a great track record of returns. Over the past five years, investors have earned a 420% total return. Its stock has grown by a compounded annual growth rate of 39%!

goeasy is one of Canada’s largest providers of non-prime loans and leasing services. The large Canadian banks have abandoned this lending segment, so goeasy has been capturing significant market share.

Over the past five years, the company has grown annual revenues by around 20% and earnings per share by nearly double that rate.

While growth could slow due to market penetration, goeasy is developing new product verticals and is looking to expand into new geographies. Despite its great track record and positive outlook, this TSX stock only trades for 11.5 times earnings. It also pays a nice 2.7% dividend, so that is an attractive bonus.

A top TSX tech stock

One technology stock that has suffered in the recent selloff is Telus International (TSX:TIXT)(NYSE:TIXT). It provides digital customer interaction services for some of the largest corporations in the world. The world is increasingly digitizing business interactions. TI is at the forefront with data analytics, artificial intelligence, and machine-learning services.

TI completed its initial public offering (IPO) last year. Despite growing revenues and adjusted EBITDA by 38% and 39% in 2021, this stock has sold off significantly. It is down 9% since its IPO. While growth is expected to slow in 2022, it still expects at least high-teens growth across all metrics.

This TSX stock only trades with an enterprise value-to-EBITDA ratio of 12.5. For a company growing at a significantly faster rate, that seems cheap. Telus International is a well-managed growth company with a good balance sheet, strong free cash flows, and an attractive long-term outlook. Consequently, it is an attractive long-term buy at this price.