Investors looking to bet on the growth of U.S. mega-cap stocks have flocked to various exchange-traded funds (ETFs) tracking the NASDAQ 100 Index in recent years.

With a heavy allocation to top tech stocks such as Apple, Microsoft, Advanced Micro Devices, NVIDIA, Alphabet, and Tesla, the NASDAQ 100 has delivered outsized returns over the last decade.

Despite falling 20% in the last few months to officially enter a bear market, there is still reason to be bullish in the long term. If you can hold past the volatility, the NASDAQ 100 could be an excellent low-cost, passive investment to make.

However, many new investors get confused at the myriad of choices out there — in particular, whether to buy a currency hedged vs. unhedged NASDAQ 100 ETF.

Currency hedging? What’s that?

The underlying stocks of the NASDAQ 100 trade in USD. When you buy a Canadian ETF that tracks the NASDAQ 100, the fluctuation of the CAD-USD currencies can affect the value of the Canadian ETF beyond just the price movement of the underlying stocks.

ETFs that are not currency hedged simply accept and ignore this phenomenon. What that means is, if the U.S. dollar appreciates, the ETF will gain additional value. Conversely, if the Canadian dollar appreciates, the ETF will lose additional value.

This can alter your returns in the short term to something different than what the underlying index experiences, which can either be positive or negative. However, ETFs that are currency hedged will use futures contracts to lock in a set CAD-USD exchange rate every month.

With a currency-hedged fund, the changes between CAD-USD will not affect the value of the fund. You only get the price movements of the underlying stocks — nothing more, minus an extra fee for the cost of hedging.

Which one is better?

The answer to that question depends on how long you plan to hold the ETF for. For most investors with a higher risk tolerance and longer time horizon, I recommend unhedged. This is because over time, currency fluctuations between the CAD-USD tend to even out (regression to the mean).

If you’re holding for a shorter period of time or are retired and don’t want the currency volatility, hedging might be worth it. In this case, you’re trying to isolate just the movements of the index you’re investing in.

If you’re somehow able to accurately predict currency exchange rates, then a hedged ETF might also be good in cases where the CAD appreciates vs. the USD. However, this is unlikely. If you’re good or lucky enough to consistently predict FX movements, I would skip the index fund and just day trade.

The main reason to pick unhedged is because currency hedging is expensive. Trading those futures contracts and rolling them (selling and buying new ones every month) adds trading expenses, which eat into the ETF’s returns over time.

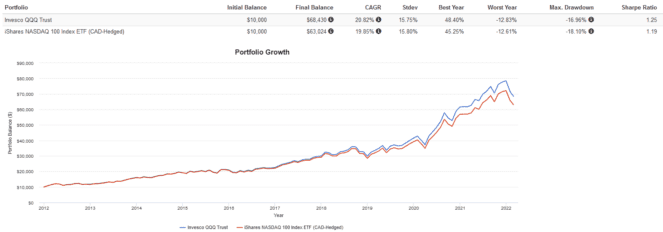

This creates what is called tracking error, or the percentage in the ETF’s performance that differs from the performance of the index it is trying to track. Below, I’ve plotted a backtest from 2012 with dividends reinvested of a Canadian-listed NASDAQ 100 ETF vs. its U.S.-listed counterpart.

- iShares NASDAQ 100 Index ETF (CAD-Hedged) (TSX:XQQ): management expense ratio (MER) of 0.39%.

- Invesco QQQ Trust (NYSE:QQQ): MER of 0.20%.

XQQ underperformed QQQ by around 1% CAGR over the time period and had a larger max drawdown and lower risk-adjusted returns (Sharpe). This was not caused by the 0.19% difference in MER but rather by the cost of the futures contract used for hedging. As seen in the chart, this can significantly eat into your returns over long periods of time.