Canadian growth stocks have seen a substantial pullback in 2022. While it is difficult to tell if they have hit a bottom, they have seen a decent bounce back in recent weeks.

Undoubtably, market volatility will persist into April. Consequently, dips could be a good buying opportunity, especially for investors willing to have a long-term mindset.

It is impossible to pick the bottom of a bear market. However, picking quality companies with long-term prospects for revenue, earnings, and cash flow growth has been a winning formula for patient, buy-and-hold investors.

It is a bonus if you can buy these Canadian growth stocks at a discounted price. If you are looking for some high-growth stocks to buy in April, here are two to consider.

Nuvei: Growth and profitability ahead

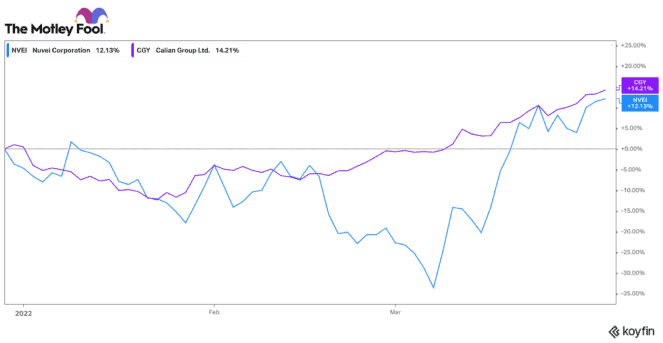

Nuvei (TSX:NVEI)(NASDAQ:NVEI) has had a strong recovery from lows hit in early March. Its stock is up 38% in the past month. However, at $95 per share, it still trades nearly 45% from its highs late last year.

Nuvei provides specialized payments technologies across the world. Its platform provides optionality in how merchants accept, authenticate, and manage a wide spectrum of payment formats (including cryptocurrency). Given the massive transformation in fintech, it is a great one-stop shop for merchants looking for optionality.

Last year, Nuvei nearly doubled its revenues and adjusted EBITDA. Unlike many tech peers, this company is profitable; it produces high +40% EBITDA margins and a significant amount of free cash flow. While growth will slow from 2021, it is still aiming for +30% growth in revenues and earnings.

Nuvei is not exactly cheap. It trades for 11 times sales and has an enterprise value-to-EBITDA (EV/EBITDA) ratio of 25. However, if it can sustain its long-term 30% growth targets for many years ahead, it may certainly be an attractive entry point here.

Calian Group: A Canadian growth stock at a reasonable price

If you are looking for growth at a more fair value, Calian Group (TSX:CGY) is a Canadian stock to consider. Calian operates four business segments in healthcare, IT/cybersecurity, advanced technologies, and learning.

It has specialized services in nuclear safety, military simulation/training, satellite communications, advanced military equipment, cybersecurity, and threat prevention/management. Some of Calian’s largest customers are defence-related (i.e., the Canadian military, NATO, and the European Space Agency).

Given the conflict in Ukraine, many Western nations are increasing their military and security spending. Calian could be well positioned to benefit from increased defence spending.

Over the past two years, it has grown revenues by 20%. EBITDA has risen by twice that rate. Given a recent acquisition in the cybersecurity space, it believes it could hit similar growth targets in 2022.

Calian has a great balance sheet with a net cash position, so further acquisitions could be on the books. While this Canadian stock is up nearly 15% in the past month, it only trades with an EV/EBITDA ratio of 11 and a price-to-earnings ratio of 16. It also pays an attractive 1.6% dividend.

If you want a Canadian stock with lots of growth ahead but at a reasonable price, Calian is one of the best you can find today.