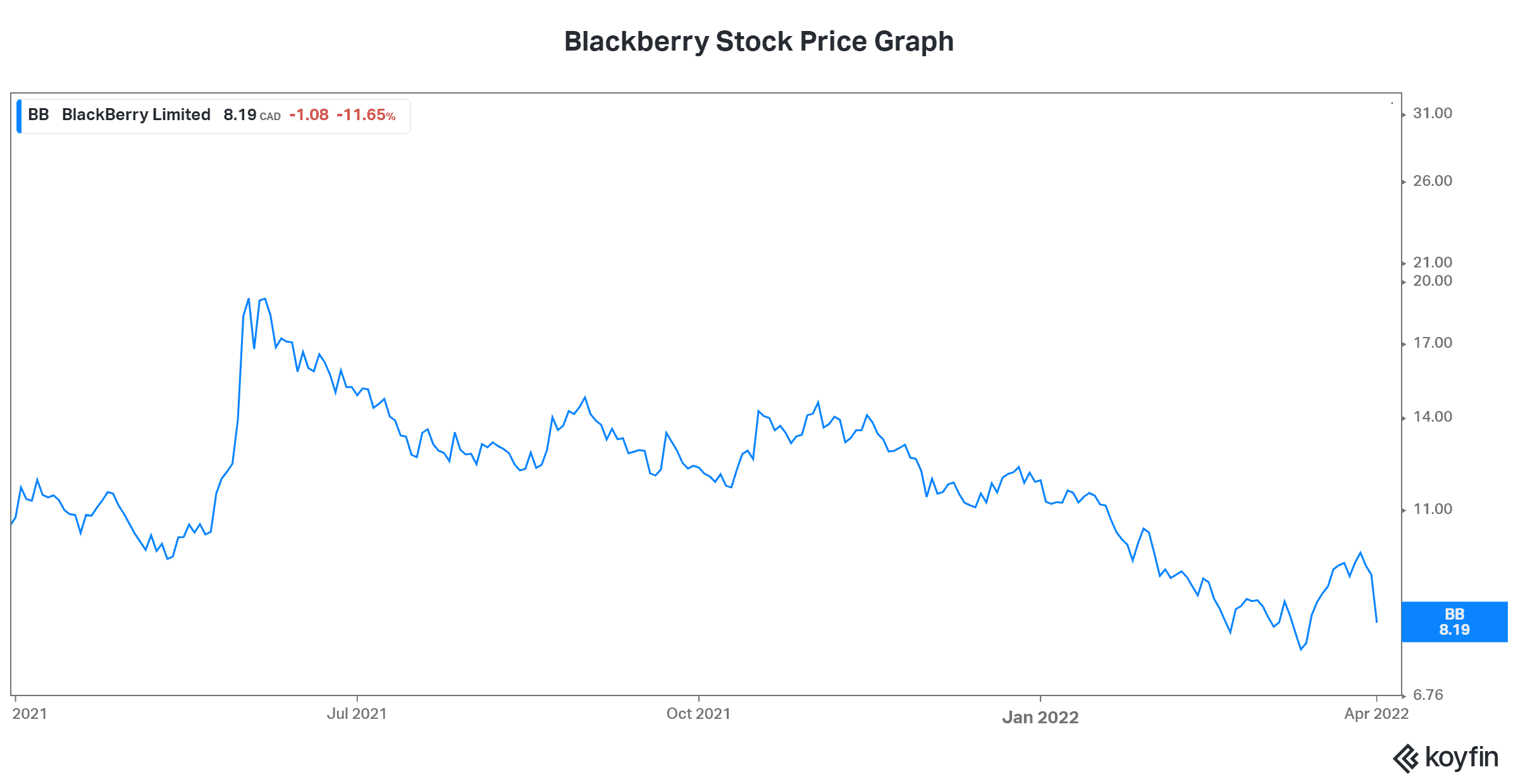

Blackberry Ltd (TSX:BB)(NYSE:BB) is seeing its stock price plunge 11% this morning as Canada’s top Internet of Things (IoT) company reported disappointing Q4F22 earnings.

Big drop in Blackberry stock driven by disappointing revenue growth and FY23 outlook

- Revenue came in flat versus last year as the cybersecurity segment disappoints

- Billings growth and design activity is rebounding strongly, but this is not yet reflected in revenue

- FY23 revenue outlook calling for no growth in cybersecurity and 12%-18% growth in the IoT segment, which is below analyst estimates

What happened in Q4 F22?

In Q4, Blackberry continued to experience challenges in its cybersecurity business. The main challenge was customer churn, as some of Blackberry’s smaller cybersecurity clients are migrating to competitors. According to management, this is happening because Blackberry’s is a premium product, and many smaller companies are looking for less expensive options. Blackberry’s offering does the best job meeting the cybersecurity needs of larger clients. Organizations such as the U.S. Department of National Defence and Deutsche Bank are new clients this quarter. This type of client has more sophisticated needs and a bigger budget.

In the company’s IoT segment, it’s all about proof of concept right now. This market is relatively new and Blackberry’s struggle for revenue continues. On the bright side, Blackberry won a record number of new design wins this quarter – 17 new auto design wins and 28 wins in the general embedded market. The IVY product is in demonstration with live data pilots ongoing. Blackberry is, in fact, receiving more proof of concept (POC) trial requests than it can handle. These are positive signs for the longer term, but right now, things are rough as revenue growth is just not there. It’s no wonder that Blackberry is seeing its stock price fall 11% today.

What did Blackberry’s management say?

While recognizing that Blackberry is facing numerous headwinds, CEO John Chen is positive on Blackberry’s future.

Visibility is improving for IVY, and cybersecurity is tracking in the right direction with solid billings growth and head to head wins.

What’s next for Blackberry?

For fiscal 2023, Blackberry is expecting a lot of momentum in its business segments. For example, in the IoT business, the company anticipates that its revolutionary IVY platform could enter production by the end of the year. This would, of course, start to drive revenue growth. Other areas of the company’s embedded systems segment are also looking good. For example, Blackberry is seeing many wins in the medical industry after Blackberry received functioning safety certifications. After all, billings growth in the quarter was 21% higher sequentially and 37% higher versus last year. This is a good forward indicator.

In Blackberry’s cybersecurity business, billings growth grew in the double-digit range in Q4. The market conditions here are good, as the threat of cyberattacks is at an elevated level. The key for Blackberry is that it must find its way in this competitive market. Product enhancements, new features, and a bundled offering will help to mitigate headwinds here. The cybersecurity market is huge and growing fast. I think there’ll be room for many competitors as the size of the pie is so big.

Blackberry has underperformed the market in the last year, with a -29% return compared to a +15% return for the market.