Real estate investment trusts (REITs) have a lot to offer. Most importantly, they often have higher-than-average dividend yields while also providing investors with diversification into real estate. If this sounds ideal for passive investors, well, that’s because it really is.

REITs benefit from their tax-efficient structure

Within the structure of a REIT is the basic obligation to distribute most of its income. In return, REITs don’t pay much, if any, corporate taxes. This tax-efficient feature gives the REIT more money for distributions. Now, I would like to qualify this article by stating the obvious. Simply put, high yields, such as the ones I’m pointing out here, do not come for “free.” In fact, these yields come with a higher risk level. This is Finance 101 — the riskier an investment, the higher the rate of return.

So, now that that’s out of the way, only proceed if you are willing and able to take on a little higher risk level for a portion of your portfolio. Here are the three high-yield REITs to beef up your passive income today.

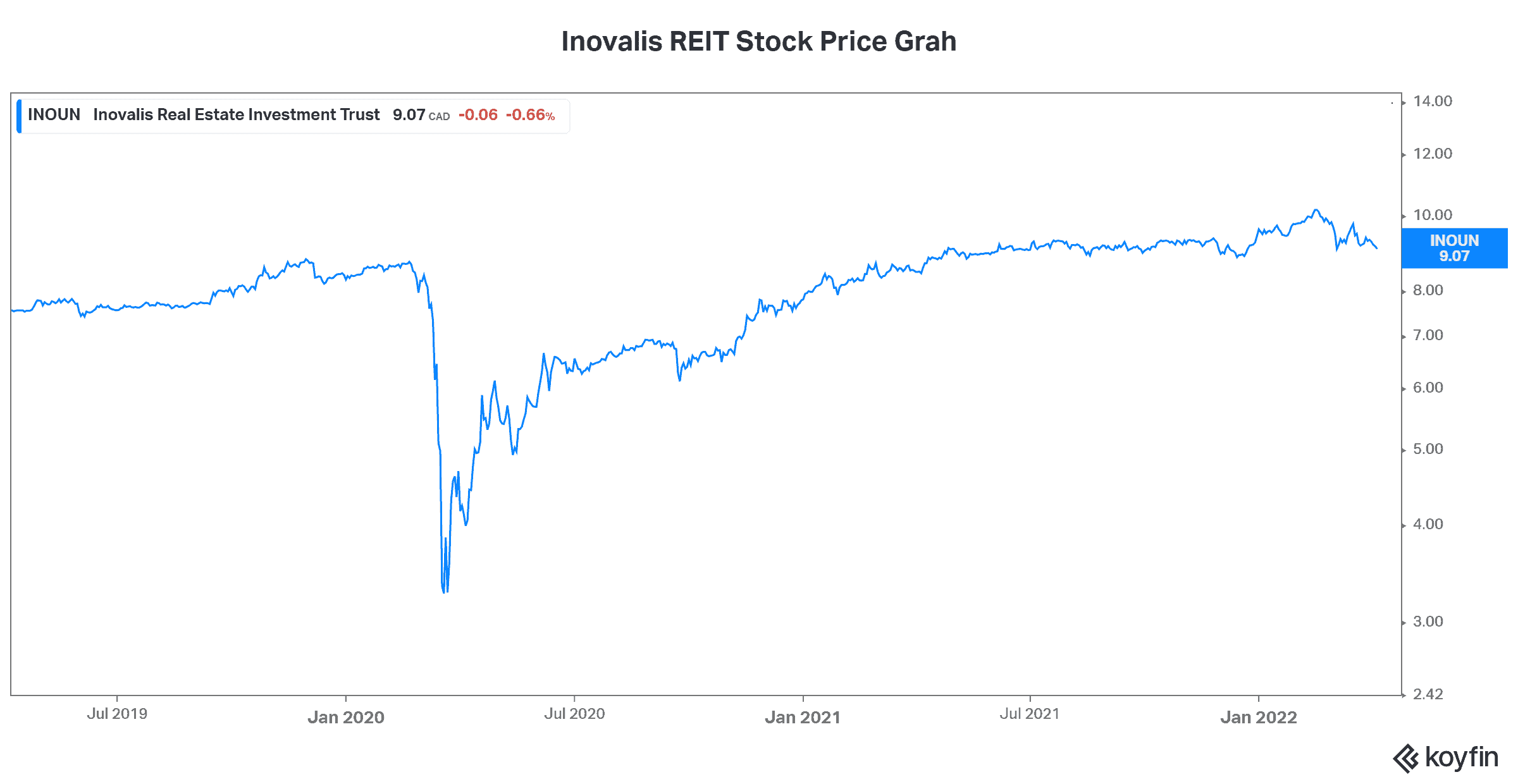

Inovalis is yielding 9%

It’s true that office properties are not exactly the real estate of choice these days. The pandemic has disrupted these once profitable and growing real estate assets to an unimaginable degree. But what if this disruption is mostly priced into the REITs?

Inovalis Real Estate Investment Trust (TSX:INO.UN) has a portfolio of office properties, primarily in Germany and France. There are some key advantages of being a property owner in Europe. For example, borrowing costs are lower as compared to Canada. While the pandemic has complicated matters, Inovalis expects the demand for office properties to improve from here. In fact, it is already doing so. In the latest quarter, occupancy levels rose 18% to 71%. While this remains less than ideal, it is a strong improvement.

Inovalis’s 9% yield is supported by the REIT’s strong balance sheet and improving fundamentals.

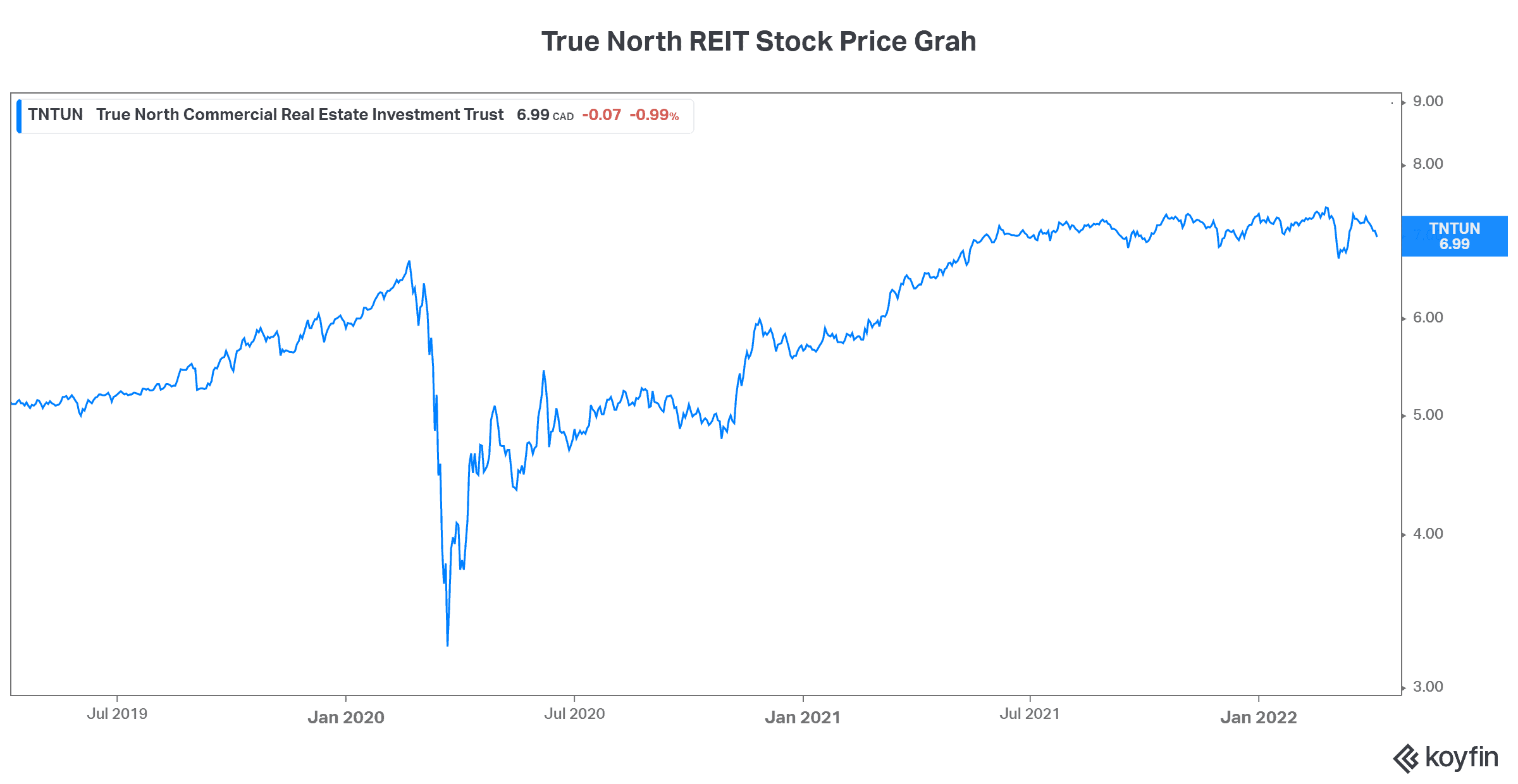

High-yield REIT True North Commercial is yielding 8.5%

For another strong yield, check out True North Commercial REIT (TSX:TNT.UN). True North owns and operates approximately 45 office properties across Canada with mostly high-quality tenants. This means tenants, such as the government, are financially strong and have long-term lease maturities. This affords True North will a stable and predictable revenue profile.

The REIT is trading only slightly above book value and has a payout ratio of approximately 100%. On a cash flow basis, the REIT’s cash flow covered its acquisition costs as well as its dividend last quarter. This is a positive position to be in. While office buildings may be in less demand as we move forward, True North is well positioned.

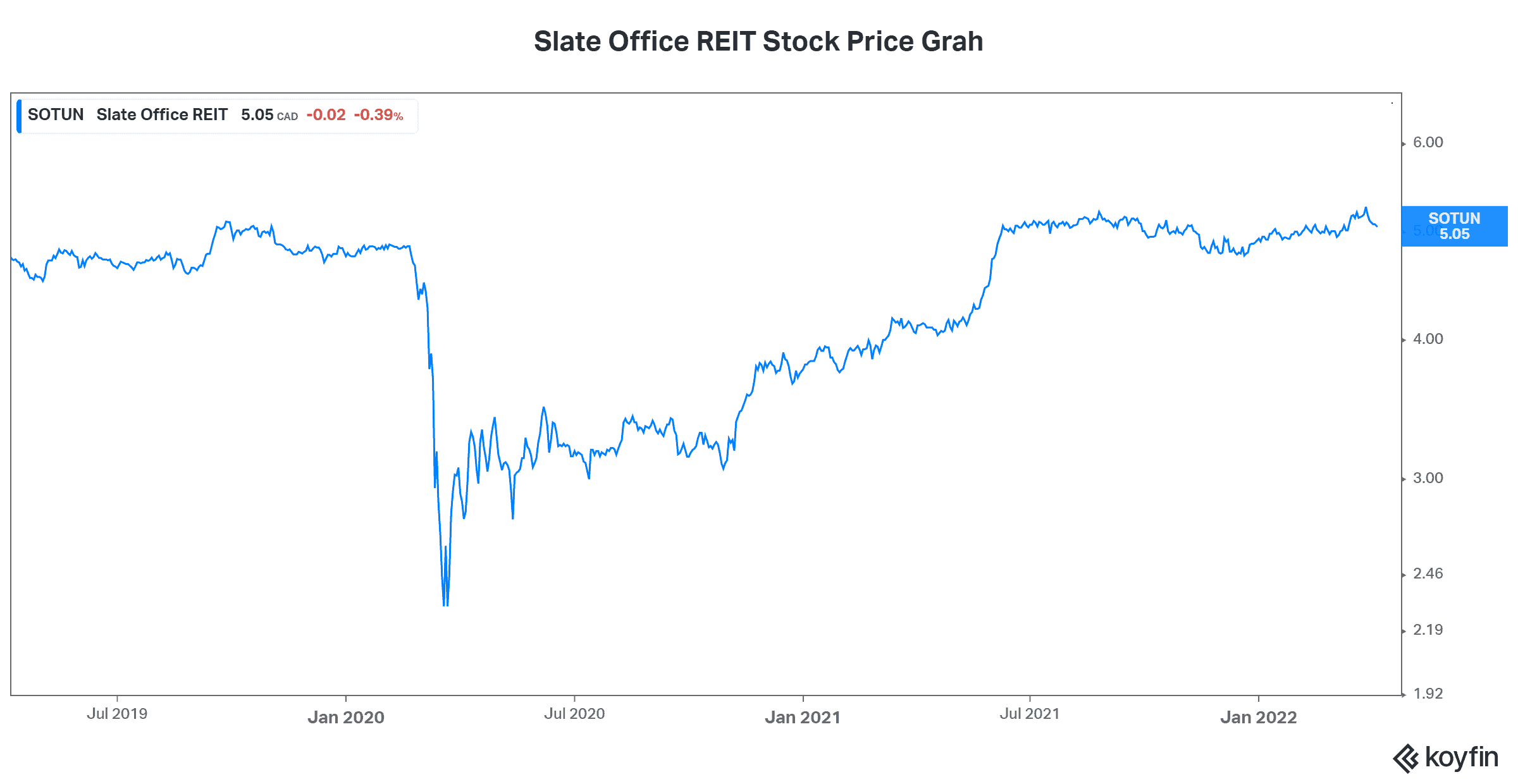

Slate Office Retail REIT trades well below book value with a 7.9% yield

Slate Office Retail REIT (TSX:SOT.UN) is another REIT that’s focused on office real estate. It owns and operates over 30 office properties across Canada as well as a couple in the U.S. and one in Ireland. Its tenant profile consists of 66% government and high-quality credit tenants. Also, it has a very strong pipeline of opportunities.

This REIT also has a relatively healthy balance sheet and is trading well below book value. While offices might not look the same and might not be needed as much, there is still a future. Slate REIT stock might be pricing in too much of a doomsday scenario at this point. Consider it for your passive-income portfolio.

Motley Fool: The bottom line

In closing, these are some of the highest-yielding REITs on the market today. Any of these stocks could be the passive-income opportunity that you’re looking for. It’s no coincidence that they focus on owning office real estate. And it’s no coincidence that their yields are so high. The pandemic has shifted work and the need for and use of office space. The question is, how much of a recovery do you expect? And do these REITs’ valuations already more than factor in this new reality? These yields can compensate you for the risk if you decide to buy.