The rise of mega-cap growth stocks in the U.S. technology sector such as Tesla, Amazon, Apple, Microsoft, and Alphabet have been responsible for the multi-year bull market we’ve all enjoyed (until 2022, that is).

The share prices of these companies have doubled, tripled, and even quadrupled in a relatively short amount of time, leaving some investors with handsome returns. New investors starting their portfolios may see these alluring returns and be tempted to chase performance.

Still, it is worth remembering that “reversion to the mean” is a very real phenomenon. The thought that “stocks can only go up forever” is less grounded in reality than it is in wishful thinking. Here’s my case for why new investors should diversify away from growth stocks.

What are growth stocks anyways?

Growth stocks are those of companies that demonstrate higher-than-average increases in their revenues, profits, and earnings, and, more importantly, they are expected to. This expectation from investors and the market is said to be “priced in” for their elevated share prices.

Growth stocks generally exhibit high valuations, in the form of elevated price-to-earnings, price-to-sales, price-to-book, enterprise value / EBITDA, and price-to-free-cash-flow ratios. They are also often more volatile than the overall market, with higher betas.

Investors buy growth stocks and are willing to pay higher prices because they expect to be able to sell them later at even higher prices, assuming the growth continues. This is why growth stocks tend to fall drastically when earnings barely miss or meet expectations.

What’s the opposite of growth stocks?

If growth is one end of the spectrum, the other end is value. Value stocks are those of more “boring” companies, such as the energy, consumer staples, financials, consumer defensive, and industrial sectors. These companies are often mature, blue-chip ones with strong business models.

These companies often have solid fundamentals and pay handsome dividends, but do not grow their earnings, revenue, or profits at high rates. They also have lower valuation ratios (the ones mentioned earlier) compared to growth stocks.

Examples of value stocks include Berkshire Hathaway, McDonalds, Coca-Cola, 3M, Johnson & Johnson, and Proctor & Gamble. The idea behind value investing is that stocks of good but underpriced companies will eventually bounce back to reclaim their true value.

Value vs. growth

Many investors expect growth to beat value, but the reality is that since 1971, a portfolio of large-cap U.S. value stocks has beaten growth soundly.

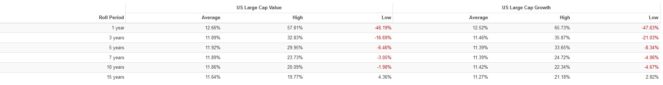

The above backtest contains trailing returns, which are influenced by the particular start date chosen. To remedy that, I’ve also included three-, five-, 10-, and 15-year rolling period backtests.

We can also examine the annual returns, which show value and growth taking turns outperforming. Notably, value stocks outperformed in the period between 2001 and 2009 (“the lost decade”), which growth stocks suffered heavily due to the Dot-Com Bubble and the Great Financial Crisis. Then growth stocks outperformed from 2010 to 2021 during a period of sustained falling interest rates.

The Foolish takeaway

Retail investors don’t need to pick between value or growth. Picking growth is performance chasing, while picking value is an attempt at market timing. Even professionals consistently get this wrong and underperform the market.

While so far in 2022 value has strongly outperformed growth, we don’t know if this is the start of a true value rotation or just an abnormal year, given high inflation and rising interest rates.

For a long-term investment strategy, diversify by buying both, preferably using an index fund that tracks the broad market. This way, you always get the average of both styles and minimize tracking error regret.