There can be incredible benefits to becoming a do-it-yourself (DIY) investor in Canadian stocks. Firstly, learning to invest yourself drastically reduces fees. Investment portfolio managers take significant fees off the top of your capital managed every year. Over many years, this can drastically degrade your overall investment returns.

Buy stocks fund managers ignore

Secondly, DIY investors can often invest in Canadian stocks that large-scale mutual funds, banks, or advisory firms cannot. Small-cap stocks are often too small or too illiquid to be investable by large firms. Smaller companies are often the ones that can offer the best chances of multiplying your money many times over. Consequently, smart DIYers have a major advantage over institutions.

DIY investing is a great skill to learn

Lastly, DIY investors get to enjoy both the challenge and reward of building your own portfolio. This can be an up-and-down process, but, overall, investing is a great learning experience. You learn about companies, managers, products, the economy, and even about yourself. Of course, you can also build considerable life-changing wealth along the way.

All in all, there is a lot for DIY investors to gain by investing in Canadian stocks. If you are intrigued by the long-term investing journey, here are two top Canadian stocks I wouldn’t hesitate owning today.

Descartes Systems: A top Canadian tech stock

If you are looking for a relatively unfollowed Canadian tech stock to own, you may want to consider buying Descartes Systems (TSX:DSG)(NASDAQ:DSGX) today. Its stock has pulled back by 27% since the start of the year.

This stock is expensive at 10.6 times sales and 24 times earnings before interest, tax, depreciation, and amortization (EBITDA). However, it is now trading closer to its pre-pandemic valuation average, so it certainly looks more attractive today.

Descartes operates the world’s largest logistics network. It has a wide suite of SaaS services that transport-related businesses can tack on as well. Once adopted, these services are quintessential and irreplaceable to its clients. Descartes captures very profitable recurring revenues. It has a cash-rich balance sheet and capital to deploy into acquisitions and internal growth.

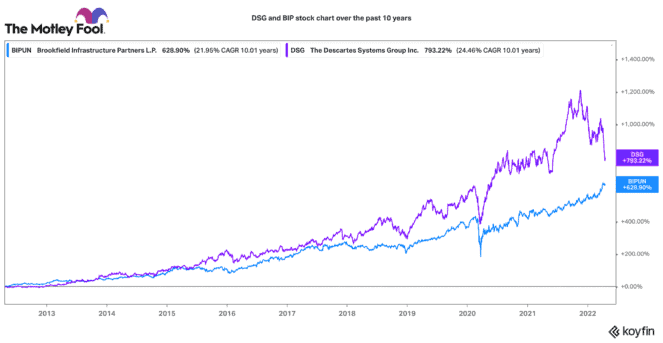

This Canadian stock has risen by a 25% compounded annual growth rate over the past 10 years. Over the long term, any significant dip (like today) has been a good buying opportunity.

Brookfield Infrastructure: A top Canadian dividend stock

Another great Canadian stock to own for years to come is Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP). This is a great stock to own for a dividend component in your portfolio. Over the past 10 years, this stock has turned a $100 investment into $484.

Over 20% of that return would actually be from distributions paid to shareholders. While this Canadian stock only yields a 3.2% distribution today, it has grown its dividend rate by a compounded annual rate of 10%.

It has high-quality, essential assets across the globe. Over 70% of these assets have some sort of inflation-indexed contractual mechanism. This means its businesses can do very well in the current elevated inflation environment.

Brookfield Infrastructure provides investors a quality portfolio of defensive assets. Investors should get a nice, growing distribution and some stable capital appreciation as well. For a reliable stock to hold for years and years to come, BIP is a great Canadian stock for DIY investors.