It’s well known that in order to set yourself up for retirement or financial freedom, it’s crucial to invest your money. Saving alone is not enough, especially with inflation so significant these days. So, finding high-quality Canadian stocks to buy is crucial to growing your capital.

But while investing doesn’t have to be complicated, it’s also not necessarily straightforward. If you’re looking to buy or already own Canadian stocks, here are three of the most common mistakes investors make that you’ll want to avoid at all costs.

Don’t buy Canadian stocks that you don’t understand

It’s crucial that any time you put your money to work and buy a stock, you understand everything about the company. Understanding how a company operates, how it makes money, who its competitors are, what its main risks are crucial questions you must know the answer to in order to make an investment

If you don’t know the entire company inside and out, how can you put an accurate value on the stock and decide if it’s undervalued or worth an investment?

Plus, understanding the businesses doesn’t just allow you to make better, more educated decisions on when you should buy the stock. It’s also crucial to help you evaluate the business after you own it.

Therefore, no matter how much hype a stock has or how much potential it may look like it has, if you don’t understand how the company makes money, you’ll want to hold off on the investment.

Don’t let emotions get the best of you

One of the most common mistakes that any investor can make is letting emotions get the best of them. Investing your own money can be difficult, and it can certainly cause different emotions. But it’s crucial not to let these impact your investing decisions. Some of the biggest mistakes are being too impatient or trying to speculate on investments.

This is another reason why it’s so important to understand the companies you own. If these stocks suddenly start falling in value, investors who don’t understand the business or who are too emotional could panic and sell the stock at the exact time that you should be buying more at a discount.

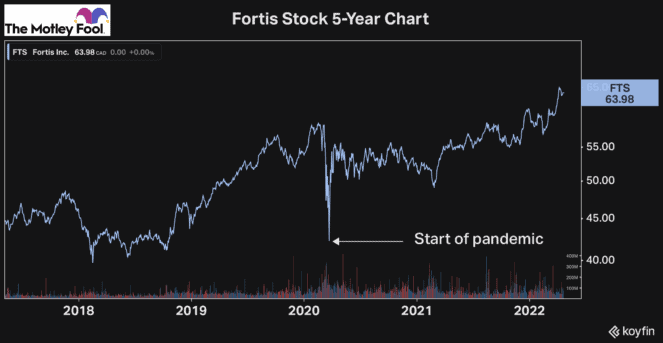

For example, Fortis is one of the safest stocks in Canada. But if you didn’t understand how safe it was, or if you were too fearful of losing money, you may have panic sold the stock at the start of the pandemic. That was the last time it traded below $43 a share and the only time since mid-2018. Today, Fortis is worth roughly $64.

Therefore, it’s crucial that you can manage your emotions and stay disciplined when investing.

Invest for the long haul

Lastly, one of the most common mistakes investors make is that they don’t have a long enough time horizon for their investments. Warren Buffett, one of the best investors of all time, has a famous quote that says, “Our favourite holding period is forever.”

Investing is about buying companies to own for years. When you try to buy Canadian stocks with a shorter time horizon, that’s a lot more speculative. So, it’s crucial to have the discipline and patience to buy and hold stocks for the long haul.

Investing for the long haul is intertwined with having discipline. It’s not uncommon that investors buy stocks hoping they can rise quickly and in a short period of time. That’s highly speculative and highly risky.

And as I mentioned above, many investors will panic sell their stocks when they start to sell off, even though they should be committed to these stocks for the long haul and use the opportunity to buy more.

Trying to forecast how certain stocks, industries or even the market as a whole will perform in the short term is next to impossible. So, investing for the long haul helps to mitigate a tonne of that risk.

Bottom line

We all want to focus on buying the best Canadian stocks to improve the performance of our portfolios. However, often just having the right mindset and eliminating common mistakes can make a big difference.

So, whether you’re new to investing or have some experience, these are three of the most common mistakes you’ll want to avoid.