The Tax-Free Savings Account (TFSA) is an amazing tool for building long-term wealth. It is not often that you get to invest, grow wealthy, and pay no tax on your returns. Yet, that is exactly what the TFSA allows Canadian investors to do.

The TFSA is the best tool for compounding wealth

Investment interest, dividends, or capital gains earned in a TFSA have zero tax liability. Likewise, investors have no responsibility to report any income or gain earned. Investing through a TFSA is a great way to simplify tax season.

Most importantly, a TFSA can help investors rapidly compound wealth. If you are not required to pay any tax on investment returns, you get to keep more capital to invest and re-invest. It may start out small, but over many years, it can grow into a fortune.

How to turn $60,000 into $600,000 in your TFSA

In fact, a $60,000 initial TFSA contribution could become as much $600,000. All you need is some great investments, patience, and then, most importantly, time. Here are three Canadian stocks that could help you get there.

Constellation Software

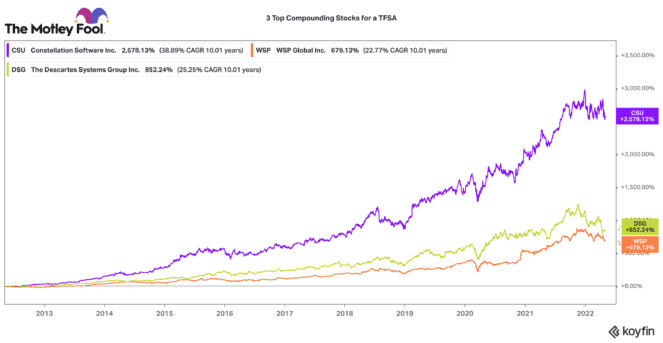

Constellation Software (TSX:CSU) has been one of the best-performing stocks in Canada for years. Over the past 10 years, it has delivered an annual average total return of 36%! An investment of $10,000 in 2012 would be worth $218,000 today. The company is now a $43 billion technology behemoth.

Given its size, growth may slow to some extent. Yet the company continues to accelerate its rate and size of acquisition. Last year, it invested the largest amount of capital in its history. This should translate into very strong cash generation now and forward into the future.

Let us just project returns to slow to the 30% annual range (a huge feat). At that rate, a $20,000 investment in Constellation left in your TFSA could be worth over $275,000 a decade from now.

Descartes Systems

Another great stock for compounding TFSA wealth is Descartes Systems (TSX:DSG)(NASDAQ:DSGX). It provides crucial software and network services for the global logistics and transportation industry. It has grown by acquiring numerous small logistics-focused software-as-a-services businesses. Descartes has compounded annual total returns at 25% rate over the past decade.

Supply chain challenges have been a major economic challenge across the world. Descartes helps businesses resolve and better manage these challenges. It has seen a significant uptick in organic growth as a result. Despite, this TFSA stock has pulled back 22% this year. Its valuation is starting to look attractive.

Even if Descartes annual rate of return dropped to 20%, $20,000 invested in this stock could be worth $123,850 in 10 years’ time.

WSP Global

A non-tech stock that has done a great job of compounding wealth over the years is WSP Global (TSX:WSP). It has grown to become one of the world’s largest design, consulting, and engineering firms. Like its peers above, growth has been supported by consolidating smaller consulting firms around the world.

Over the past 10 years, it has compounded annual returns by 22%. What is interesting is that its annual rate of return over the past five years has accelerated to 26%. This has come as the company added several higher margin businesses to its service platform.

Likewise, it has focused on operating efficiency and improving its overall margin profile. WSP has a great balance sheet and further acquisitions will likely fuel strong growth. If it can continue its pace of returns at 26%, a $20,000 investment in a TFSA could be worth $201,700 in 10 years.