Demand for silver was strong in 2021 and growth is expected to continue, as silver could hit a record in 2022. This anticipated growth is due to record silver industrial fabrication, which is expected to improve by 5% this year, as the use of silver increases in green technologies. Geographic turmoil and inflation are also drivers for precious metals. The recent slide in silver stocks is a buying opportunity. First Majestic Silver (TSX:FR)(NYSE:AG) and Silvercorp Metals (TSX:SVM)(NYSE:SVM) are two top silver stocks to buy this month.

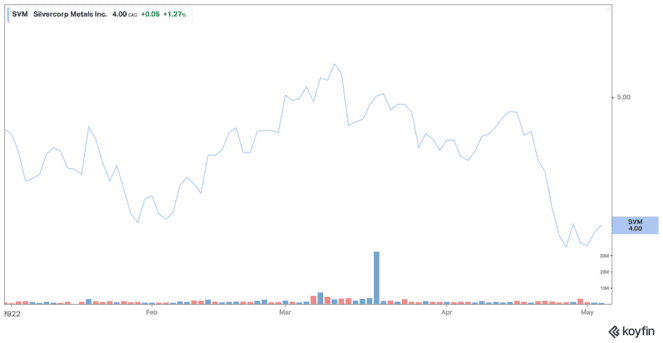

Silvercorp Metals

Based in Vancouver, Silvercorp has become the largest primary silver producer in China since beginning production in 2006.

The company’s Ying deposit allows it to benefit from high profitability and returns due to its exceptionally high-grade nature as well as its low-cost and efficient jurisdiction.

Silvercorp has grown its operations organically over the year. The silver miner posted 11% year-over-year revenue growth to $59.1 million in the third quarter. Meanwhile, operating cash flow increased 20% to $28.7 million. The company currently pays a semi-annual dividend of US$0.0125 per share for a yield of 0.8%.

On the production side, Silvercorp expects that 2023 will be its best year with around 7.6 million ounces of silver, and all-in sustaining costs (ASIC) are expected to be in the range of $141.6-143.5 per tonne. The company is the lowest-cost producer among industry peers. After dipping more nearly 15% since the beginning of the year, the silver stock has a favourable price/earnings (P/E) ratio of 15.9.

In addition, Silvercorp has a 28.3% stake in New Pacific Metals, which owns several large silver deposits in Bolivia.

Silvercorp looks cheap at the moment and rising silver prices should significantly boost its earnings as well as the value of its stake in New Pacific Metals.

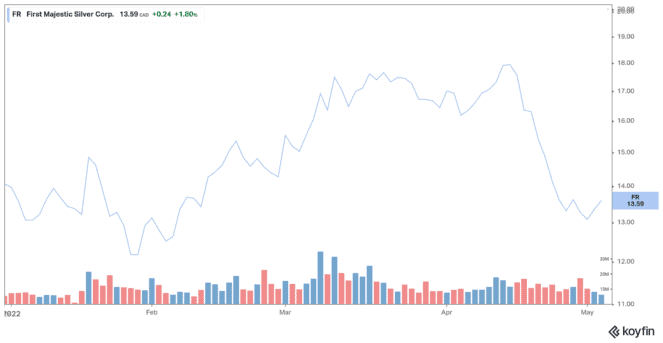

First Majestic Silver

First Majestic Silver currently operates four fully producing silver mines in Mexico and Nevada in addition to holding interests in eight other exploration projects in the same regions. The company’s silver production hit a quarterly high of 8.6 million ounces to close out the fourth quarter of 2021.

For 2021, First Majestic Silver reported record annual revenues of $584 million — a 61% increase over the prior year, thanks to higher silver spot prices and its acquisition of the mine Jeritt Canyon. For 2022, First Majestic Silver has released guidance indicating that it expects to produce approximately 12.2 to 13.5 million ounces of silver, along with continued operating cost reductions to improve margins.

Recently, the silver miner recorded a convincing 59% increase in production. Approximately 7.2 million silver equivalent ounces were mined during the first quarter. This is a significant ramp up in production.

Shares of First Majestic have fallen approximately 3% year to date. This is an interesting point for those with no exposure to silver. First Majestic deserves a premium multiple as it is a top miner.

In any case, such a silver stock is more of a long-term hedge than a short-term trade. There are benefits to owning silver as part of a diversified portfolio.