Welcome to a series where I break down and compare some of the most popular exchange-traded funds (ETFs) available to Canadian investors!

The total U.S. stock market is down over 11% year to date as a result of rising interest rates and high market volatility. The current correction could be a great buying opportunity though. Thankfully, both Vanguard and BlackRock provide a set of low-cost, high-liquidity ETFs that offer exposure.

The two tickers up for consideration today are Vanguard U.S. Total Market Index ETF (TSX:VUN) and iShares Core S&P U.S. Total Market Index ETF (TSX:XUU). Which one is the better option? Keep reading to find out.

VUN vs. XUU: Fees

The fee charged by an ETF is expressed as the management expense ratio (MER). This is the percentage that is deducted from the ETF’s net asset value (NAV) over time and is calculated on an annual basis. For example, an MER of 0.50% means that for every $10,000 invested, the ETF charges a fee of $50 annually.

VUN has a MER of 0.16%, compared to XUU at 0.07%. For a $10,000 portfolio, the difference works out to around $9 per year. While miniscule, this can add up over time, so the win goes to XUU here.

VUN vs. XUU: Size

The size of an ETF is very important. Funds with small assets under management (AUM) may have poor liquidity, low trading volume, high bid-ask spreads, and more risk of being delisted due to lack of interest.

VUN has attracted AUM of $5.1 billion, whereas XUU has AUM of $2.1 billion. Although both are sufficient for a buy-and-hold investor, VUN is currently the more popular ETF among Canadian investors.

VUN vs. XUU: Holdings

Both VUN and XUU track the total U.S. stock market, which is comprise of 82% large-cap stocks (as measured by the S&P 500), 12% mid-cap stocks, and 6% small-cap stocks. Both ETFs also use a fund-of-funds approach, holding U.S.-listed ETFs as a “wrapper.”

VUN tracks the CRSP US Total Market Index by holding just one other ETF — its U.S.-listed counterpart. XUU tracks the S&P Total Market Index and is a bit more complex, holding a total of four ETFs covering the total U.S. market: large caps, mid caps, and small caps.

Something else to note here is that neither ETF is currency hedged. The underlying stocks of the S&P 500 trade in USD. When you buy a Canadian ETF, the difference between the CAD-USD pair can affect the value of the Canadian ETF beyond the price movement of the underlying stocks.

ETFs that are unhedged accept this phenomenon. What that means is if the U.S. dollar appreciates, the ETF will gain additional value. Conversely, if the Canadian dollar appreciates, the ETF will lose additional value. This introduces extra volatility that could affect your overall return.

VUN vs. XUU: Historical performance

A cautionary statement before we dive in: past performance is no guarantee of future results, which can and will vary. The portfolio returns presented below are hypothetical and backtested. The returns do not reflect trading costs, transaction fees, or taxes, which can cause drag.

Here are the trailing returns from 2016 to present:

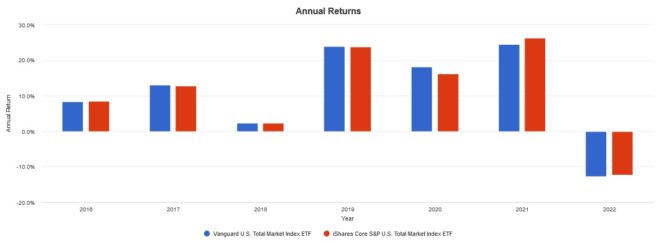

Here are the annual returns from 2016 to present:

Both ETFs had virtually identical performance, with some variation year by year due to tracking error. Over the long run, I expect returns and risk to indistinguishable.

The Foolish takeaway

Given that both ETFs perform more or less identically and have sufficient AUM, I would pick the one with the lower MER, which would be XUU. However, if you idolize Jack Bogle and love Vanguard, VUN is a good pick too.