High-yield dividend stocks are always attractive possibilities. But these high yields often come with problematic businesses. In this article, I present to you three dividend stocks that have it all: high yields of up to 6.35% but also very attractive financials and futures.

Without further ado, here are the three high-yield dividend stocks that are providing us with a great opportunity for attractive dividend income.

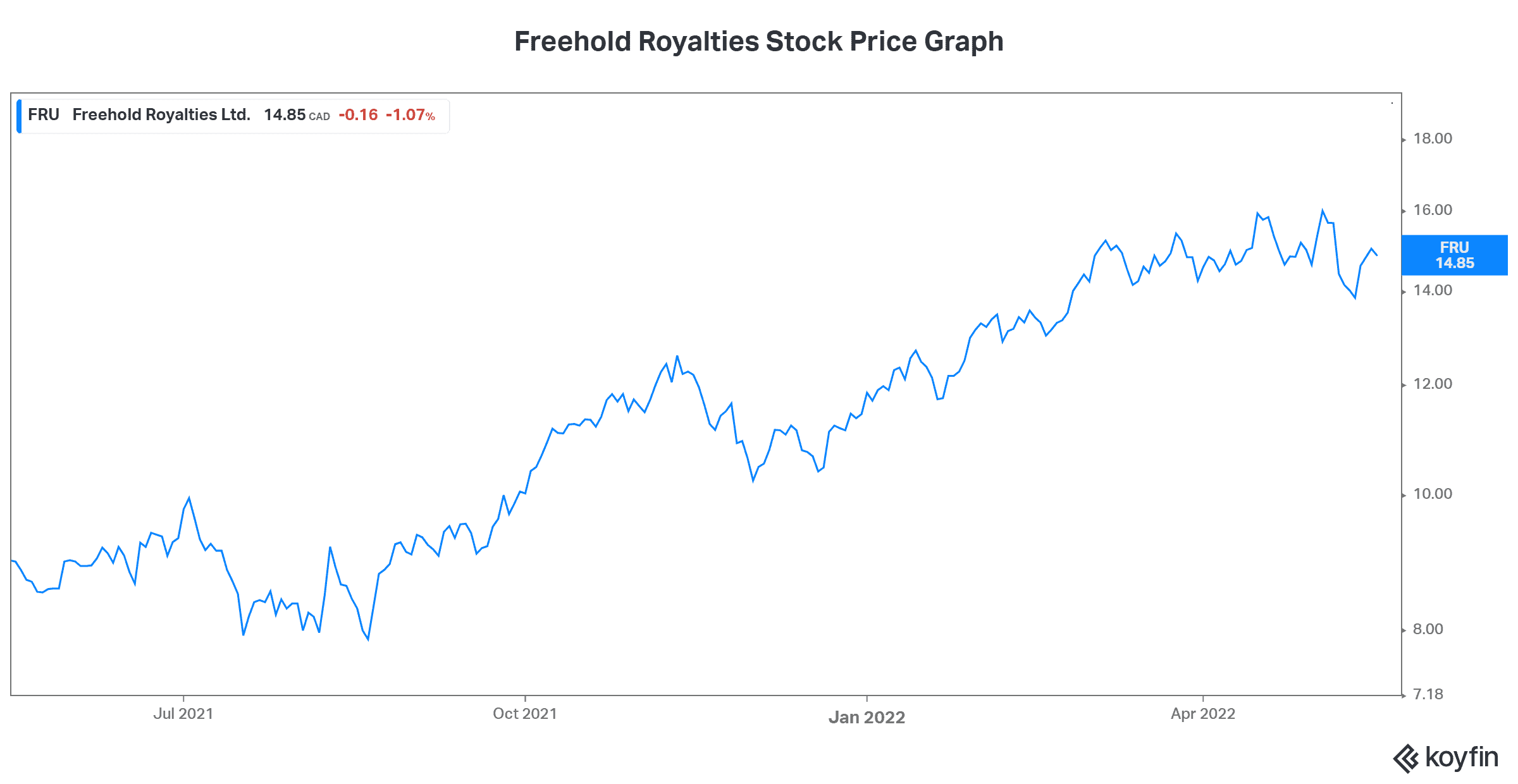

Freehold Royalties: An energy dividend stock that’s so much more

As a royalty, Freehold Royalties (TSX:FRU) is an energy stock like no other. In fact, it holds its place as one of the lowest-risk energy stocks that you can find. Freehold is a Canadian oil and gas company engaged in the production and development of oil and natural gas. It’s different than other energy companies because it’s a royalty. What that means is that there’s less risk involved with this name. Freehold collects royalties from other companies who are actually taking on the exploration and production risks.

Like other energy companies, Freehold is shattering records. And this momentum is building. In the first quarter of 2022, funds from operations rose 122%. Also, dividends increased 200% versus last year. With the rally in oil and gas prices expected to continue, Freehold plans to continue to strengthen its balance sheet and asset base.

Freehold is currently yielding 6.36%. Its business is thriving, and investors can rely on high-yield stocks such as Freehold for income.

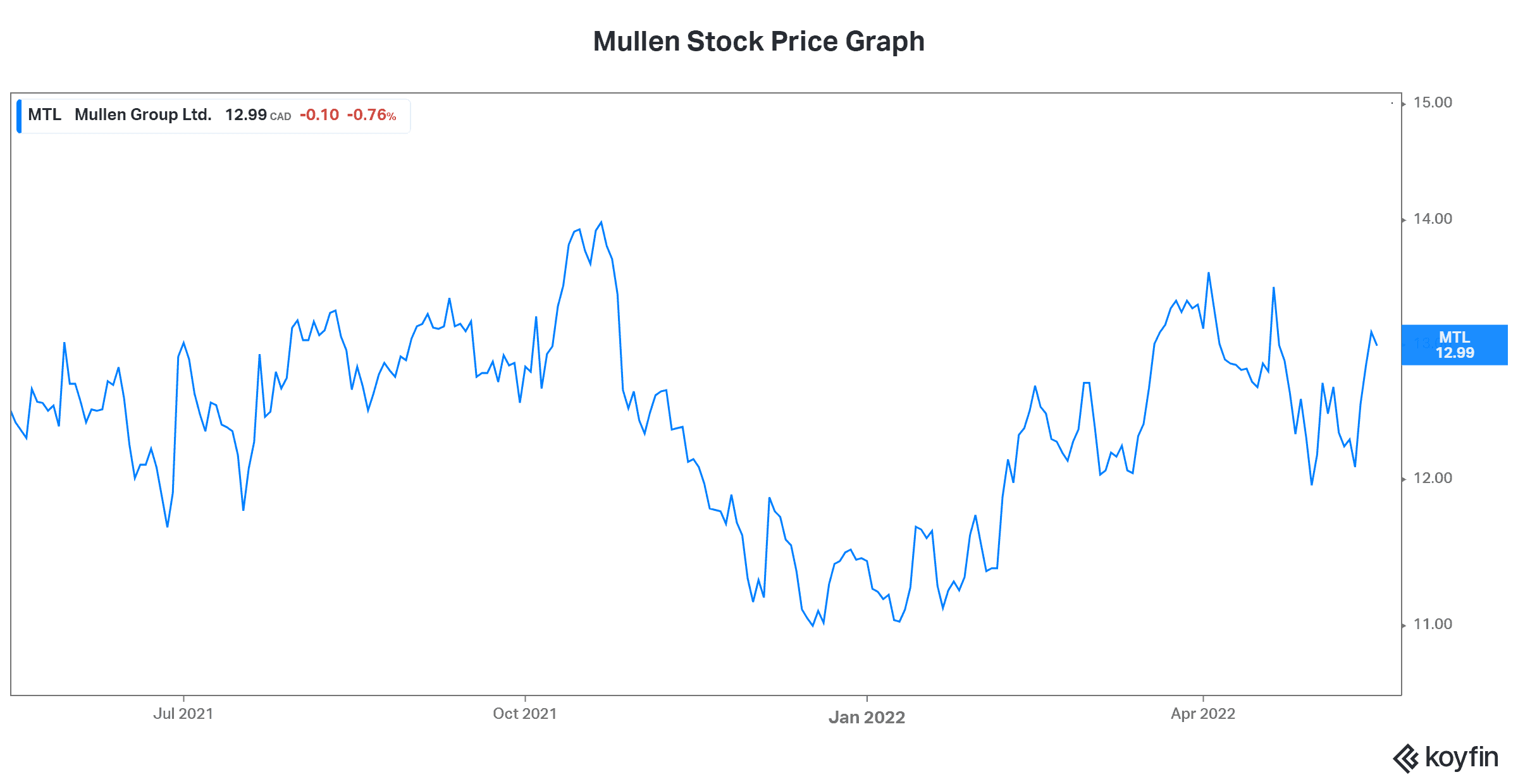

Mullen Group: A dividend stock that’s rising from the ashes

Mullen Group (TSX:MTL) is a supplier of trucking and logistics services in Canada. Not too long ago, the company was quite heavily exposed to Canada’s oil and gas sector. In fact, it came close to ruin because of that during the years of low commodity prices. It was this experience that intensified Mullen’s diversification goals. The company was already in the trucking business, but management took it up a notch.

With a focus on “less-than-truckload” trucking and urban deliveries, Mullen found a niche. The timing has been good, as we all know how the pandemic has changed online shopping behaviours. Smaller truckloads are ideal for accommodating online shoppers. They enable better inventory management and greater efficiency.

Today, Mullen is reporting record revenue. The company is also increasing its dividend significantly. First-quarter 2022 revenue increased 57% to $457 million. Furthermore, its dividend per share increased 25% to $0.15. This translates into a juicy dividend yield of 5.5%. It’s a dividend that’s also well supported by the company’s booming business.

Mullen’s fortunes are rising. Investors can also benefit by gaining access to Mullen’s generous dividend yield and bright future.

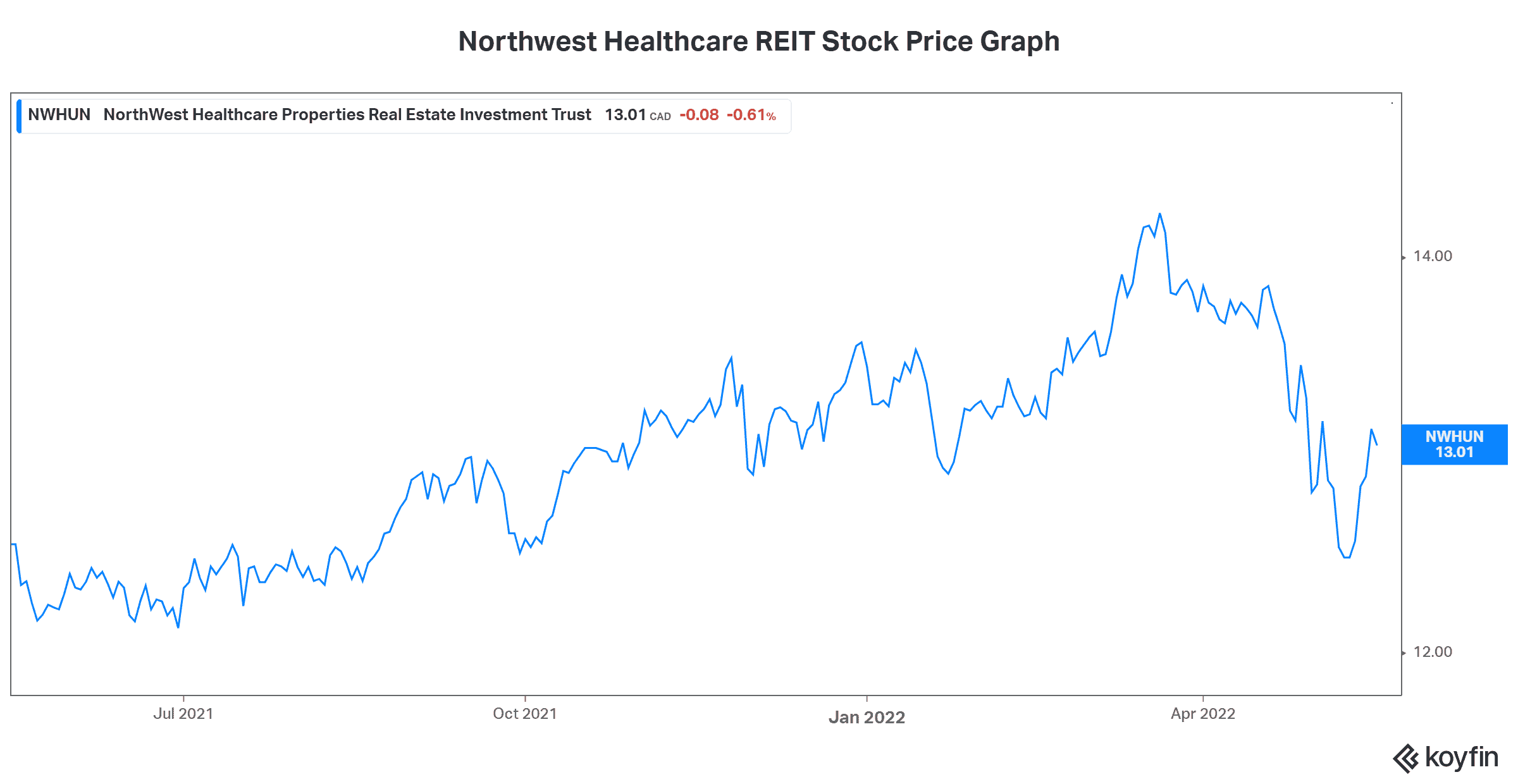

Northwest Healthcare Properties: A REIT with a strong, defensive future

Coming in at a yield of 6.1%, Northwest Healthcare Properties REIT (TSX:NWH.UN) is a solid and defensive dividend stock. In short, it’s a real estate investment trust (REIT) that owns and operates a lucrative portfolio of global healthcare real estate.

A few characteristics make this dividend stock extremely attractive. The first one is the defensive nature of its revenues and cash flows. It’s in the healthcare business — a business that must go on through rain or shine. Secondly, Northwest’s revenue is inflation indexed. This speaks for itself. Lastly, Northwest REIT’s future is tied to the aging population — a trend that is accelerating. This unsettling and sombre fact ensures a bright future for healthcare properties.