Tech stocks have been hit hard. After years of explosive returns and sky-high valuations, it’s been a time of reckoning. Are there great buying opportunities today? Or do we need to wait for the dust to settle? Let’s consider two top Canadian tech stocks: BlackBerry (TSX:BB)(NYSE:BB) and Shopify (TSX:SHOP)(NYSE:SHOP). Which one, if any, should you buy today?

The revaluation of tech stocks: What Shopify and BlackBerry have in common

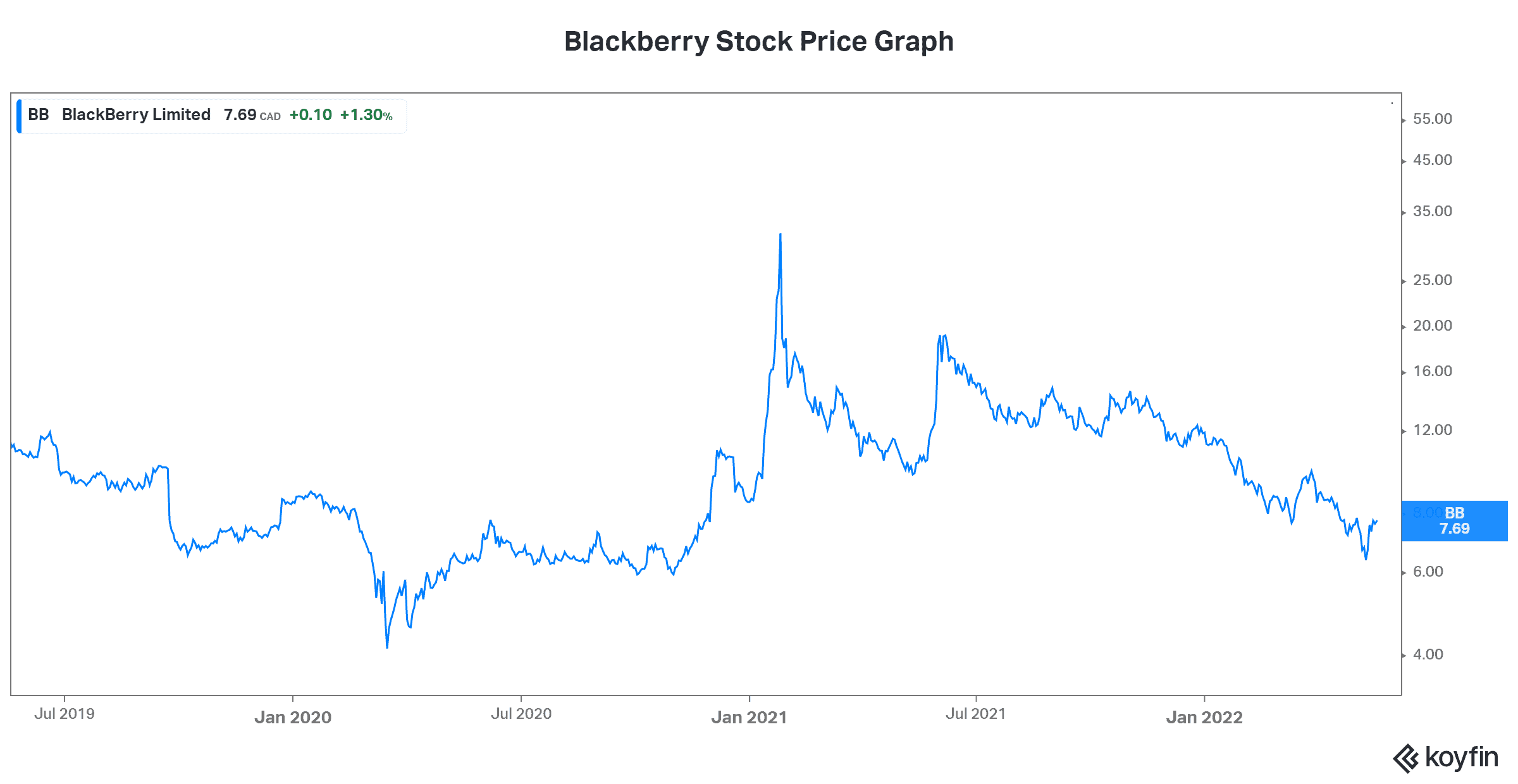

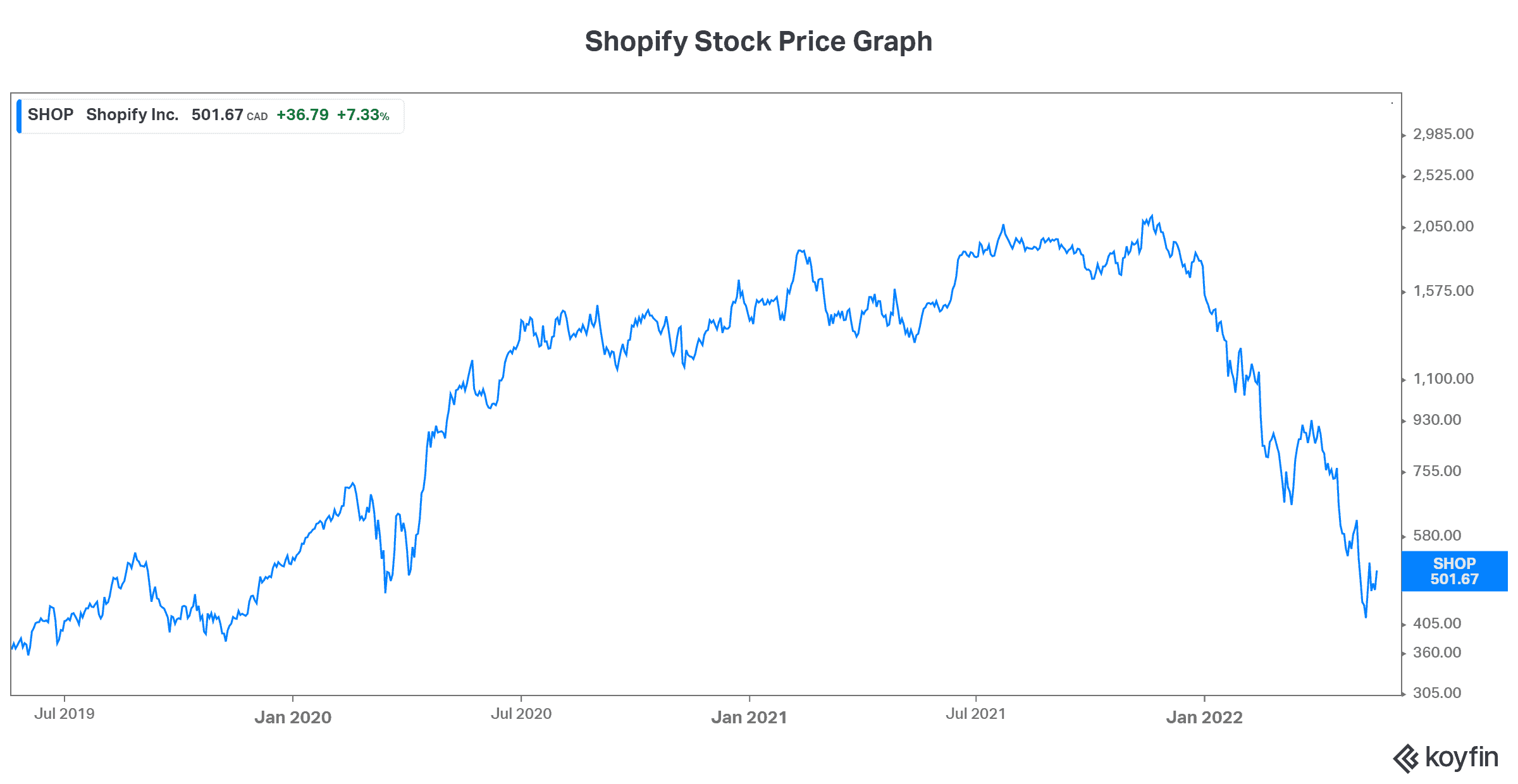

The Canadian tech index has fallen 35% so far in 2022. It’s fallen 43% from 2021 highs. Shopify has retreated over 70% in 2022 and 76% from its high. Finally, BlackBerry has sunk 35% and 60%, respectively. In what has been called the inevitable tech stock crash, we are left reeling. If you owned these stocks and rode them down, it has definitely been painful.

But here’s something to get excited about: many of these tech stocks are trading at their pre-pandemic levels. While this, in and of itself, is not a reason to buy, things are closer to making sense again. No stock can go to the stratosphere forever. There must be some realism and accounting of risk in valuations. So, maybe moving forward, we will see more realistic valuations. I think that would be good for the market.

Companies like Shopify, whose business was always a valuable one, has been throttled. The problem has been with multiples. It’s also been that investors are looking at profitability. No company can lose money forever, and no stock can sustain such lofty valuations.

BlackBerry: Unlike Shopify, BlackBerry’s business is gaining positive momentum

As one of Canada’s most interesting tech stories, BlackBerry is a tech stock to consider. There’s been a lot of volatility in its stock price over the last three years. But one thing has not changed. BlackBerry is going after two of the most lucrative markets in technology today: the internet of things (IoT) market and the cybersecurity market.

While the company is still ramping up, it has a couple of key differentiating factors on its side: its reputation and its expertise. In fact, this can be seen in the many industry awards BlackBerry has won. It can also be seen in BlackBerry’s list of clients, which includes top government agencies, banks, and automotive giants.

After many years of net losses and cash burn, BlackBerry has finally outlined its expectations. In short, the company expects to break even in fiscal 2024 and to generate positive earnings and cash flow in fiscal 2025. While these numbers may have disappointed some investors, they do not include BlackBerry’s IVY, which provides upside to the numbers. To get an idea of what kind of upside we’re talking about, the potential market for IVY is huge. Forecasts are calling for it to be approximately $800 million by 2025.

Shopify Stock: Downside momentum persists

The other tech stock that I’d like to review is Shopify. As the clear winner in recent years, Shopify stock is undergoing the ultimate revaluation of the decade.

The problem here is that earnings and profitability are falling. With this, earnings estimates for the quarters and years ahead are being ratcheted down. I mean, many growth opportunities exist for Shopify. The problem is that the company is increasing spending by a lot to pursue this growth. And it’s hitting profitability. This warrants caution.

When Shopify first emerged, one of the risks was always that Shopify’s business is highly competitive. Also, that it deals with a lot of smaller clients. These customers are more likely to be impacted by the growing list of economic headwinds today, inflation and rising interest rates being the most dangerous. Lastly, Shopify does not have a good profitability profile, with paltry margins and returns.

Motley Fool: The bottom line

The tech stock selloff has definitely got me looking into where I can find value. Shopify and BlackBerry stocks have both sold off big in recent months. But, in my view, only BlackBerry represents a good buying opportunity here. It’s simply pursuing more lucrative, profitable industries. Also, BlackBerry has better competitive position. In the end, all of this makes BlackBerry stock the better buy today!