It has been an incredibly challenging time for Canadian growth stock investors. Many of Canada’s best-known growth stocks have been slaughtered. The market is worried about declining growth, rising interest rates, and elevated valuations (especially for technology stocks).

The recent pullback has created some incredible opportunities, especially in non-technology growth stocks. Investor sentiment is very low, and the market is wracked with worry. Short-term-minded investors are selling their best-quality growth stocks for cash, and prices keep getting cheaper.

Shrewd investors that can think long term can pick up some of these great stocks at fire-sale prices. Here are three high-quality Canadian growth stocks that look incredibly cheap today.

WSP Global: A discounted Canadian growth stock

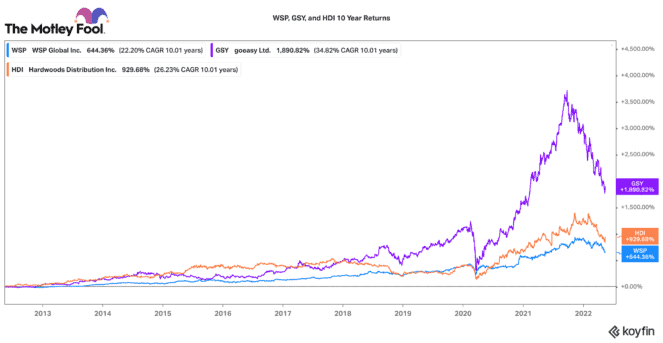

WSP Global (TSX:WSP) is one of the world’s largest consulting, engineering, and design firms across the globe. Even after its recent 26% decline, this Canadian stock has produced a 644% total return over the past decade. That is a 22% compounded annual return!

WSP just produced very strong first-quarter 2022 earnings. Net revenues, adjusted EBITDA, and adjusted net earnings grew year over year by 26%, 34.7%, and 44.8%, respectively. These are incredibly strong numbers, despite the supposedly poor economic outlook for the world.

Today, this Canadian stock trades for 23 times earnings. It is not the cheapest stock, but that is down from 32 times earnings only a few months ago. Given that earnings are accelerating, the pullback presents very attractive long-term value for shareholders today.

goeasy: A cheap financial stock

If you are looking for a very cheap Canadian growth stock, you don’t find much better than goeasy (TSX:GSY). This stock is down 37% in the year. It pays a very attractive 3.2% dividend and trades for only nine times earnings today.

Many may not know it, but this Canadian stock is one of the best-performing stocks on the TSX over the past decade. It is up 1,890% over the past decade! That is a 34.8% compounded annual return. It just reported first-quarter results in 2022. Loan growth was strong, credit quality was improving, and adjusted earnings per share grew by a high-teens rate.

Yet one analyst noted that the stock is trading only just above “liquidation value.” Clearly, the market is pricing a worst-case scenario, creating a great opportunity for long-term investors to buy the stock.

Hardwoods Distribution: A high-growth Canadian stock on sale

The cheapest stock on this list is Hardwoods Distribution (TSX:HDI). Not many people know of this stock. Yet it is one of the largest distributors of architectural building supplies in North America.

Despite a recent 25% decline, this Canadian stock has still delivered a 929% return over the past decade. It has grown by consolidating both large and small building products distributors. Over the past five years, it has grown both EBITDA and earnings per share by a 35% average compounded rate.

Despite its great track record, this stock only trades for 5.5 times earnings. You’d think something might be wrong with its business. Yet it just delivered a record quarter, where adjusted EBITDA and profit per share both increased 200%. That is largely due to some recent major acquisitions, but the company continues to perform very well.

The Foolish bottom line

The market is freaking out, but there are plenty of bargains out there. If investors consider operational results over stock prices, there are plenty of investment gems to be found. Be patient and think long term, and you could stand to earn a fortune from today’s ugly stock markets.