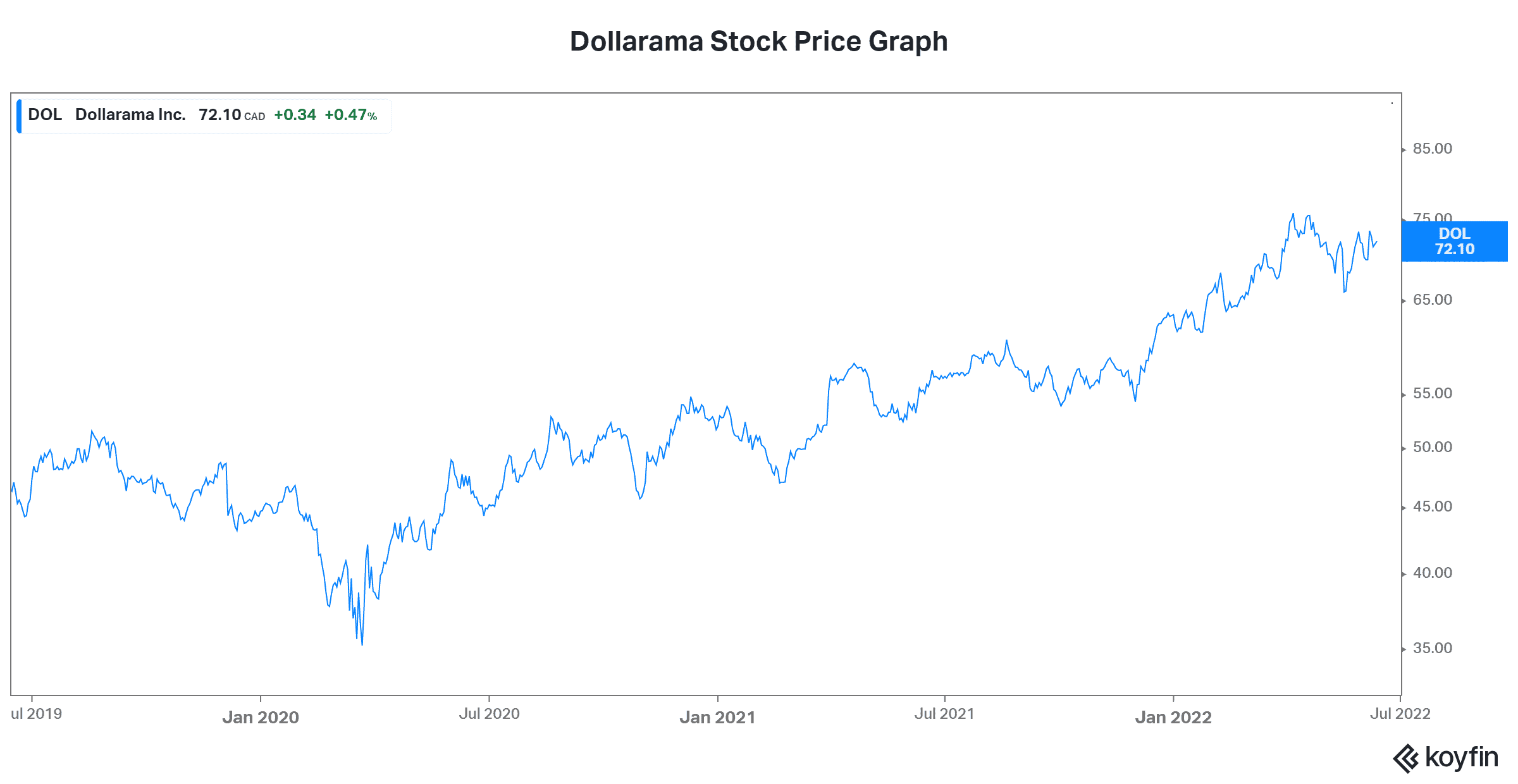

Dollarama (TSX:DOL) is one of Canada’s best success stories. Today, as a retailer that offers the best relative value, this company is well positioned. Despite the massive inflationary pressures, Dollarama is looking good. It’s a rare breed these days, with a 14% rise in 2022.

Here are the most important things to remember after Dollarama’s recent quarterly earnings release.

Dollarama feels the pressure from inflation

Inflation has been the key reality that the markets have been grappling with all year. So, it comes as no surprise that Dollarama is feeling this pressure along with the rest. Management is noting wage pressure. They’re also noting supply chain issues and rising transportation costs. These are just some examples of the pressures they’re grappling with.

In response to this inflation, Dollarama is successfully raising its prices. In fact, the company recently introduced a new $5 price point. We can only expect this inflation to worsen over time. As all the experts are now saying, this inflation situation will not be short-lived — it is not transient. So, as Dollarama’s management has warned, “There will continue to be cost increases.”

All retailers clearly have no choice but to pass these cost increases along to the consumer, at least it part. But as Dollarama puts it, they move on price last. In short, it’ll continue offering the best relative value.

Recession fears: The consumer is looking for value more than ever

In this inflationary environment, Dollarama’s value proposition is more valuable than ever. It was clearly always valuable. Now, with prices of everything rising, it is even more so. And as time moves on, consumers will increasingly be forced to search for the best value for their dollar.

This is actually an environment that Dollarama can really thrive in. It can certainly bring new customers through the doors. Gas prices have risen by more than 50% in the last year. Also, food prices are up an estimated 10%. This is clearly hitting home. And the longer it goes on, the more likely it is to change many people’s financial status. It’s already enough to make an impact.

It’s clear that these inflationary pressures will not a short-term phenomenon. This forces us to take stock of things and to find a way to reduce our bills. Dollarama’s relative value proposition can help with this.

Dollarama: The value proposition makes sense globally

DollarCity, which Dollarama owns a majority stake in, is a Latin American dollar store chain. It has actually fared just as impressively as Dollarama has. While no specific details were provided, management noted that DollarCity’s performance was comparable to Dollarama’s performance in the latest quarter, which is strong.

In the latest quarter, Dollarama’s sales increased 12.4%. EBITDA increased 21%, and EPS increased 32%. Furthermore, Dollarama saw a double-digit increase in traffic at its stores and a 7.3% same-store-sales growth rate. These are all very bullish results that Dollarama stock rallied on. They’re really solid numbers especially considering the inflationary pressures out there. Simply put, these results offer proof that Dollarama is a valuable option for consumers. It can help us fight inflation.

Back more specifically to DollarCity, which entered Peru in May of last year. Similar to Dollarama’s experience in Canada, it’s increasingly being recognized as a destination of compelling value. DollarCity now has 350 stores in four countries, El Salvador, Columbia, Guatemala, and Peru. These stores offer Dollarama greater diversification. They also offer Dollarama exposure to high growth and underpenetrated markets. Dollarama’s initial target is to have 600 stores in Latin America by 2029.

Motley Fool: The bottom line

As I have clearly outlined, Dollarama stock is one of the best retail stocks to own in this inflationary environment. For now, Dollarama continues to be heavily reliant on lower price points. Over time, we can expect the company to adjust its pricing strategy toward higher price points. The company’s natural protection has already been on display in its last quarter. Expect more of the same in future quarters.