For over two years now, investors have been watching Air Canada (TSX:AC) and its stock price closely after its significant selloff to start the pandemic.

The company was impacted severely, causing it to lose tonnes of value, dilute shareholders and take on tonnes of debt just to survive. In recent months, though, the company’s operations have been recovering rapidly, as many Canadians look to travel for the first time since the pandemic began.

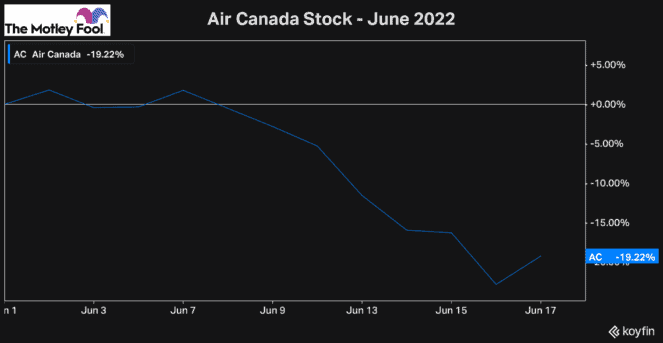

Despite these positive developments, though, Air Canada stock has seen its price trade range-bound all year. And in recent weeks, it’s sold off significantly once again, losing over 19% since the start of June.

After the recent selloff this year, Air Canada stock has now seen its price fall by over 60% from where it was before the pandemic. So, you may be wondering, with the worst of the pandemic now over and so many restrictions dropped, why does Air Canada stock continue to see its share price fall significantly, and is it undervalued?

Why is Air Canada stock still seeing its price fall?

First off, it’s important to know that because there is a tonne of factors impacting the economy right now, many of those factors are playing a role in how Air Canada stock performs and which way its price moves.

Without a doubt, though, the largest impact that the airliner faces is the impact that inflation is having on its operations.

Inflation is driving up costs for everything, especially the price of jet fuel, which is one of the most significant expenses airliners have. Furthermore, besides its impact just on costs, if inflation were to continue to stay high, then over the coming months, it could end up impacting consumers’ demand.

Furthermore, inflation is also what’s causing central banks to increase interest rates so rapidly. And in this environment, as interest rates rise, riskier investments tend to lose value quickly, including Air Canada, which is still in turnaround mode.

In addition, higher interest rates will certainly impact Air Canada’s profitability as well, especially given all the debt it had to add to its balance sheet to survive the pandemic.

Because of these factors impacting stocks, analysts are lowering their expectations for Air Canada, both in terms of what its business can achieve this year and also in its target price.

It’s also crucial to understand that until the stock can make significant developments, it will largely move with the market. Therefore, as more attractive and, lower-risk stocks continue to fall in price as the selloff worsens, Air Canada stock will follow suit.

So, when could the airliner finally turn the corner and see its stock start a sustained rally?

When will Air Canada begin to rally?

At this point, it’s unclear how long Air Canada may be affected. As I said above, it will take a significant catalyst and clear evidence that the company’s operations are recovering before investors begin to buy up the stock.

For now, though, until central banks can get inflation under control and the economic environment continues to worsen, it will be tough for Air Canada stock to make up any ground.

Investors know that if the economic situation worsens, Air Canada’s recovery could be put on hold. And given all the impacts it faced during the pandemic, the business is more vulnerable to an economic slowdown than many other stocks.

So, it’s not surprising that Air Canada has seen its stock price fall significantly in June. And while it will be tough to recover over the coming months, the stock certainly does offer value for long-term investors willing to buy and hold as Air Canada makes a years-long recovery.

For now, though, while there is still so much risk in markets, there are better investments offering more stability and value for investors to buy now.