Throughout the year, stocks across almost every industry have been impacted by the economic environment, primarily surging inflation. And with so many stocks being negatively impacted by inflation, it can certainly be challenging to find investments in this environment. However, not only is Dollarama (TSX:DOL) one of the best retail stocks to buy as inflation soars, it’s one of the best — period.

Retail stocks, in particular, are some of the stocks that will almost certainly see the most noticeable impacts from inflation.

First off, rising prices will impact these companies’ expenses. Product costs will increase, shipping prices are going through the roof, and that’s already on top of significant supply chain issues for many companies.

That’s not all, though. As inflation is impacting consumers, too, it will cause many Canadians to lower their spending. In particular, retail stocks in the consumer discretionary sector could see much more noticeable impacts on sales, depending on how high inflation stays and for how long.

However, Dollarama’s business model is so unique that it may be one of the few retail stocks that can benefit from inflation and is, therefore, one of the best stocks you can buy now.

Dollarama’s business model makes it one of the best stocks to buy while inflation is surging

Dollarama is known as a discount retailer. Consumers typically look to Dollarama to shop for essentials that they need to buy and know they can find for less than at Dollarama’s big-box competitors. Therefore, as inflation rises, it will naturally drive more consumers to shop at Dollarama for two reasons.

First off, the price for essentials will already be rising, sending Canadians looking for discounts. However, with inflation and interest rates rising rapidly and squeezing consumers’ budgets, it will be paramount to save as much money as possible when buying these household items.

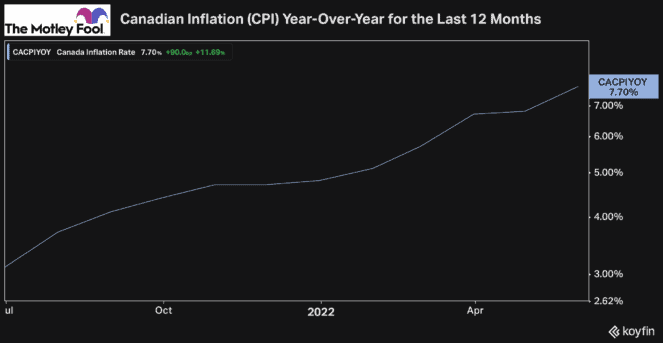

In Dollarama’s recent earnings report for its first quarter of fiscal 2023, which ended May 1, 2022, the company already reported a more than 7% jump in same-store sales. And since then, as we can see in the chart above, inflation has continued to rise. So, it’s reasonable to expect Dollarama to continue seeing rapid growth in sales, which is why it’s one of the best stocks to buy as inflation continues to soar.

Now, the company does, of course, face some headwinds as a result. Not unlike other retail stocks, Dollarama faces rising costs as well. However, Dollarama has been and can continue to mitigate against rising costs with strategic price increases.

Just recently, it finally began selling products for $5. And when many of the products it sells are already lower-cost items, Dollarama can get away with passing price increases onto customers much more than its big-box competitors. Therefore, not only is Dollarama one of the few stocks that can potentially grow and gain market share as inflation rises, but it has to be considered one of the best stocks to buy now.

Bottom line

Many Canadian stocks are facing severe headwinds as inflation continues to rise. This will not only impact their ability to do business and earn a profit over the short term, but it’s also impacting their share prices considerably.

So, if you’re looking to find high-quality Canadian stocks that you can buy and have confidence in while inflation continues to be the most significant factor impacting stocks, there’s no question Dollarama is one of the best stocks to consider today.