Alimentation Couche-Tard (TSX:ATD) delivered slightly disappointing fourth-quarter results from analysts expectation earlier this week. Couche-Tard operates over 14,000 convenience stores and gas stations across North America, Europe, and Asia. In its fourth quarter of 2022, the company experienced some challenges from high inflation, geopolitical tensions, and changing economic conditions across the world.

Fourth-quarter 2022 results

Total revenues were placid. They only grew by 1% to $3.8 billion. While gross margins improved modestly across its business, earnings were impacted by several significant one-time items.

Firstly, the company took a $56 million write-off after ceasing all operations in Russia. Secondly, it took an impairment charge on its investment in cannabis retailer, Fire & Flower Holdings. Lastly, it settled and redeemed $250 million of senior unsecured notes and incurred an early redemption premium of $4.1 million.

Combine all these factors and Couche-Tard reported net earnings of $477 million (or $0.46 per share). That was down 15.3% from this time last year. Bay Street analysts were expecting $0.53 net earnings per share in the quarter. Adjusting for some of the one-time items, Couche-Tard grew earnings by 5.8% to $0.55 per share.

Full-year 2022

For the year, the company performed relatively well, especially considering the challenges it faced from staffing constraints, inflation costs, and rapidly shifting consumer patterns. In 2022, it grew total net earnings per diluted share by 3.3% to $2.52. Adjusted net earnings per diluted share increased by 6% to $2.60.

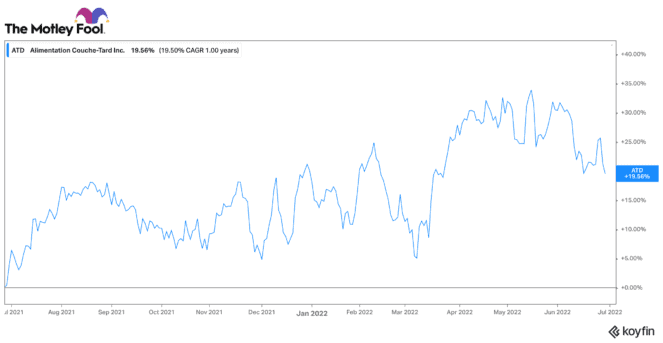

Couche-Tard delivered ample shareholder returns in 2022

It wasn’t all bad news. In the year, the company repurchased $1.9 billion worth of shares. In the fourth quarter alone, it bought back $834 million shares. In effect, it reduced its share count by about 3.5% in 2022. Following the quarter, the company also announced a further repurchase program that could allow the purchase of as much as 10% of its public share count.

Likewise, Couche-Tard increased its annual dividend by 25.6% to $0.4175 per share. While that only equals a 0.8% dividend yield at today’s price, the growing dividend is a sign of financial confidence for shareholders.

Reasons to like Alimentation Couche-Tard stock

While growth was perhaps not as robust as expected, there are still reasons to like this stock. First, it continues to earn strong earnings from the capital it invests. Return on capital employed (ROCE) was 15.4%, only down slightly from the prior year. In essence, this means it earns 15.4 cents of new profit on every $1 it invests — not a bad return, if you ask me.

Second, it continues to invest in organic growth initiatives such as new food offerings, more efficient payment processing, electric vehicle infrastructure, and new stores. It added 133 new stores since the start of its fiscal 2022 year. It has another 58 stores under construction at the moment.

Third, the company maintains a strong balance sheet and is primed to continue returning capital to shareholders. Further, a decline in the economy could present opportunities to acquire convenience businesses at attractive valuations.

The Foolish takeaway

All in all, Alimentation Couche-Tard is in a good position operationally and financially. Certainly, economic circumstances are weighing on its business. However, it has a top management team and a smart capital-allocation strategy. I would wait to buy it one dips or declines, but it is certainly a top stock I’d keep on my radar for a long-term investment.