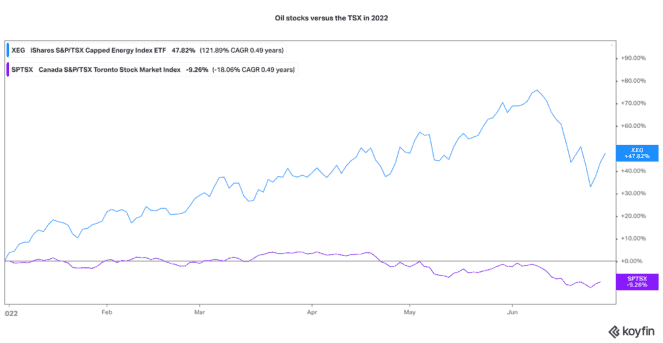

TSX energy stocks have recently hit a hurdle in their bullish climb. The S&P/TSX Capped Energy Index is down over 11% in the past month alone. While this may sound bad, it is still up 48% this year. That is compared to the S&P/TSX Composite Index, which is down over 9% in 2022.

Oil and gas stocks have had a great year. Yet there are still reasons to be optimistic about the sector. Oil supply remains constrained due to ESG pressures, the war in Ukraine, and a lack of production growth. Despite the high prices, global energy demand remains resilient.

Plenty of dividends and cash returns to come

Most TSX energy companies are now looking to return most of their cash flows and profits right back to shareholders. Already, investors have enjoyed significant dividend increases, ample share buybacks, and special dividends.

If oil can continue to remain elevated in the US$100-per-barrel range, there will likely be plenty more returns to come. The recent pullback may present an attractive opportunity to buy TSX energy stocks at better valuations and more attractive dividend yields. If you are looking for some quality stocks with fast-growing dividends, here are two to consider buying on the dip.

A top TSX energy stock for any investor

The pullback is a great opportunity to upgrade into some of the highest-quality energy stocks in Canada. One of my favourite stocks for dividend growth is Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ).

It has one of the best track records of growing its dividend among any stock in Canada. In March, it increased its quarterly dividend by 28% to $0.75 per share.

CNQ has grown its dividend by a 20% compounded annual growth rate (CAGR) since 2007. Its current dividend is over 16.5 times larger than it was then!

CNQ has incredibly long-life assets that can produce oil and gas at a very low cost (below US$30 per barrel). Consequently, it consistently produces a growing stream of cash flows that support its dividend. CNQ stock has pulled back 17% in the past month. It trades with an attractive 4.36% dividend yield right now.

A green mid-cap TSX energy stock

If you are looking for a mid-cap TSX energy stock, you might want to consider Whitecap Resources (TSX:WCP). After it declined 13% in the past month, its stock is yielding 3.85%. Every month, it pays a $0.03-per-share dividend. It just increased its monthly dividend by 33% in March.

Whitecap produces 131,000 barrels of mostly light oil across British Columbia, Alberta, and Saskatchewan. It can produce oil very efficiently and has a free cash flow breakeven (after base dividend payment) level at about US$40 per barrel. At current prices, it expects to earn over $1.5 billion of discretionary excess cash.

With a target to return 50% of that cash to shareholders, chances are very high for another dividend increase and significant share buybacks this year.

Likewise, if you are sensitive to environmental concerns, this is a great energy stock. It has a carbon-sequestration operation that recycles any carbon emissions produced. For a well-managed, greener energy stock with a nice dividend, Whitecap is a solid stock pick today.