Welcome to a series where I break down and compare some of the most popular exchange-traded funds (ETFs) available to Canadian investors!

Canadian investors taking a passive approach to buying domestic stocks generally default to the tried-and-true S&P/TSX 60 Index, but that’s not the only option out there. There’s also the lesser known but still solid FTSE Canada Index.

Both Vanguard and BlackRock provide a set of low-cost, high-liquidity, CAD-denominated ETFs for tracking these indexes. The two tickers up for consideration today are iShares S&P/TSX 60 Index ETF (TSX:XIU) and Vanguard FTSE Canada Index ETF (TSX:VCE).

Which one is the better option? Keep reading to find out.

XIU vs. VCE: Fees

The fee charged by an ETF is expressed as the management expense ratio (MER). This is the percentage that is deducted from the ETF’s net asset value (NAV) over time and calculated on an annual basis. For example, an MER of 0.50% means that for every $10,000 invested, the ETF charges a fee of $50 annually.

XIU has an MER of 0.20% compared to VCE at 0.06%. The difference here is around $14 annually on a $10,000 portfolio. The clear winner here is VCE, which is significantly cheaper.

XIU vs. VCE: Size

The size of an ETF is very important. Funds with small assets under management (AUM) may have poor liquidity, low trading volume, high bid-ask spreads, and more risk of being delisted due to lack of interest.

XIU currently has AUM of $10.67 billion, whereas VCE has AUM of $1.23 billion. Although both are highly liquid and more than sufficient for a buy-and-hold investor, XIU is clearly the more popular one at this time.

XIU vs. VCE: Holdings

Both ETFs have nearly identical sector weights, with over 40% of underlying holdings in the financial and energy sectors, which is typical for the Canadian stock market.

XIU and VCE share the same top 10 holdings, with stocks like Royal Bank, Toronto-Dominion Bank, Enbridge, Bank of Nova Scotia, Canadian National Railway, and Brookfield Asset Management dominating.

However, there are some differences in the indexes each ETF tracks. While VCE tracks the FTSE Canada Index, XIU tracks the S&P/TSX 60 Index.

These indexes have slight differences that shouldn’t affect performance too much but are still notable. Firstly, XIU has a total of 60 holdings versus VCE at just 51. VCE also excludes some stocks that FTSE decides to allocate to its U.S. indexes instead, most notably Shopify.

XIU vs. VCE: Historical performance

A cautionary statement before we dive in: past performance is no guarantee of future results, which can and will vary. The portfolio returns presented below are hypothetical and backtested. The returns do not reflect trading costs, transaction fees, or taxes, which can cause drag.

Here are the trailing returns from 2013 to present:

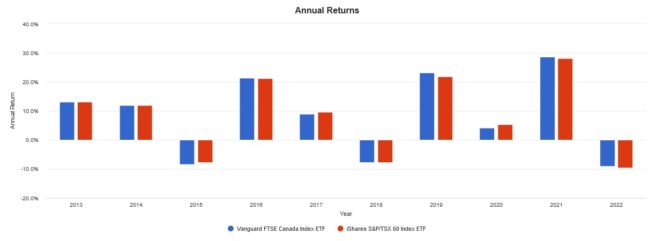

Here are the annual returns from 2013 to present:

Both ETFs have virtually identical performance, with XIU having a very slight edge. I chalk this up to the fact that XIU held more stocks that may have outperformed in the last few years. Over time, this difference is likely to disappear.

The Foolish takeaway

If I had to pick and choose one ETF to buy and hold, it would be VCE, due to its lower MER. However, if you plan on doing more frequently trading, XIU might be a better pick thanks to its much better liquidity. A good strategy is using both ETFs as tax-loss harvesting pairs.