After a tough June, there are plenty of attractive opportunities to buy TSX stocks that produce passive income. Nearly every sector on the TSX has seen some downward pressure. Passive-income stocks held up well in the early part of the year. However, this bearish market has pulled even the best-quality dividend stocks down.

Time to upgrade your passive-income portfolio

It is presenting a good opportunity to buy stocks at better valuations and higher dividend yields. As stock prices decline, their dividend yield on cost increases. As a result, investors can lock in elevated passive income returns as the market declines.

Brookfield Infrastructure Partners: A premium dividend-growth stock

One TSX stock that I’m thinking about buying for its passive-income stream is Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP). With a market capitalization of $35 billion (between its partnership units and corporate shares), Brookfield Infrastructure is one of the largest infrastructure stocks on the TSX.

Not only is its business diversified by asset category, but it is also invested across the world. For example, it owns and operates ports in the U.K., LNG export terminals in the U.S., cell towers in India, and regulated transmission lines across North America (to name a few).

Stability and reliability from diversity

While it adds a level of complexity, there is an element of stability and balance in its diversification strategy. One business segment may outperform, while another may underperform in a different economic cycle. Its diverse global presence also allows it to be opportunistic and acquire assets whenever there is a value opportunity.

90% of its assets are regulated or contracted. This means its baseline of cash flows are relatively reliable and economically stable. The best part is that 70% of these assets are indexed to inflation. That means when inflation has been soaring (like it has), Brookfield gets to increase its rate base on an annual basis.

This passive-income stock benefits from inflation

In addition, inflationary factors like high oil prices and rising energy demand are very favourable for Brookfield. It sees higher volumes through its ports, railroads, pipelines, and better pricing on processed energy products.

As a result, the company is very well positioned in the current environment. Last quarter, it grew funds from operation (FFO) year over year by 14.3% to $493 million. It saw strong organic growth across nearly all its business segments.

A long history of dividend growth

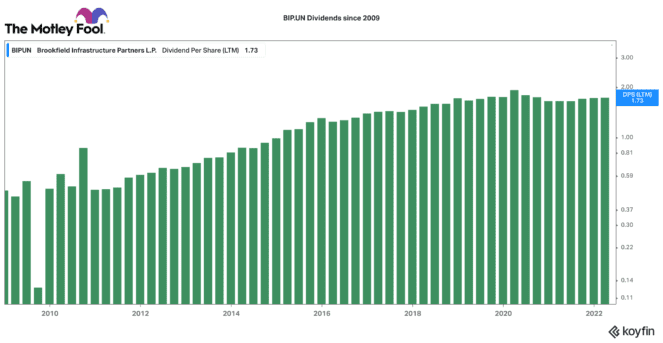

Brookfield Infrastructure just increased its dividend by 6% to US$0.54 per unit. It just completed a three-for-two stock split, so that is why the payments might look a little lower than last year (in reality, it is not). Overall, this is just a great stock for passive income.

Brookfield Infrastructure has a very long history of raising its distribution. In fact, since 2009, Brookfield has grown its per unit distribution by a 10% compounded annual growth rate. Its current annual distribution is 245% larger than it was in 2009! It currently targets an average annual distribution growth rate of 5-9%.

The Foolish takeaway

Today, this passive-income stock yields 3.8%. It trades at the lowest valuation since the March 2020 market crash. If you are looking for a combination of defensive assets, solid organic/acquisition growth, and reliable passive-income streams, Brookfield Infrastructure Partners is a top stock to check out in July.