Can anyone else hear the tune to Billy Joel’s “We Didn’t Start the Fire” playing along in the background?

- U.S. inflation just printed 9.1%

- The Bank of Canada hiked 100 basis points

- Bank runs in China

- A state of emergency in Sri Lanka

- Ongoing war in the Ukraine

- Electricity prices skyrocketing

- Shinzo Abe assassinated

- Rogers being Rogers

On and on it goes …

It sure does seem like there’s A LOT of “somethings” out there these days!

From where I sit as Motley Fool Canada’s chief investment adviser, it’s all having a rather dramatic impact on the psyche of existing and would-be investors.

To put it mildly, the market is no fun right now. Like, zero.

Money goes in and almost immediately becomes worth less than it was sitting in your bank account.

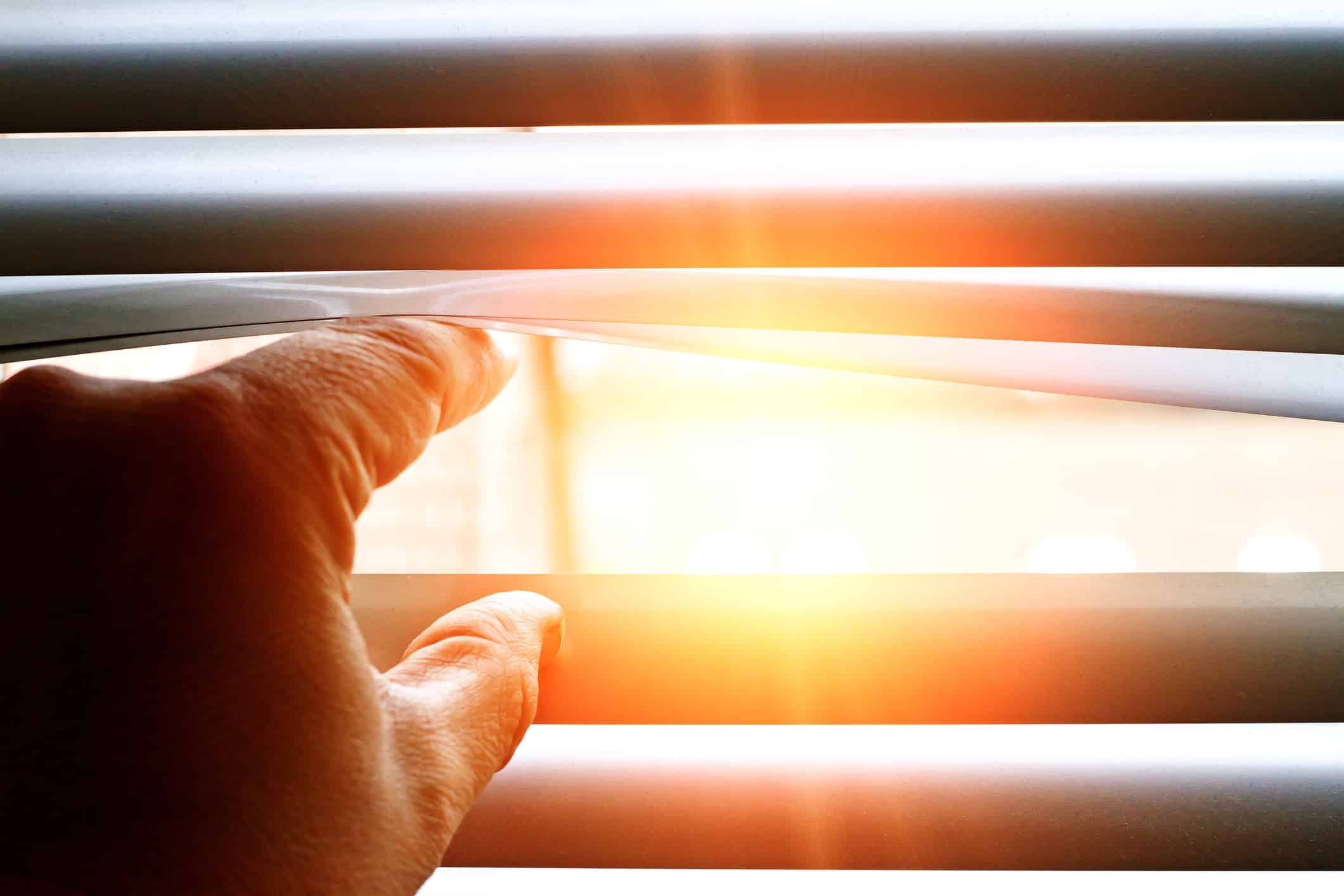

Believe me … I get it. My advisor colleagues at The Motley Fool Canada and I have been investing more often in our personal accounts in recent months than any of us can recall. I won’t speak for the rest of them, but in the moment, investing sure feels like I’m lighting my money on fire and watching it go up in smoke.

So why are we doing it?

Because if we look to history, which is as great a resource as we investors have, we see there’s always A LOT of “somethings.” Check out this chart that my former Foolish colleague Morgan Housel put together showing all the “smart” reasons to sell stocks (or not invest at all) over past decades, starting in the 1950s.

Through all of life’s tumult — the wars in Korea and Vietnam, the energy crisis in the ’70s, the collapse of the Soviet Union, 9/11, the housing bubble — the S&P 500 maintained an undeniable upward trajectory.

Is Now a Good Time to Invest in the Stock Market?

As you can see from the chart above, it’s always a good time to buy stocks when you have a long-term investing mind-set.

Especially during times of strife, when you can find wonderful businesses on massive sale.

So I say: Pull together any capital you’re not going to foreseeably need within the next five years and invest on! A decade from now, you’ll be glad you did.

To your wealth,

Iain Butler, CFA

Chief Investment Adviser, Motley Fool Canada

(PS: Need a nudge? Part of my job as the lead advisor for Stock Advisor Canada is to make investing as easy for you as I can. Our stock recommendation this month is about as close to a lay up as you’re going to find in the Canadian market. We know this company well and if your time horizon is aligned with ours, you’re almost assuredly going to profit from buying and owning this business.)