The best growth stocks are always attractive stocks to own. The trick is to buy them when they’re not trading like growth stocks. That is, to buy them when their valuations are low. Sierra Wireless is an example of such a growth stock.

Please read on as I tell you why Sierra Wireless (TSX:SW)(NASDAQ:SWIR) is the best growth stock to buy in 2022.

A growth stock benefitting from strong secular trends

Secular trends are trends that are long term in nature. They’re driven by increases in demand that are based on an industry shift. For Sierra Wireless, this has never been more relevant. As a leader in the Internet of Things (IoT) industry, Sierra is seeing strong growth. It is, after all, delivering the “connectivity, modules, and router solutions.” These are needed to accelerate the digitization of industries.

As you know, this trend is alive and well in most industries. Simply put, IoT technology is enabling connectivity that is transformational. For example, in the utilities business, Sierra Wireless’s IoT solutions have provided important technology that has made a huge impact. Smart metering and pipeline management connectivity have really had a huge positive impact on the business. This comes in the form of greater efficiency, lower costs, and better client satisfaction.

Sierra Wireless: Strong demand = strong results

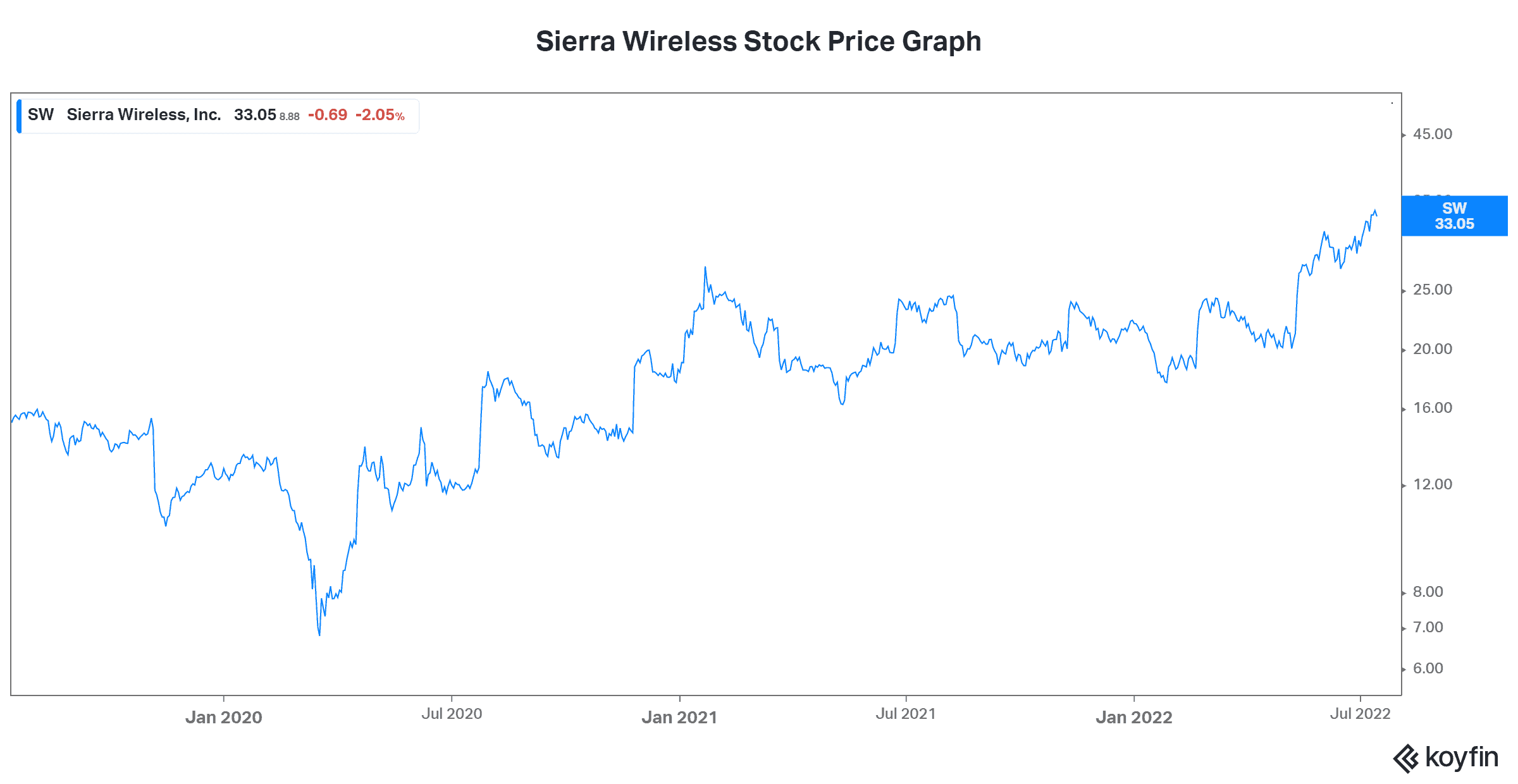

In its latest quarter, Sierra Wireless reported a 60% year-over-year revenue-growth rate. Sequentially, a 15% sequential revenue-growth rate was achieved. Also, the company reported EPS of $0.23. These results were significantly above expectations, which is a very positive thing. Moreover, this has caused analysts to increase their estimates for the years ahead — also a very positive thing. In fact, there’s a strong correlation between rising estimates and stock price performance. On that note, the chart below shows this in action.

A solid growth stock with strong company fundamentals

Sierra Wireless stock has stood out this year, as its stock price has rallied significantly. It’s up almost 50%. This at a time when the TSX has fallen 14%. Needless to say, things are working for Sierra Wireless.

Sometimes with growth stocks, we don’t always get good company or financial management. Too often, we see a hyper focus on revenue growth at the expense of everything else. With Sierra Wireless, however, we get both strong revenue growth and solid financials. For example, Sierra Wireless has significant levels of cash on its balance sheet — almost $100 million. This provides a great cushion and flexibility to make it through challenges.

Sierra Wireless stock: Not the typical growth stock valuation

Considering how massive the potential is for the IoT industry, it wouldn’t be surprising to see Sierra Wireless stock trading at very high multiples. But it’s actually trading at bargain multiples, in my view. It trades at 21 times 2023 EPS estimates. 2023 earnings are expected to increase by more than 30% versus 2022. In 2022, they swing to $0.89 from steep losses the prior years.

Backlog is strong, demand is strong, and the company’s balance sheet is pristine. Execution in the last couple of years has been exemplary. And the outlook is bright. I do not think that Sierra Wireless’s valuation reflects all of this.

The bottom line

So, to reiterate, I believe that Sierra Wireless is one of the best growth stocks to buy in 2022. It’s armed with strong company financials and strong demand for its products. The company is at the heart of one of the most exciting industries today. This industry has a lot of growth ahead, and Sierra Wireless will benefit.