The tax-free savings account (TFSA) has been a savings boon for investors since it began in 2009. Today, the total contribution allowance is $81,400. As you can see, the potential tax savings of this investment vehicle are substantial.

There are many stocks to buy to help take advantage of this but let’s start with the basics.

The TFSA has a clear purpose

The Canadian population is aging. Also, pension plans are quickly becoming a thing of the past. This all means that Canadians must accumulate their own savings to support them through to whatever ripe old age they encounter.

Enter the TFSA – a tax-free investment account that incentivizes savings. The incentive is that it’s tax-free, and the investor keeps 100% of all capital gains and income from investments. When the TFSA was first established, the maximum contribution was a mere $5,000. The concept was nice, but the tax savings were minimal. Today, the limit is much higher. This means that the tax-savings have become substantial.

It makes absolute sense to maximize your contributions to the best of your ability. If you have $81,400 lying around somewhere, get it into a TFSA. Here are three stocks to buy.

Enbridge: A high yield dividend stock for tax-free income

Enbridge Inc. (TSX:ENB)(NYSE:ENB) is a Canadian energy infrastructure giant. Its assets are a critical piece of North America’s energy infrastructure, and are powering industry and home life.

Today, Enbridge is benefitting from the rapid rise in oil and gas prices. This is driving record cash flows and shareholder value creation. In fact, dividends are on the rise as the company keeps growing. In the last five years, Enbridge’s dividend has grown at a compound annual growth rate of 8.85%.

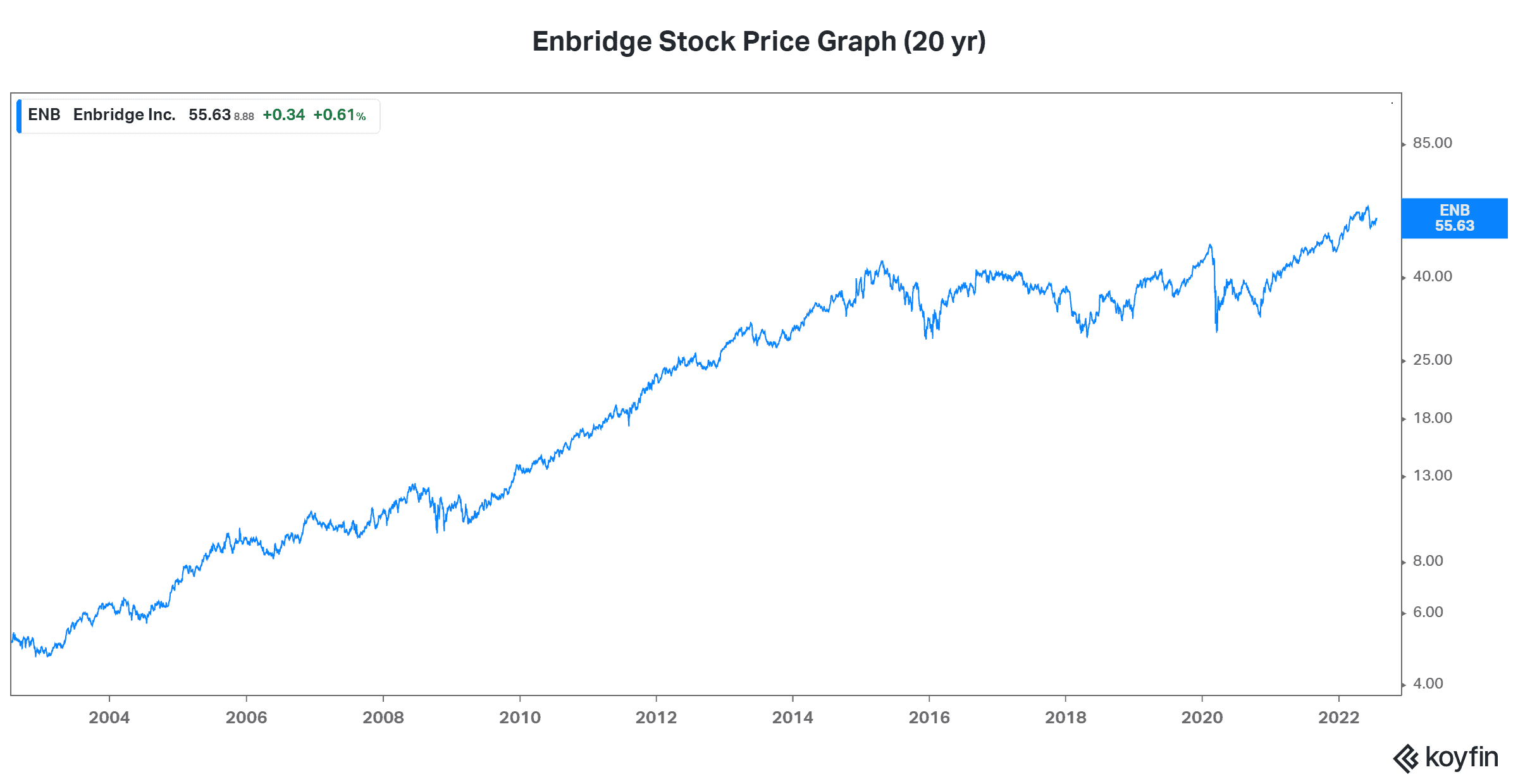

But Enbridge has been a core holding throughout decades. This is because it’s been a steady and predictable dividend stock. Enbridge’s stock price graph below illustrates how its stock price has also grown very nicely.

So, $27,000 invested in Enbridge stock today would yield $1,670 in annual dividend income ($140 per month). Not bad at all.

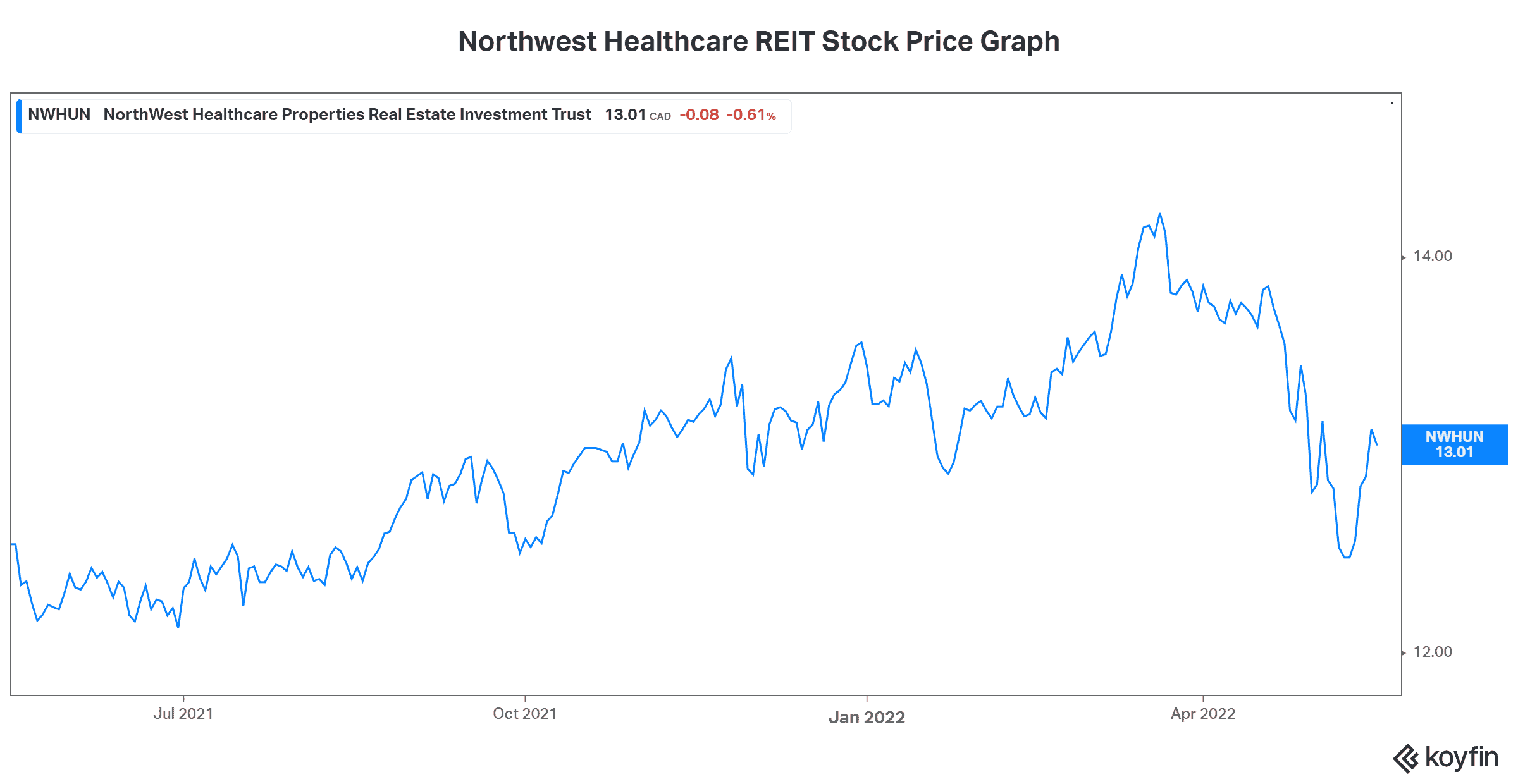

Northwest Healthcare Properties REIT: A 6.22% yielder with stable characteristics

Northwest Healthcare Properties REIT (TSA:NWH.UN) is a real estate investment trust (REIT) that owns and operates a lucrative portfolio of global healthcare real estate.

The REITs concentration on the healthcare industry means two things. Firstly, it’s a defensive holding. Healthcare needs are not impacted by economic cycles. Secondly, it means that there are strong long-term growth drivers. Simply put, the aging population will keep healthcare needs growing and the industry thriving. But there’s more. And it’s a crucial, very key point — Northwest’s revenues are inflation-indexed. In the inflationary environment that we live in today, this is a key advantage.

So, Northwest Healthcare is yielding 6.22% today. $27,000 invested here would provide $1,680 in annual tax-free income ($140 per month).

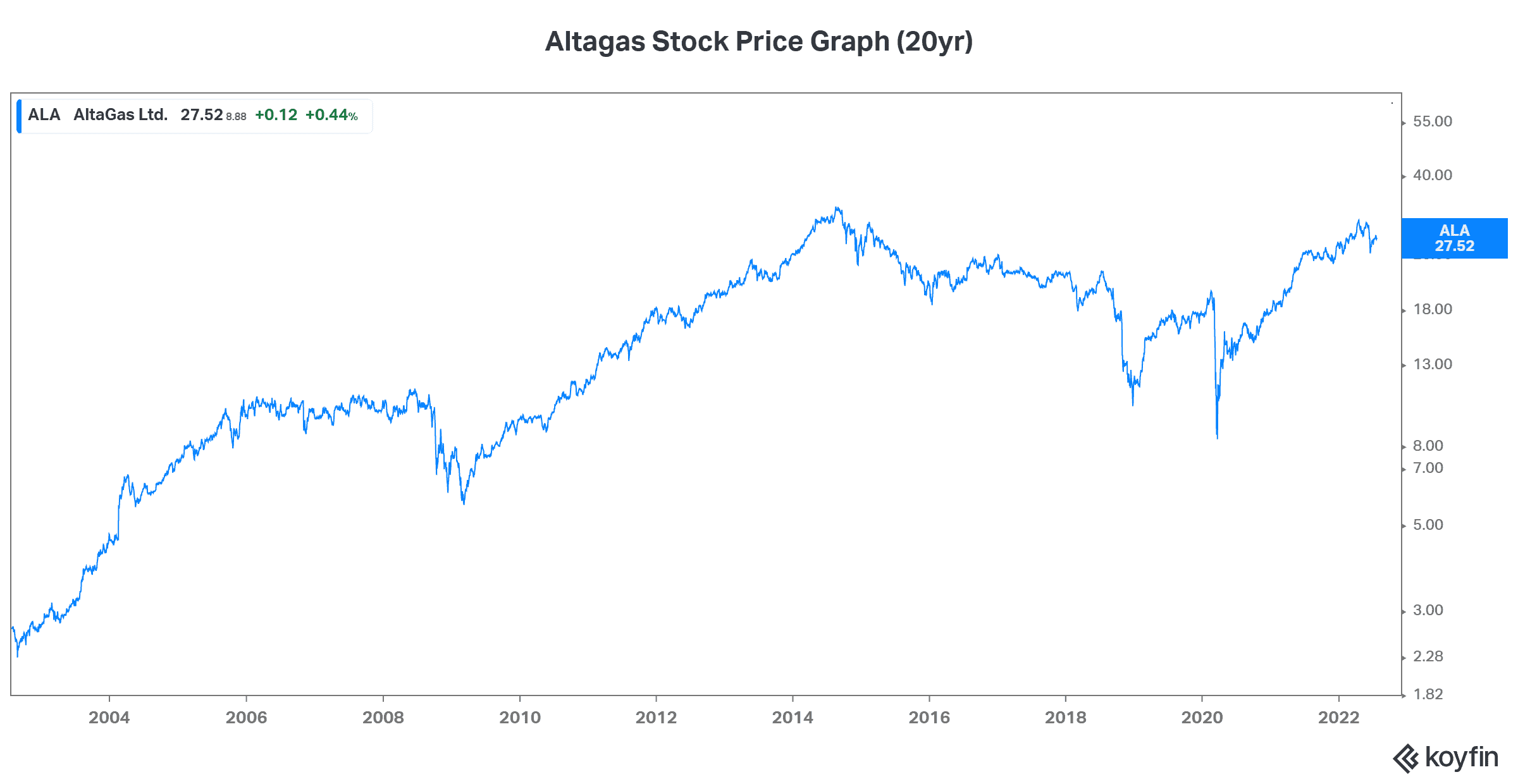

Altagas: A 3.84% yielding dividend stock with tons of upside potential

Altagas Ltd. (TSX:ALA) is an energy infrastructure giant with a strong position in two distinct areas. The first is the utilities business. This business is a stable one with consistent, steady growth. It’s the part of Altagas’ business that’s regulated and defensive. The other business is the midstream business. This is the business with the rapid growth.

In the first quarter of 2022, free cash flow at Altagas increased 21% to $505 million. This was a reflection of the company’s strong and steady utilities business as well as strong global demand for its natural gas by-products. In fact, global exports rose 16% in the quarter, to a record 88,000 barrels per day of liquified petroleum gas.

So, $27,000 invested in Altagas stock today will generate $1,040 in annual income ($86 monthly). On top of this, I believe that Altagas stock has plenty of upside from its natural gas by-product business.

Finally, adding up all of the dividend income from the three stocks, we arrive at a total of $4,390 in annual income ($365 per month). This is significant tax-free income that comes from a safe place.