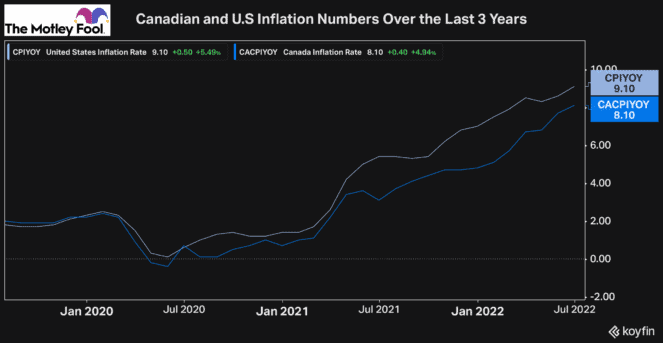

In 2022, one of the most significant factors impacting almost every stock and every consumer is sky-high inflation. After two years of severe economic effects induced by the pandemic, inflation has been increasing rapidly. It’s now at a 40-year high, making it difficult for investors to decide what the best stocks are to buy now.

A little inflation is actually good for the economy and helps it grow over the long-term. It incentivizes consumers to spend today since their cash will be worth less tomorrow. That’s why the Bank of Canada and Federal Reserve generally aim to keep inflation around 2% in North America.

However, when inflation gets out of hand, as it currently has, it can become a significant problem that impacts almost everybody.

So, if you’re looking to grow your passive income and offset the impact that inflation has on your wallet, here are two of the best dividend stocks you can buy now.

An impressive dividend growth stock that can benefit from inflation

If you want to increase your passive income and protect your portfolio from inflation, one of the best Canadian stocks to consider adding to your portfolio is Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP).

First off, its operations are well-diversified and highly defensive. The company owns assets such as utilities, ports, railroads, data storage centres, and more. This is one of the safest and most defensive stocks you can buy in Canada.

Furthermore, many assets that Brookfield owns have contract clauses that tie revenue to inflation. Meanwhile, much of its costs are fixed. Therefore, as inflation increases, Brookfield actually has the potential to increase its profitability.

And because it aims to grow its distribution by 5% to 9% each year, it’s one of the best dividend growth stocks to buy, especially in this high inflation environment.

So, if you’re looking for the best stocks to buy in the current environment, Brookfield is one to consider and currently offers a yield of roughly 3.7%.

One of the best stocks to buy as inflation surges

Another high-quality Canadian stock that can help offset the impacts of inflation is a real estate stock like Morguard North American Residential REIT (TSX:MRG.UN).

Diversification is vital for REITs. You certainly don’t want to own all your properties in the same region, as that only adds risk. But while most residential REITs in Canada are diversified across the country, Morguard also owns many properties south of the border.

In fact, only about a third of its properties are located in Canada. The other two-thirds are spread across nine states south of the border. This is key for diversification and could also play a crucial role in helping Morguard offset rapidly rising inflation, which is why it’s one of the best stocks to buy now.

In the U.S., there are no rent controls, meaning that Morguard can increase its rents significantly to keep up with inflation. And in the most recent quarter, we saw exactly that. Its U.S. portfolio provided 16% same-property net operating income (SPNOI) growth. For comparison, in Canada, its SPNOI actually declined by 3.3% last quarter.

In Canada, Morguard revenue grew by 3.2% year-over-year in the quarter. However, its costs were up by 10% due to inflation. In the U.S., its operating costs were also up by 10%. However, its average monthly rents in states such as Florida, Texas, North Carolina, Georgia, and Colorado all increased by over 10%, which more than offset cost increases.

With this in mind, if you’re looking to increase your passive income and protect yourself from inflation, Morguard offers a current yield of 4.2% and is easily one of the best stocks you can buy now.