AltaGas Ltd. (TSX:ALA) is a North American energy infrastructure company with a focus on owning and operating assets that provide clean and affordable energy. It’s also a thriving energy stock.

Without further ado, let’s look at why AltaGas is a top energy stock to buy on the TSX today.

A defensive energy stock

I’m tired of hearing about how inflation is eating away at wealth and profits. I mean, my gas bill is up big time. The cost of food is also climbing at an exponential rate. I’m happy to say I’ve found a beneficiary of this inflationary environment.

AltaGas has two segments: the defensive utilities segment (accounting for half of total EBITDA) and the midstream segment. The utilities segment provides AltaGas with steady and defensive utilities earnings. The midstream segment provides the company with impressive growth.

EBITDA (earnings before interest, taxes, depreciation, and amortization) in the utilities segment increased 7% last quarter. This is the steady and highly predictable portion of AltaGas’ business. It continues to benefit from rate increases that are driving these strong results. This segment is also benefitting from increased efficiencies due to the company’s strategic investments.

The fact that half of its EBITDA comes from the defensive utilities business is key. It positions AltaGas as a nicely diversified energy stock with a very attractive risk profile. This is a good fit for investors who are thinking about downside risk and upside potential.

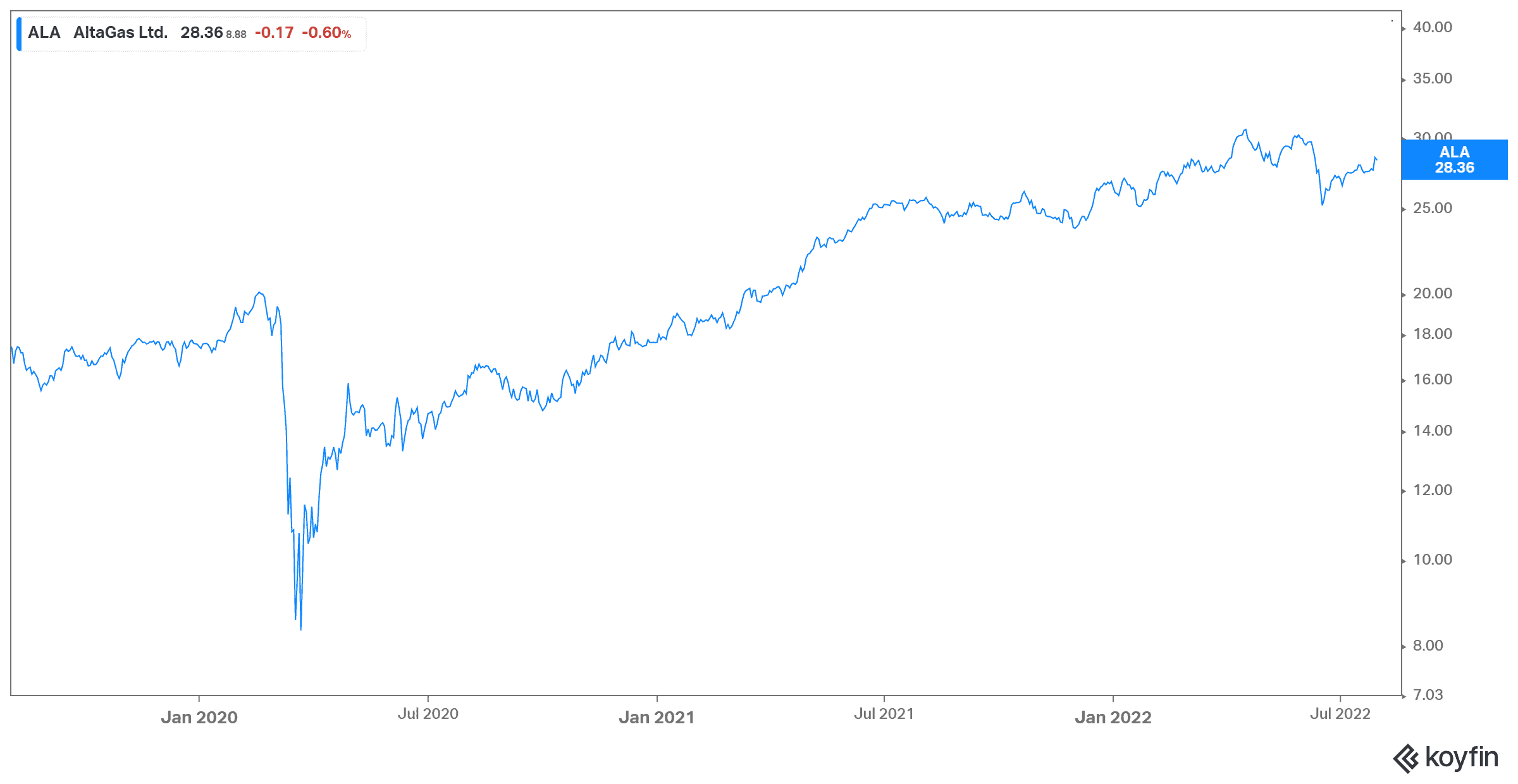

So, AltaGas is a top energy stock that’s up more than 40% in the last three years, and currently yields a healthy 3.7%. But it also has tons of additional upside.

AltaGas continues to be undervalued due to the sheer magnitude of its midstream opportunity

The bright spot of AltaGas’ midstream operations is its global export platform. Through these facilities, the company is exporting record amounts of propane and butane to a variety of Asian markets. In 2021, EBITDA from the midstream segment increased 55%.

Volumes have continued to rise rapidly into 2022. And they show no signs of slowing down, as global demand for liquified petroleum gas (LPG) continues to strengthen. During the company’s latest earnings call, AltaGas management remarked that there’s a “tremendous opportunity to export cleaner LPGs to Asia”.

And there are hard numbers to back up this claim. AltaGas has seen its volumes of LPGs go from zero (three years ago) to 111,000 barrels a day in the last quarter. Last quarter, volumes also increased 27% versus the previous year. These numbers speak volumes (pun intended). Demand from Asia remains strong and is driven by the global energy crisis/energy shortage. It’s also driven by the quest for energy security, which AltaGas readily provides.

Finally, the following management quote speaks to the company’s competitive advantage in its export business. This is the growth engine that has a long runway ahead.

“The midstream business will continue to be centered around our global export platforms which provide access to key west coast North American ports. They also provide a 60% structural advantage over the U.S. Gulf Coast and a 45% advantage over the Middle East for shipping time savings.”