Recent stock market weakness has been good for those of us who have some cash. The S&P/TSX Composite Index has fallen 8% so far in 2022 and 12% from its highs. This means that the some of the best TSX stocks to buy can now be bought at more attractive prices.

The best time to buy stocks

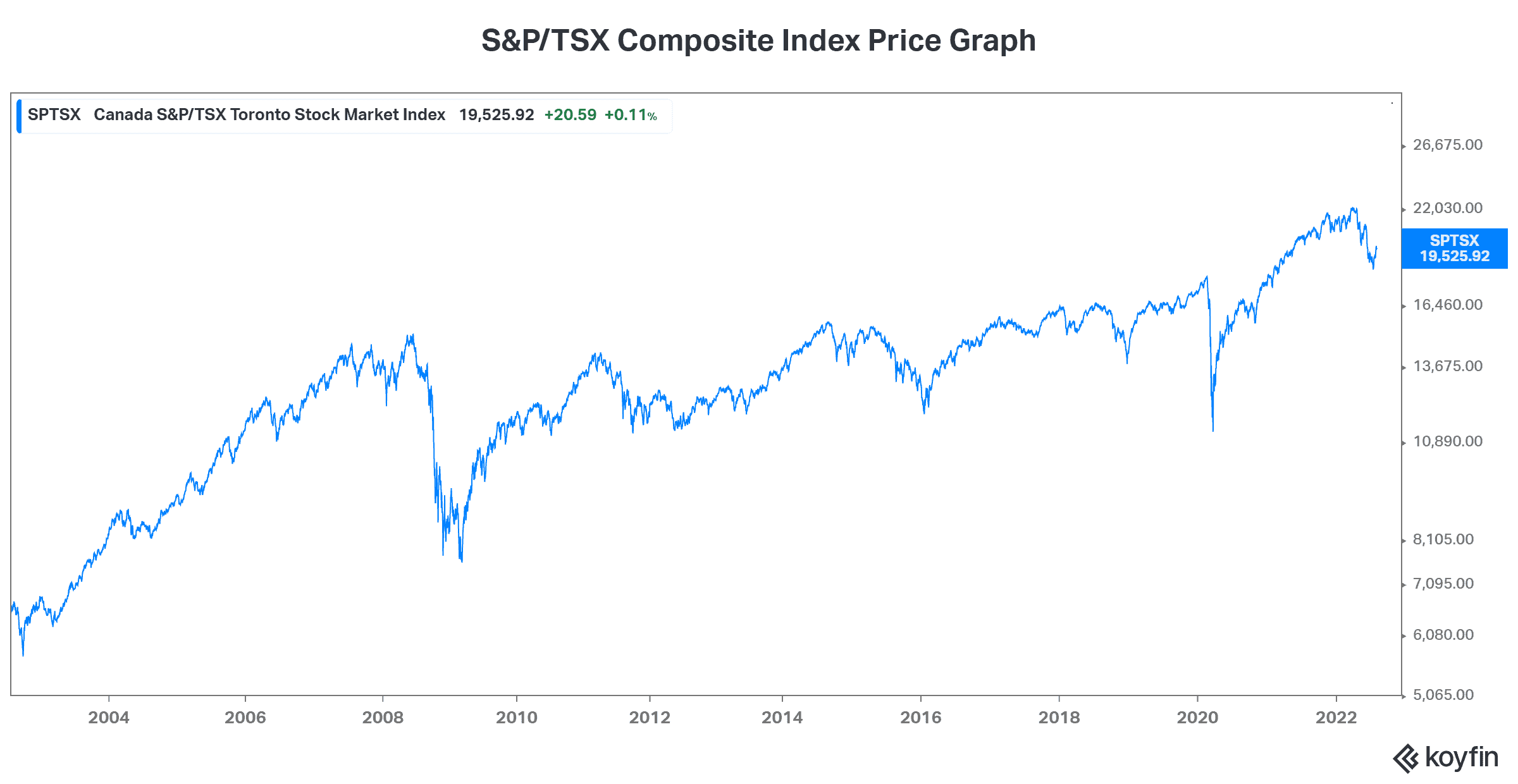

The examples of stock market turmoil throughout history are plenty. The patient investor can always find good times to buy stocks on the dip. See the price graph of the S&P/TSX Composite Index below for proof.

For example, the 2007 financial crisis was a great time to buy. Also, stocks were cheap during the 2020 pandemic crisis.

Obviously, the best time to deploy cash into the market is when you have it. But that’s not the only consideration. Historically, times of stock market weakness and uncertainty rank among the best times to buy.

Investors who adopt this attitude of buying at these times will be greatly rewarded. Today, the stock market decline is driven by inflation and rising interest rates. Simply put, we risk heading into a recession and that is never good news. Although it always feels like this time is different, the end result has always been the same — buying in times of crisis leads to superior long-term returns.

So if you’ve got $5,000, here are two simple stocks to buy for outsized potential returns.

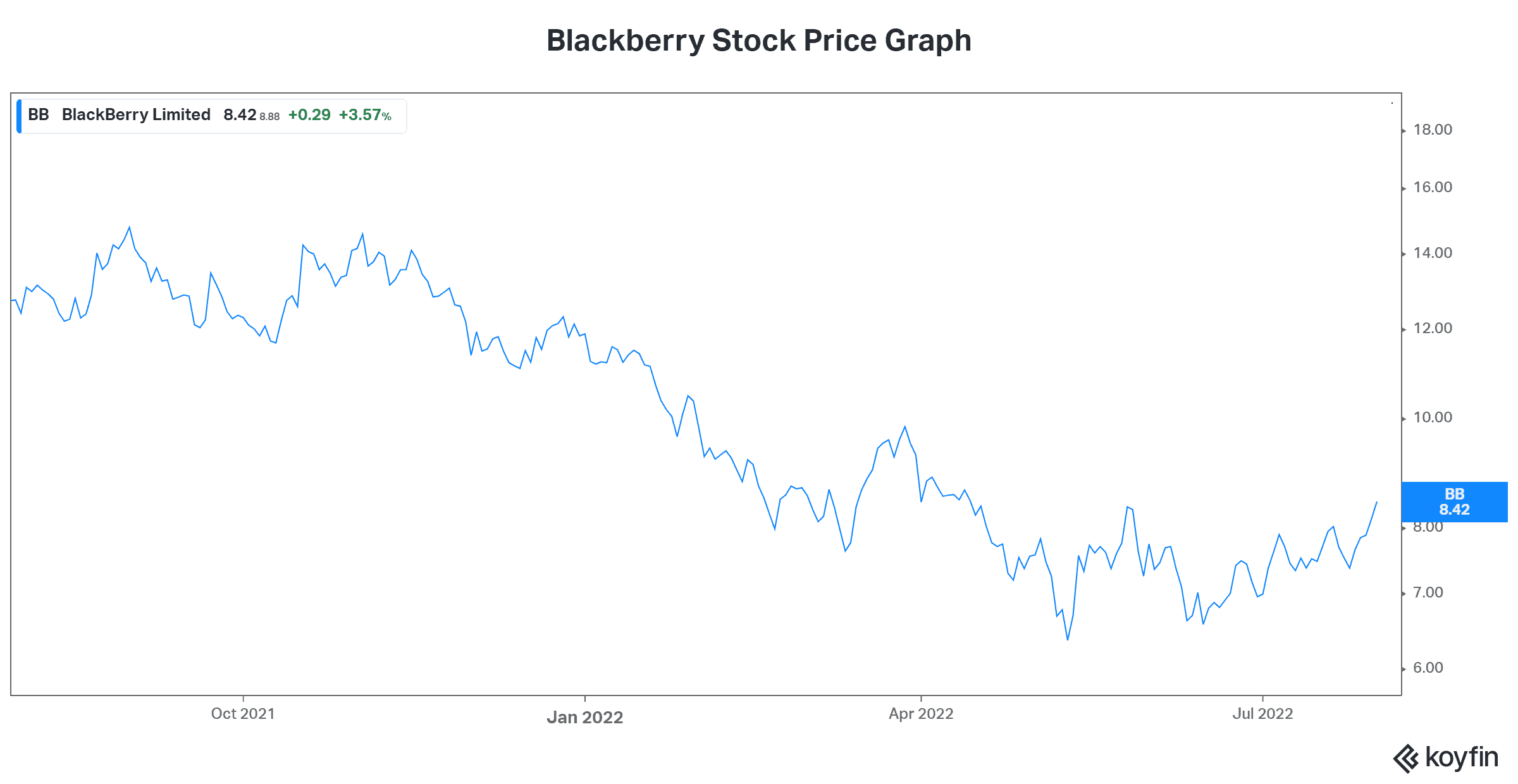

Blackberry stock: Trading at bargain valuations

Blackberry Ltd. (TSX:BB)(NASDAQ:BB) is one of Canada’s leading technology companies. Its expertise, relationships, and awards in the cybersecurity and embedded systems industries are widely respected. Yet Blackberry stock continues to struggle. In fact, it’s sitting at approximately $8 after falling 32% this year.

At this price, Blackberry stock is a very attractive bargain. This is because the company has such high growth opportunities coming its way. Blackberry QNX is driving the embedded car revolution. It currently has a 26% market share in the core auto market. This market is expected to see an 8% to 10% compound annual growth rate to 2026 – and this doesn’t include the partnership of its cloud data platform for connected vehicles IVY with Google.

Blackberry IVY will unlock new markets and products. For example, it will enable advanced driver assistance technologies and the cockpit domain controller, which integrates the computer with the automobile. These data-driven solutions will increase the level of customization for the consumer and lead to better performance. These areas are growing at 29% and 40%, respectively. Blackberry is targeting design wins for its IVY platform for 2023.

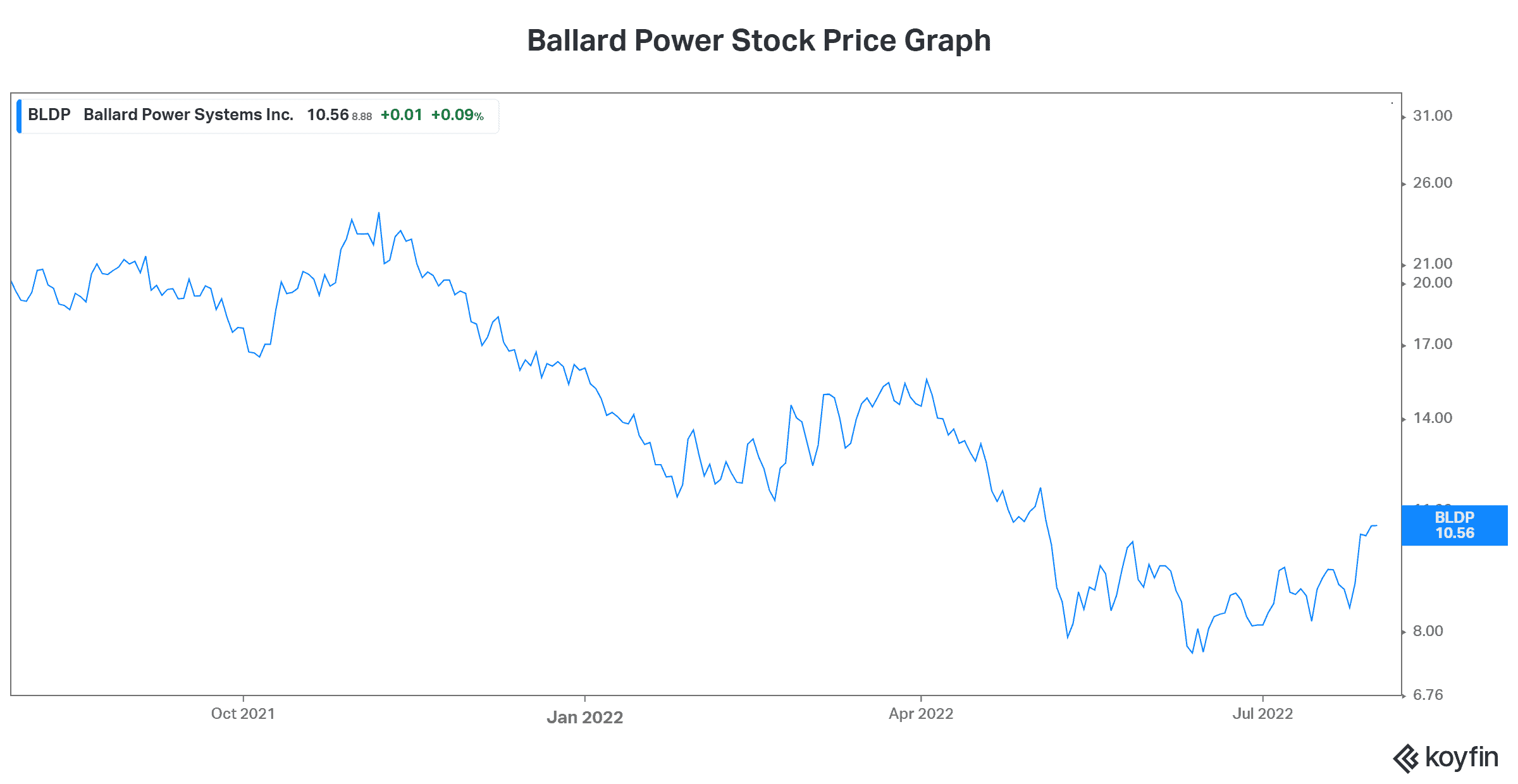

Ballard Power: A stock to buy for its disruptor status

The second of the TSX stocks to buy if you’ve got $5,000 to invest is Ballard Power Systems Inc. (TSX:BLDP)(NASDAQ:BLDP). Ballard is a leading global provider of innovative clean energy and fuel cell solutions. These fuel cells power transportation vehicles such as buses and trucks with zero emissions.

Clean car tech is an exciting industry with explosive growth potential. The move towards clean energy is gaining steam and Ballard is benefiting with a leading presence in this market. In fact, more and more countries and jurisdictions are using Ballard’s fuel cells to power their buses, trains, trucks, and even ships. Finally, costs are falling rapidly. As revenue growth heats up as expected, Ballard Power stock has great potential.

Ballard’s revenue growth in its latest quarter was 19.5%. The company noted that powerful market drivers are accelerating including increasingly supportive policies and rising costs of traditional energy sources (oil and gas). All of this is driving strong momentum for Ballard.

Lastly, management reiterated its growth expectation for the next five years. They expect 2024/25 to be an inflection point for revenue growth, with a steep growth curve to 2030.

Motley Fool: The bottom line

The two TSX stocks to buy now have a lot going for them. But the one thing they have going against them is net losses. And this is a dangerous situation to be in especially when rates are rising and risk tolerance is declining. However, I think that this basket of stocks shows great potential. And really, all you need is for one of them to blow the lights out for this investment decision to be the right one.