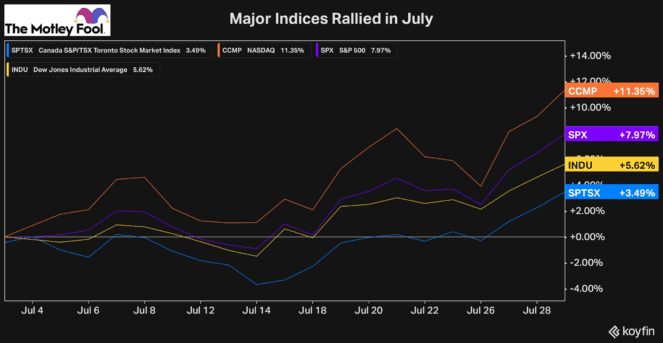

All throughout this year, and unlike the last two years, we’ve seen a tonne of ups and downs from the market. In June, it was a rough month for stocks, particularly in Canada, as energy stocks were some of the worst performers. Then in July, many stocks and indices saw strong bounce-backs, as market sentiment slightly improved and caused a lot of investors to buy stocks while they were still cheap.

Although the energy-heavy TSX slightly lagged its peers in June, the S&P 500 was up by almost 8%, and the Nasdaq even gained more than 11% in the month.

Despite some stocks recovering in value, though, there are still plenty that are cheap, and there are a tonne of bargains for investors to consider, especially if you have the patience and discipline to invest for the long term.

So, if you’ve got cash and you’re looking to take advantage of the opportune market in 2022, here are two of the best value stocks to buy now.

An ultra-cheap Canadian media stock

One of the cheapest stocks to buy in Canada, and one that’s worth considering for value investors, is Corus Entertainment (TSX:CJR.B), a Canadian media company with television, radio, and streaming assets. The company also has its own content production segment.

Corus is a stock that’s been cheap for some time. Long before the pandemic, it came under pressure as streaming services rose in popularity. Then it had an issue with debt that caused it to trim its dividend. From there, the pandemic hit and massively impacted advertising. Despite all these headwinds, though, Corus continues to improve its position.

The company’s operations have improved, and it’s reduced a tonne of debt in recent years. Therefore, the stock has much less risk today, yet it still trades at dirt-cheap prices.

For example, right now, Corus trades at a forward price-to-earnings (P/E) ratio of just 4.7 times — an unbelievably cheap valuation. Furthermore, it has an enterprise value (EV)-to-EBITDA ratio of just 4.6 times, which is also quite low. And its dividend, which currently offers a yield of roughly 6.4%, has a payout ratio of just 35%.

There’s no question that Corus is ultra-cheap and an excellent investment for passive income. Therefore, if you’re looking for some of the top value stocks to buy now, Corus is one of the first I’d recommend.

One of the lesser-known Canadian stocks to buy while it’s ultra-cheap

In addition to Corus, another high-potential Canadian stock to put on your watchlist and buy while it trades so cheaply is High Liner Foods (TSX:HLF).

High Liner is a seafood company with decades of experience that supplies both grocery stores and restaurants across North America. This is a business that could see some slowdown in sales. However, in general, much of its sales will be robust.

In addition to its reliable sales, going all the way back to 2012, the stock has only had four quarters where it reported a net loss and no year where it ever lost money.

So, while High Liner continues to sell off in this environment, it’s certainly worth considering as an investment. Right now, the stock trades at a forward P/E ratio of just 7.1 times. That’s cheap for any stock, but particularly a company with as much resiliency as High Liner. In addition, much like Corus, its EV/EBITDA ratio is also reasonable, at just 7.1 times.

Therefore, if you’re looking to take advantage of this environment and find top stocks to buy while they’re dirt cheap, High Liner is one I suggest you add to your watchlist today.