Warren Buffett advises investors to buy the stocks of great companies and “hold them forever”. Forever is fairly optimistic, and it’s hard to predict which companies will be around in another 50 years, so today I’ll aim for the next decade.

The TSX is full of long-standing, wide-moat blue-chip stocks with an established track record of increasing revenues, consecutive dividend payments, and strong earnings growth. Buying and holding one of these titans in your portfolio, reinvesting the dividends, and buying the dips consistently could be a rewarding long-term strategy.

Royal Bank of Canada

The king of Canadian bank stocks is the Royal Bank of Canada (TSX:RY)(NYSE:RY). As one of Canada’s largest and oldest banks (dating back all the way to 1864), Royal Bank has been a mainstay in the Canadian stock market for decades. It operates in multiple segments, including personal and commercial banking, wealth management, insurance, investor and treasury, and capital markets, and employs over 85,000 with offices across Canada.

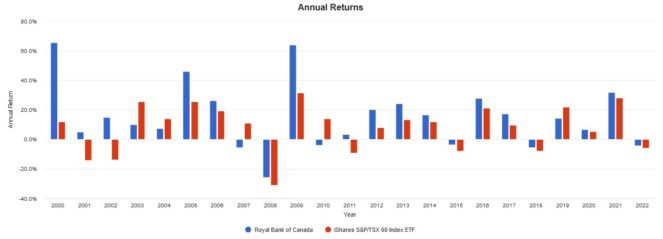

RY’s share price has weathered numerous stock market crashes, from the 2001 Dot Com Bubble and the 2008 Great Financial Crisis to the 2020 COVID-19 Crash to recover solidly each time and return to record growth. The Big Six Bank has a strong record of dividend increases, and currently pays a forward annual yield of 4.05%

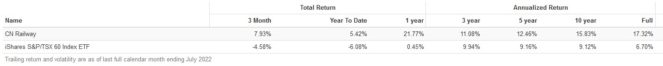

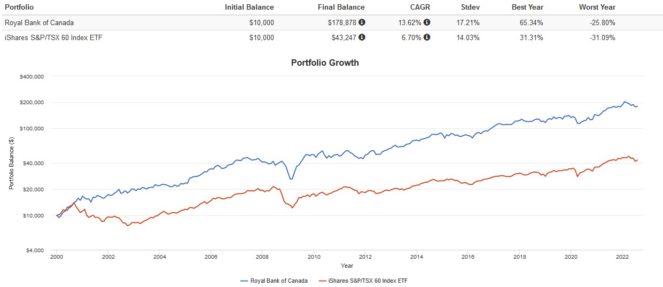

Currently, RY is the largest stock in the TSX by market cap, having ascended to that position through years of strong growth, profitable operations, and effective management. If you invested $10,000 in RY in 2000 and held it until now while reinvesting dividends, you would’ve beaten the S&P/TSX 60 Index with a compound annual growth rate of 13.6%, and turned your initial investment into $178,878!

Canadian National Railway

Canadian National Railway (TSX:CNR)(NYSE:CNI) operates a network of 19,500 route miles of track spanning Canada and the United States since 1919. These railways are the artery system of our economy and absolutely vital to Canada’s supply chains, which depend on CNR’s ability to move goods cheaply and efficiently across the country.

As a result of this dependency, the railway enjoys a wide economic moat, with little fear of disruption. It operates in a virtual duopoly with just one other major competitor, and thus has a much lower risk of losing its market share and profits to an upstart company. From a strategic perspective, CNR has a strong network effect owing to its extensive network of rails that hinders potential competition.

CNR has also been a very investor-friendly company. Share buybacks, forward stock splits, and other corporate actions that reward investors have long been a mainstay. The company has paid out an increasing dividend for over 25 consecutive years, qualifying it as a Dividend Aristocrat.

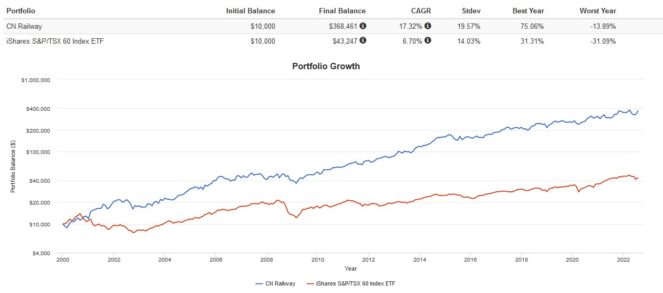

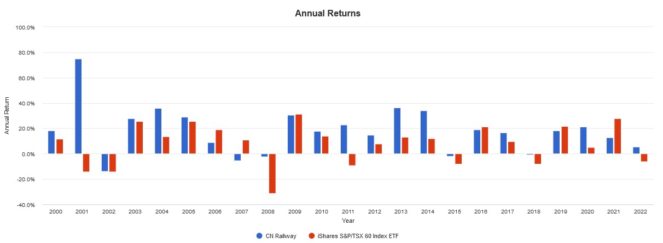

If you invested $10,000 in CNR in 2000 and held it until now while reinvesting dividends, you would’ve beaten the S&P/TSX 60 Index with a compound annual growth rate of 17.3%, and turned your initial investment into $368,461!