Shares of Cineplex (TSX:CGX) shot up on Monday, with Cineplex stock seeing a climb of about 4.75% in morning trading. The move likely came as meme stocks saw an enormous climb once more.

What happened?

Meme stocks started to rally again, with retail trades having their moment in the sun yet again. Share purchases surged in the 24 hours leading up to market open, with Reddit channel wallstreetbets putting renewed attention former greats such as AMC (NYSE:AMC).

AMC stock was up a whopping 17.25% on Monday at the time of writing, with no other news besides the attention set out by traders of meme stocks.

So, why was Cineplex stock involved? It seems that Motley Fool investors may want to hang back there. Again, there was no news that came out having to do with any type of growth in the entertainment industry. But even still, should you ignore what’s going on with AMC stock and others?

Shares down; Revenue up

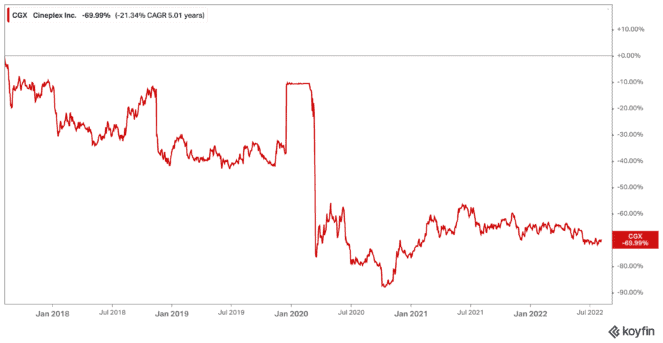

Cineplex stock has indeed seen some growth, but not in terms of its share price. Shares of the company are down about 16.25% year to date as of writing this article. Even worse, shares are still down about 67% after falling during the early days of the pandemic.

But speaking of the pandemic, Cineplex stock stated during its last earnings report that the company was seeing a trend towards pre-pandemic levels. Total revenue increased by 452.3% year over year to $228.7 million for the quarter! Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) came in at $36.5 million, up from a loss of $30.1 million the year before. The company still operates at a loss but has been improving each quarter.

Second-quarter earnings will be out soon, and Motley Fool investors may want to pay close attention. This would give investors a hint at summer performances, when most movies hit the box office. And with several new action movies bringing in audiences, it could be quite the surprise.

So, which is it: Buy, sell, or hold?

In my opinion, Cineplex stock is still miles away from where it was before the pandemic. It was a top dividend provider, with shares at about $35. Even that was less than the nearly $50 price it enjoyed back in 2017.

Analysts fell much the same, with signs of recovery underway that also affected AMC stock as box office rates rose in July. Still, one cannot ignore the massive increase in streaming services offering movies straight to your home. This alone has made many analysts lower their predictions.

That being said, Cineplex stock could be an outperformer in the next year, with an average consensus price target of $17.75. That’s a potential upside of about 56% as of writing. I would wait for the second-quarter results to come out before buying. That’s especially considering the recent rise in meme stocks, like AMC stock and others. Because one never knows, in times like these, when a sudden drop could happen once again.