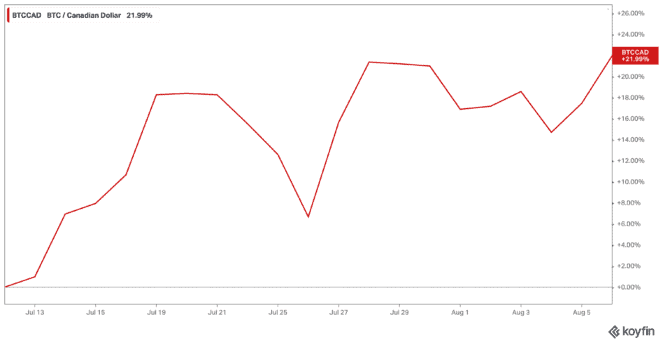

Bitcoin (CRYPTO:BTC) has been on the rise in the last month, with prices climbing 22% since July 12 alone. Granted, there have been some dips, and we aren’t out of the woods yet. But with more positivity in the market, is Bitcoin now a buy?

Catalysts

The growth started in mid-July, as the market in general started to react to positive market movement. Across the TSX, we’ve seen positive growth in the last month. And that includes with cryptocurrency.

But a major catalyst that could mean a growth movement is on the way is the investment from meme traders. Remember them? Reddit channel wallstreetbets came into the spotlight by sending cryptocurrency, tech stocks, and other companies soaring within just a day, all from a group decision to buy at once.

While this isn’t a good investment strategy, it does show that investors are starting to believe growth in the market is coming. And, even better, it could be here to stay. That could mean there’s about to be a massive move back towards that other growth currency, Bitcoin.

What to watch

Should Motley Fool investors go out and buy Bitcoin in bulk? I’m not sure about that yet. But if you’re interested in cryptocurrency in general, Bitcoin is probably the way to go. Most of the digital currency traded out there is Bitcoin, so it’s unlikely to be going anywhere. That makes it one of the safer plays in an industry, which has a massive bubble due to burst at any moment (if it hasn’t already).

A way to get into Bitcoin then is by dollar-cost averaging. This reduces volatility by simply investing at consistent intervals. Granted, Bitcoin is quite expensive. But if you’re looking to get in safely, then this is the way to do it.

The main point we like to focus on at the Motley Fool is the ability to invest long term. Sure, you could get into Bitcoin on a consistent basis, and hopefully it will rise fast in the next year. But that’s not really the point of investment. Instead, you should invest long term and be confident in the growth of cryptocurrency.

So, what will it take for Bitcoin to rise again? It will take adoption of cryptocurrency, which has been expanding at a massive rate. In the next decade, major countries and corporations are likely to adopt cryptocurrency and create their own digital currency. This will create the biggest catalyst to the rise in Bitcoin.

Bottom line

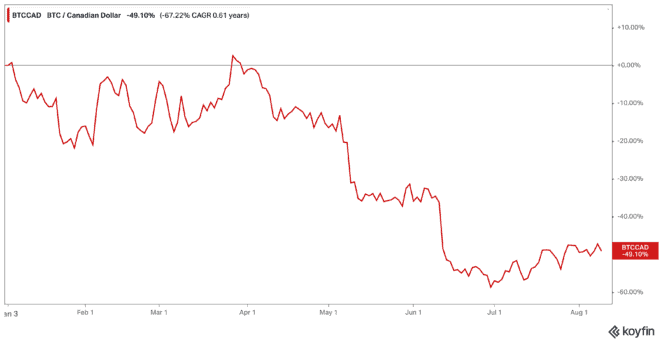

I’d say Bitcoin is a buy. But that’s based on its future performance and a cheaper, less-volatile share price. The crypto is down about 50% year to date, yet it still trades at almost $30,000 — much lower than the 52-week high of $85,357, making it a solid time to jump in.

After that? Hold on. Because you could be in for a pretty crazy decade. And it should be the good kind of crazy.