Throughout 2022 stocks from almost every industry and sector have seen significant headwinds, with most losing value. However, while most industries have been struggling, the stocks of energy companies such as Freehold Royalties (TSX:FRU) have seen major tailwinds all year, despite energy stocks also pulling back in recent months.

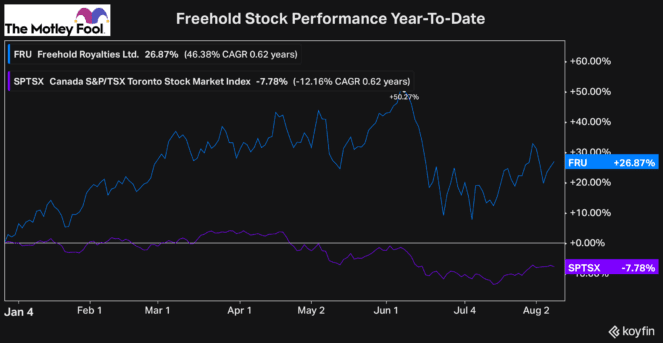

In Freehold’s case, the stock is now up 26% year to date. That’s a strong performance in any year, and it’s well ahead of the TSX, which has actually lost over 7% so far this year. However, Freehold has pulled back in recent months and is down significantly from the 50% gain it saw earlier in the year.

Energy stocks like Freehold have sold off in recent months due to fears of a recession in the near term and, consequently, the fact that energy prices have fallen as a result.

However, even with the recent pullback in commodities prices, these high-quality energy stocks like Freehold continue to operate in an environment with major potential for profitability.

Therefore, when Freehold Royalties stock reported its earnings for the second quarter of 2022 this week, it was no surprise that the company posted another record quarter of funds from operations (FFO).

Freehold Royalties stock smashes earnings once again

Freehold Royalties has many factors working in its favour, which is why it continues to perform well and is one of the best energy stocks you can buy in this environment.

First off, as prices rise, Freehold, which earns a royalty from other companies producing energy on its land, could see a significant increase in revenue. In addition, though, it isn’t only energy prices that play a role. As energy companies naturally produce more energy, Freehold has the opportunity to make even more money.

And while both U.S and Canadian producers on its land have increased production this year, even more production is expected to come online in the second half of 2022. So on top of the fact that Freehold just reported another quarter of record FFO, there’s a tonne of more growth potential on the way for the stock.

How did the stock perform in the second quarter of this year?

In the second quarter of 2022, Freehold Royalties reported FFO was up a whopping 109% year-over-year. This was in large part due to the increase in energy prices, but growing production on its land also played a role.

In addition, Freehold’s recent acquisitions also helped play a role in the growth the company achieved.

So while FFO was up 109% year-over-year, on a per share basis, because Freehold financed part of its recent acquisitions by issuing new shares, the growth was just 81%, still an impressive jump.

And because this record FFO allowed Freehold Royalties stock to have a payout ratio of just 43% in the quarter, the company elected to increase its dividend once again for September’s dividend, its seventh increase since the start of 2021. The stock is now paying out $1.08 yearly or $0.09 per share monthly. That’s significantly higher than the $0.18 per year that Freehold was paying at the end of 2020.

Even with the new dividend increase, though, it’s clear that Freehold is remaining conservative when it comes to returning cash to investors.

For one, management likely doesn’t want to increase the dividend to an unsustainable level. In addition, though, management has also proven that it can find value accretive acquisitions to make with its excess cash, which is what’s led to a tonne of growth in recent years.

The company continues to acquire new land, particularly south of the border, where the energy industry has even more tailwinds and more potential for production growth.

Therefore, with Freehold Royalties stock now offering an incredible dividend yield of 7.8% as of Tuesday’s close, there’s no question that it’s one of the top dividend stocks you can buy for passive income in the current market environment.