If you want to turn a TSX stock portfolio into a passive-income fortune, the Tax-Free Savings Account (TFSA) is the place to start. When you invest in stocks through your TFSA, all income (dividends, interest, and capital gains) is safe from tax liability. The TFSA is the only Canada Revenue Agency (CRA) registered account that can grow capital with zero tax (even when you want to withdraw your funds, unlike the Registered Retirement Savings Plan).

Compound your passive income into long-term wealth

That means all the passive income you earn can accumulate, be re-invested, and compound. If you don’t have an immediate need for the cash, you can grow an impressive amount of wealth over the long term.

Here is how it works. You invest in a stock that produces a reliable stream of passive income. Over time, it pays (and hopefully grows) its dividend regularly. You take all that income and either re-invest in the same stock, or into a diverse range of other dividend-paying stocks. The more stocks you own, the more income you earn from them.

Over time, it snowballs and can create a lot of equity capital and passive income. Of course, you will need capital to start. If you were 18 years or older (and a Canadian resident) in 2009, you can contribute a total of $81,500 to your TFSA today.

As an example, if you put $40,000 each into two top TSX dividend stocks, you could earn nearly $3,600 a year, or around $10 a day.

TD Bank: A Canadian dividend stalwart

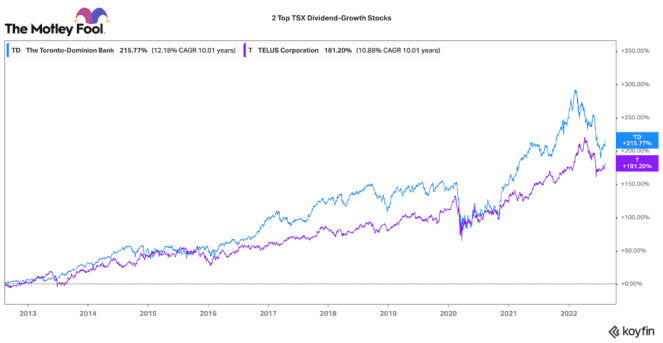

One passive-income stock you could consider right now is Toronto-Dominion Bank (TSX:TD)(NYSE:TD). This top TSX stock has pulled back 12% this year. It is trading with an attractive dividend yield of 4.3%. For context, its five-year average dividend yield is 3.8%. That means investors are getting an attractive yield on the stock cost now.

Bank stocks are hurting over worries about the economy and a recession. Yet, as one of the largest banks in Canada and the eastern United States, it is prudently managed and relatively well capitalized. It could even benefit from higher profit margins if interest rates stay somewhat elevated and the economy remains steady.

Over the past 10 years, it has delivered average annual returns between 10% and 13%. Chances are good that will likely continue. If you put $40,000 into TD stock, you would earn $430 every quarter, or $4.70 averaged daily. TD has a long track record of increasing its dividend annually, so investors will likely see their passive-income stream steadily expand as well.

TELUS: A passive-income growth story

Another faithful passive-income stock to consider is TELUS (TSX:T)(NYSE:TU). While TELUS is one of the more expensive TSX telecom stocks, it has consistently outperformed its peers.

The company is rapidly modernizing its 5G and fibre optic network. It expects to finish a lot of its capital spending by next year, after which, it should yield a lot of spare excess cash.

It has a great long-term track record of around 7% annual dividend growth. However, it projects 7-10% annual dividend growth over the coming few years. Today, at $29 per share, TELUS stock yields close to 4.6%. If you put $40,000 into this stock, you would earn $460 per quarter, or $5.04 averaged daily.

The Foolish takeaway

I suggest investors have a more diversified portfolio than this. However, this illustrates how you can relatively easily build a passive-income portfolio. Not only do your stocks keep growing their passive-income streams (through dividend increases), but you can also grow them by re-investing the proceeds. Let the compounding cycle work for you, and you can build significant wealth over a lifetime.