Shopify (TSX:SHOP)(NYSE:SHOP) shares made a bit of a comeback this week, rising about 10% with a rebounding market. Shares of Shopify stock are still down significantly, of course, by 70% year to date and 76% since all-time highs.

But with Shopify stock showing positive signs of movement in a recovering economy, could it be possible the e-commerce company will hit triple-digits in 2022?

Let’s look back before looking forward

Shopify stock hit all-time highs of $228 (adjusted for the stock split) in November 2021. Soon after, shares started to fall, but of course not drastically due to the company’s performance. Though growth slowed year over year; the drop in tech stocks, supply-chain disruptions, and the ongoing pandemic were all factors.

Not that Shopify stock was solely without blame. The company’s chief executive officer even admitted that he “made a mistake” and grew the company too much, too soon. While the basis of the growth is sound, putting money into payments and shipping, it was too fast and the company was forced to lay off about 1,000 employees last month.

This did not make Shopify stock look good, but investors were impressed. Shares have started to climb since that announcement, and with inflation in the United States coming in lower than the month before (down from 9.1% in June to 8.5% in July), there’s hope yet that we’ve seen the tail of this down market.

So, what’s next for Shopify stock?

Shopify stock continues to grow

During Shopify stock’s most recent earnings report, the company reported 16% growth year over year to $1.3 billion for the second quarter. Its monthly recurring revenue was up by 13% year over year, with subscriptiosn solutions revenue up 10%.

The digital commerce leader’s gross merchandise volume, a highly focused on fundamental for e-commerce stocks, also rose 11%. Shopify stock also saw profit rise 6% in the quarter year over year, with an operating loss of 15% of revenue. This was down from income that made up 12% of revenue the year before. The company posted a net loss of $1.2 billion after achieving net income of $900,000 in 2021, much of it due to the net unrealized loss on equity and investments.

So it’s growing, but the drop in Shopify stock has certainly hurt the company. So now the question is whether or not this massive company hoping to continue making acquisitions and maintain its place as a household name can reach $100 once more.

Yes, but when?

It’s quite likely Shopify stock will reach $100 once again, especially with investors so eager to buy it up at any sign of improvement. This week alone, the company saw a massive increase in daily share volume. On Thursday, average trade volume surpassed 4 million, whereas the average remains around 3.4 million.

So the question is whether Shopify stock could in fact surpass $100 in 2022. Let’s look at the stock market as a whole, and Shopify’s drop, to see whether that could be possible.

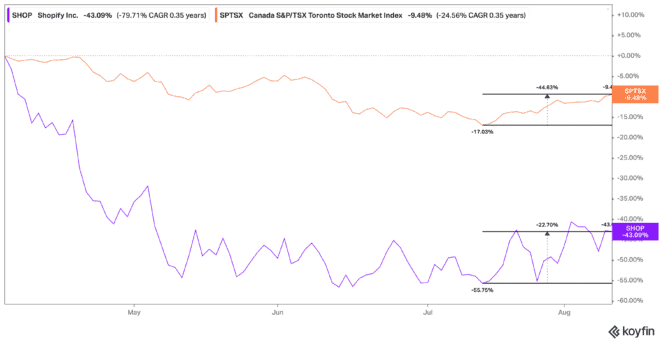

The TSX started dropping in April of this year, falling about 17% from peak to trough. Shopify stock during that time fell 54% to hit its lowest point, where it remained for quite some time. Yet both the market and Shopify stock started rebounding at the same time on July 14. Now, Shopify is up by 28% since then, and the TSX is up by 9%.

Bottom line

While I believe it’s unlikely that Shopify stock will get back to all-time highs this year, I do think that due to the rebounding market and obvious interest in the tech stock, it could easily hit three digits this year. If it were to hit pre-TSX fall highs, that would see Shopify hit a share price of $90 per share. Should investors get really excited and continue to drive the momentum forward, it is quite likely that $100 could be achieved by the holiday season.