Valuable TSX stocks. Motley Fool investors have been on a hunt lately for them, me included. And one of the best places to look are with large, blue-chip institutions — institutions that have been around for decades, if not over 100 years.

It’s almost as if during periods of growth, investors simply forget about them. And it’s about to be one of those times. With everything down, practically everything is about to go up. And yet we’re ignoring this incredibly valuable TSX stock that we should be buying up in bulk again and again.

That TSX stock is Bank of Montreal (TSX:BMO)(NYSE:BMO). Let’s look at why.

First off, it’s a Big Six bank

The Big Six banks have been around for 100 years or more, and in the case of BMO stock, it’s been around for almost 200 years. In that time, it’s dished out returns, paid out dividends, and grown its business on a global scale. But as a Canadian bank, it also has the advantage of doing well after a recession.

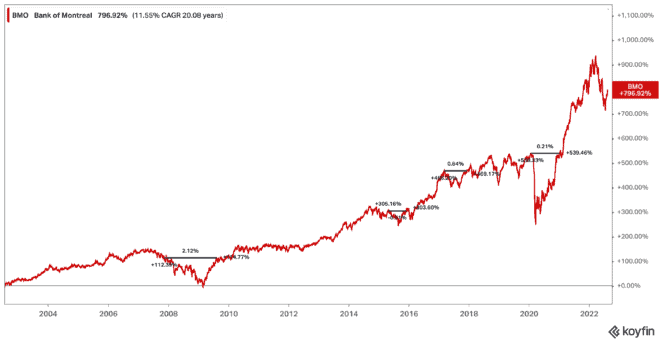

Right now, we’re not exactly in a recession. However, we’re in a market correction, and BMO has bounced back to pre-drop prices within a year of the original fall every single time. Just look at the chart below, and you’ll see exactly what I mean.

You see? Fall after fall, the TSX stock manages to climb back up over at least the last two decades. But go back even farther, and you’ll see that BMO and the other Big Six come back thanks to those provisions for loan losses. But there are even more reasons to consider the bank stock.

Future growth

BMO stock hasn’t just sat around waiting for a rebound to occur. Since 2020, the bank has been making major investments in its global business. This includes acquiring $3 billion in energy loans from Deutsche Bank. The acquisition of Bank of the West from BNP Paribas in France to merge with its BMO Harris Bank, doubling its presence in the United States. Finally, in July it announced the plan to purchase Radicle Group to help meet the “surging demand” from clients on how to transition to clean energy.

The TSX stock continues to remain far down. But Motley Fool investors should really get with it. This is an opportunity to see this major Big Six bank explode over the next decade. That comes from its expansion in the United States and within the clean energy sectors especially.

Finally, it’s so cheap

The TSX stock is set to explode, and yet shares trade at just 7.16 times earnings as of writing. Shares are also down 1.5% year to date but have bounced back by an incredible 10.35% in the last month alone. So, now is as good a time as any to buy this TSX stock and lock in a great deal, with an amazing 4.35% dividend yield.

I mean, come on. If BMO stock even just reaches 52-week highs, Motley Fool investors could see insane returns. The stock currently trades at $135 per share. To reach 52-week highs of $154 per share, that’s growth of 18%. It’s something that could certainly be achieved in the next few months. That would turn a $10,000 investment into $11,407! Plus, you’d get an additional $412 in dividends.