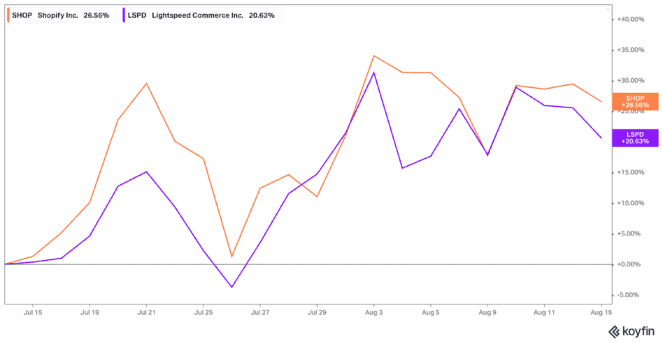

Shopify (TSX:SHOP)(NYSE:SHOP) and Lightspeed Commerce (TSX:LSPD)(NYSE:LSPD) have both seen shares climb this month. The TSX today remains down by about 5% year to date, yet in the last month it’s now up 10%. This has led to a renewed interest in both Shopify and Lightspeed stock, with shares up 26% for Shopify, and 21% for Lightspeed at the time of writing.

But before you go ahead and start buying up these growth stocks once again, let’s look at what’s been going on for both.

Shopify stock

The renewed interest in Shopify stock comes on the heels of some not-so-great earnings, and a huge layoff of staff. Yet investors seemed almost pleased at the news, with signs the company was finally getting control of its spending habits. Still, it’s not like it was one of the growth stocks that had to be careful in the past.

Shopify stock went from a market capitalization of about $2 billion in 2015, to soar to a market cap of almost $270 billion when shares started to fall. The e-shop platform now has a market cap of $64.3 billion, a little higher than where it was in January 2020.

What does this tell us? That investors are back where they were in the pre-pandemic days, but not completely. There’s more stability in that the company has a huge range of clientele completely reliant on the websites built with Shopify. It’s gained immense popularity both as a stock, and an e-commerce provider. And while this recent slump in the markets continues, it will eventually end. And consumer spending will come back once more to the benefit of Shopify stock.

Meanwhile, the company is making partnerships investors are impressed with. That includes one with YouTube, and the acquisition of Deliverr. These will help the Canadian e-commerce giant move towards the next phase of growth. How long that takes, however, is anyone’s guess.

Lightspeed stock

So what about Lightspeed stock? What’s surprising is that compared to Shopify stock, it’s doing quite well. In share price maybe not so much, but certainly in terms of earnings. The company recently reported that while e-commerce was down, its point-of-sale earnings were up. This boost came as fewer COVID-19 restrictions meant more use of its point-of-sale services in restaurants and retail businesses.

Not only is Lightspeed seeing an improvement in its POS business, but once e-commerce rebounds it will see improvements there as well. All while its huge acquisitions continue to bring in revenue and prove the worth of their US$2 billion price tag. In fact, despite current challenges, the chief executive officer wrote to employees that he does not feel there will be a need to take the drastic measures that Shopify has taken — that is, massive layoffs.

The optimism comes from the launching of two new products, and the broadening of its software offerings thanks to these acquisitions. This has moved it towards an all-in-one service similar to the goal of Shopify. Yet it’s also why the company shows a net loss nearly double that of last year. It recently reported a loss of US$0.68 per share, up from US$0.38 per share in 2021.

So, which is it?

It’s a hard choice, as both Shopify stock and Lightspeed stock have a lot of attention on them, and a promising future. However, if it comes down to just one of these companies on the TSX today, I’d go with Shopify stock.

I’m not all that convinced that Lightspeed stock will be able to get around all the massive spending it’s done in the last few years. It started out at a $2.5-billion market cap, soared to $17.3 billion, and is now back to $4.3 billion. That’s a dramatic rise and fall, and yet the company remains in a precarious position with a mountain of debt to pay off.

Not that Shopify stock is in a coveted position, but large institutions that have been around the block a while continue to partner with the company. And as mentioned, the e-commerce giant has large institutions reliant on the stock for survival. With that in mind, Shopify is what I would choose on the TSX today over Lightspeed stock.