Buying stocks for the long term is often the best investment strategy for many Canadians. Thinking like a long-term investor (rather than a trader or speculator) can be a great way to build wealth.

Great investors like Warren Buffett and Charlie Munger have made their fortunes by buying top-quality companies and holding them for decades. In fact, Mr. Buffett once thoughtfully remarked, “The stock market is designed to transfer money from the active to the patient.”

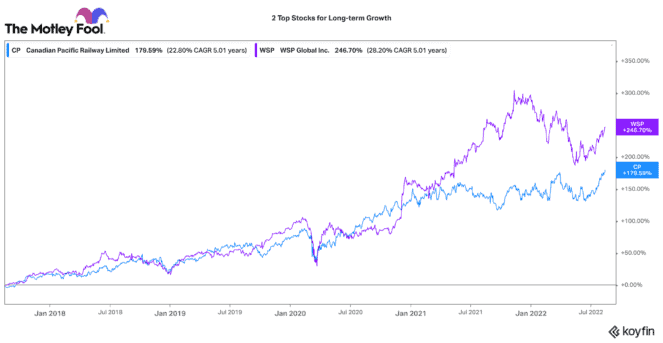

If you are interested in being patient for the next decade or more, two stocks that could significantly grow your portfolio are WSP Global (TSX:WSP) and Canadian Pacific Railway (TSX:CP)(NYSE:CP).

WSP Global stock

WSP Global is fast becoming a global leader in consulting, engineering, and design. Recently, it has pursued an acquisition streak focused on environmental consulting. In 2022 alone, it has added three large consulting businesses to its portfolio.

Environmental consulting now makes up an approximate 30% piece of its business. Given global environmental and climate change concerns, this should provide strong long-term growth.

A National Bank analyst recently noted that these acquisitions could accrete as much as 15% earnings-per-share growth in 2022 alone. This doesn’t factor in organic growth from its current operations either. The analyst increased their price target to $188 per share, which would project 18% upside from here.

WSP has a long track record of making smart, accretive acquisitions. Since 2012, it has added nearly 25 consulting firms. These significantly expanded its expertise and geographic exposure. Since its initial public offering in 2014, WSP stock has delivered a 452% (or 22% annual) total return.

This stock is not cheap (it never is), but it is one of the highest-quality consulting businesses in the world. Given strong tailwinds supporting growth and a great operational platform, I expect strong returns for many years ahead.

CP Rail

You may not consider a boring blue-chip stock like Canadian Pacific Railway (TSX:CP)(NYSE:CP) a growth stock. Yet it has delivered very strong historical returns. Over the past decade, it has earned shareholders a very strong 566% total return (20.8% annually).

CP has been a pioneer in driving very efficient railroads across Canada. It has used its large land assets to expand, develop, and grow its transport network. This network is set to grow significantly larger if its deal to merge with Kansas City Southern railroad gets approved by regulators.

It would be the first and only Canada-America-Mexico railroad. The deal could provide very long-term growth opportunities. Like WSP, this is not a cheap stock by any means. However, if it can deliver results like it had in the past, it could be a very good stock for long-term investors.