Dollarama (TSX:DOL) has become one of the best companies for Canadians during this period of market uncertainty. And I mean that in more than one way. Dollarama stock is one of the last companies out there to raise prices during inflation. Furthermore, it continues to offer a wide range of brand-name products at cheap prices.

In terms of Dollarama stock, those factors cause investors to seek it out. After all, with more Canadians using Dollarama, shares should go up!

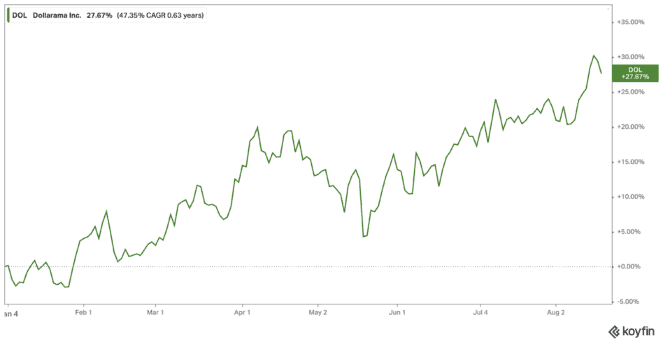

And indeed they have. Dollarama stock is up by an incredible 28% year to date. Yet in the last month, shares have been slowly but steadily dropping. Here’s why I think that will continue.

Inflation resistant, but not forever

During periods of inflation, Canadians use companies like Dollarama stock to try to adjust to this new world of more expensive products. But what about when inflation comes under control? As of now, July numbers from Statistics Canada showed that inflation rose 7.6% year over year. That’s down from 8.1% in June.

While we still have a ways to go, and interest rates are still up, the market tends to react to news pretty much as it hits headlines. The market is a reactionary place, as we’ve seen, so this good news could signal the lowest point of the market.

That seems true so far, if the last month is any indication. Shares of the TSX are up 10% in the last month. That’s compared to Dollarama stock, which is up just 5%. However, this week, shares started to drop. And it could be the sign that the end is near.

What should investors do?

Dollarama stock is a great company; I’m not suggesting it isn’t. But right now, it’s overvalued, as investors flocked to it to hide from inflation. With inflation seemingly slowly but surely getting under control, it looks like Dollarama stock may start to see its shares come back down to reality.

As of writing, the company already trades at a higher price than consensus price targets. Further, it trades at 35.07 times earnings. So, it’s certainly not cheap. And with so many companies out there down and starting to climb back up, it’s simply not one I’d consider for now.

However, Dollarama stock is an excellent company that’s done well over time. It’s expanding its stores even more across Canada. It’s also expanding its borders to Latin America. And during its latest results, it increased net earnings by 32.4%, earnings before interest, taxes, depreciation and amortization by 20.9%, and sales by 12.4%. Plus, shares are up 742% in the last decade, a compound annual growth rate of 24%!

Bottom line

Dollarama stock is a great company to have on your watchlist, but it’s certainly due for a drop in this changing market. So, if you’re an investor seeking out companies to achieve growth this year, perhaps choose another. Meanwhile, add Dollarama stock to your watchlist, as you can certainly pick it up at a cheaper price for superior long-term growth.