The last two-and-a-half years have been nothing short of disastrous for Cineplex (TSX:CGX). It went from being a relatively reliable cash flow machine to a company on the brink of destruction. While this has left scars, we can finally let this memory rest comfortably in the past, because Cineplex stock is due for a major recovery.

Here’s why Cineplex has become one of the best opportunities of the summer.

Two steps forward and one step back for Cineplex

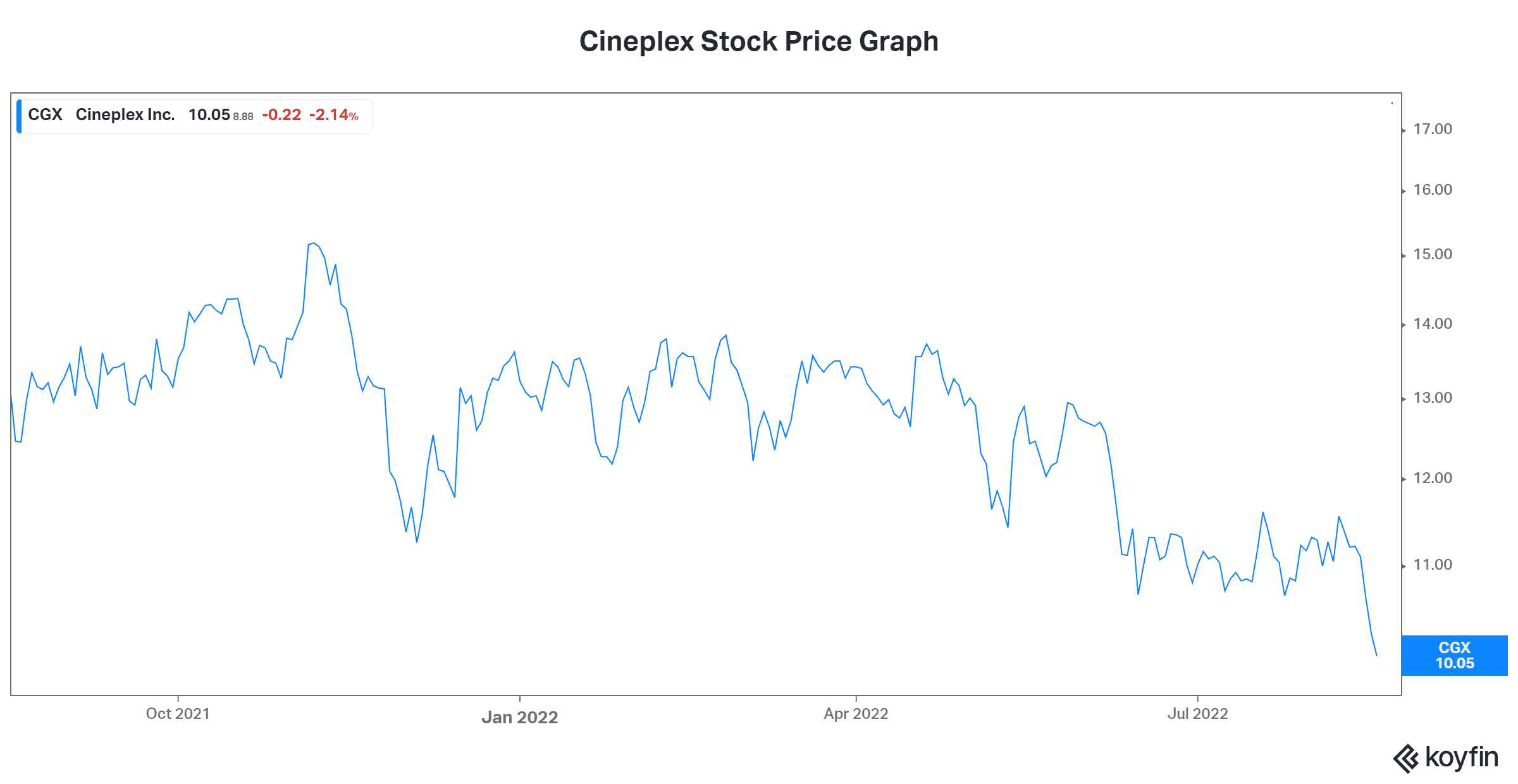

The road to recovery is rarely a straight line up. Inevitably, there are setbacks and struggles. For Cineplex, this comes in the form of a short-term content supply-chain disruption. This disruption means that the movie slate will be lacking in August and September, causing third-quarter financial results to suffer. As a result of this, Cineplex has seen its stock price fall 11% since early August. It had already been languishing since the beginning of the year, and it’s now 25% lower than where it started 2022.

But there’s a disconnect. At the beginning of the year, hopes were high for a recovery in Cineplex’s business. The stock was trading at $13.60. Today, Cineplex stock is trading at approximately $10. Yet we are seeing this recovery play out. For example, revenue increased 439% in the second quarter. Also, all segments of Cineplex’s business reported positive adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization), which is now at 87% of pre-pandemic levels. That looks like a pretty strong recovery to me.

North American box office roaring back

North American box office numbers speak volumes. In April, box office numbers were at 56% of pre-pandemic levels, 72% in May, 89% in June, and 85% in July. Cineplex stock is not acting like it, though. It seems like the last two years have created a weary investor base, which is very understandable. But not logical, in my view.

I know that sentiment is sticky. It takes a long time for people to change or adjust their views and feelings about something. But stay with me here; I have more to say about why Cineplex stock is undervalued and underappreciated. Firstly, Cineplex is trading at a mere 10 times 2023 expected earnings per share (EPS) and eight times 2024 expected EPS. This is despite the fact that earnings and cash flows are in strong recovery mode.

You saw the numbers I pointed out earlier. But there’s more. For example, management expects EBITDA to hit pre-pandemic levels in 2022. This is key. A lot has changed since before the pandemic. We have seen how vulnerable Cineplex can be. But we’ve also seen how resilient its business is, as it roars back to life. Cineplex was enjoying a stock price above $30 before the pandemic.

Financial covenant testing suspended

So, back to Cineplex’s latest setback. The content disruption is not an insignificant event, but it is hopefully the last COVID-related disruption that Cineplex will have to face. But, importantly, Cineplex will not be facing it alone. This means that financial covenant testing will be suspended in the third quarter. This should help Cineplex get over this setback and prepare for better days ahead. According to management, the 2023 film slate is strong. Blockbuster movies such as Antman, Aquaman, and John Wick are expected to be released. This should drive attendance and spark a further recovery for Cineplex.

In the meantime, Cineplex’s balance sheet is acceptable, and its liquidity position is strong. With $238 million available on its credit facilities and rapidly rising earnings, Cineplex is in recovery mode. It’s making it out of the depths of despair into better days.

Motley Fool: The bottom line

Cineplex’s business is stronger than it was. It’s also more diversified than it was. I think it’s ready to face its competitive environment with the knowledge that movie-goers are coming back in droves. Streaming did not completely obliterate the business. And beyond that, Cineplex’s other businesses, such as the entertainment and leisure business, offer an increasingly valuable diversification effect. This will further increase Cineplex’s stock and valuation.